by Trent Smalley, CMT | Oct 5, 2020 | Stock Market Analysis, Stock Market Trends

Good Morning. I wanted to provide a quick update on the JSPM Omaha Growth Strategy which saw its inception on July 27, 2020. In just over two months the portfolio returned nearly 10%. In the same time period, The Dow Jones Industrial average returned approximately 8%,...

by Trent Smalley, CMT | Aug 19, 2020 | Stock Market Analysis, Stock Market Trends

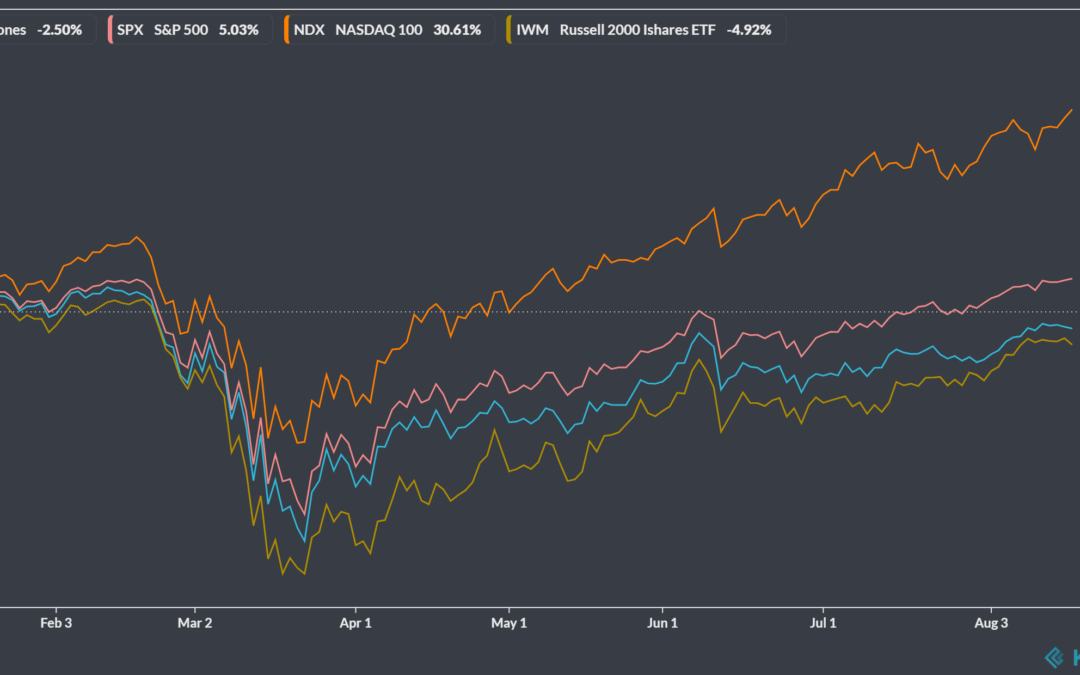

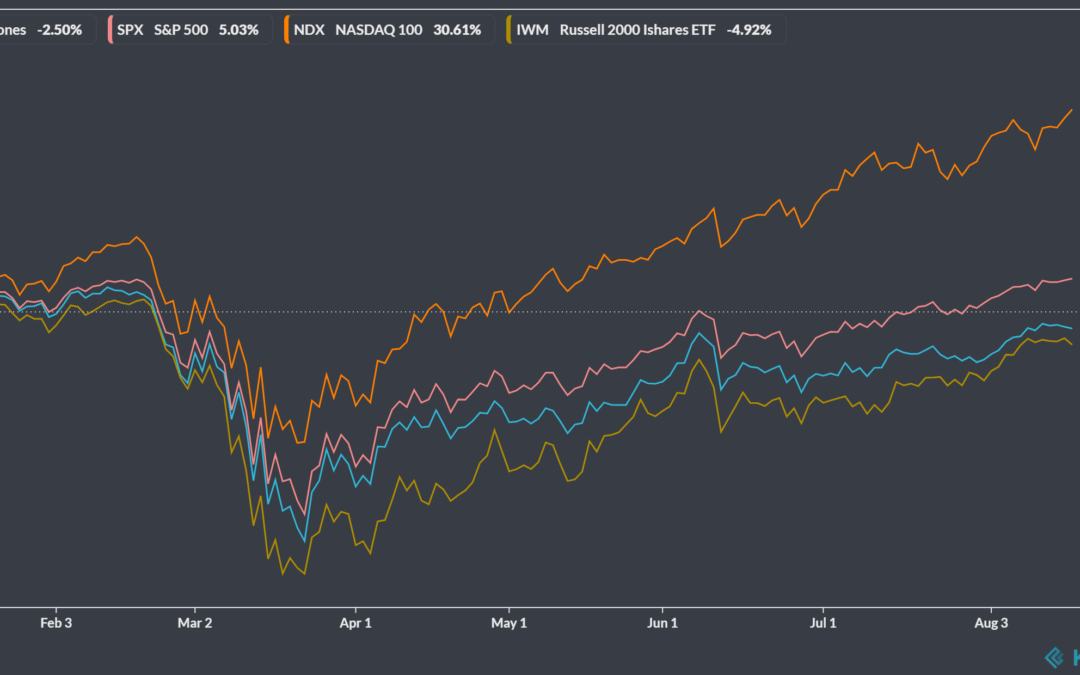

Good Morning. And there you have it; the benchmark S&P 500 index has made a new all time high. I saw headlines in the local news and several non-financial media outlets that against all odds, stocks have V recovered. This is not a bad thing of course, unless you...

by Trent Smalley, CMT | Jun 30, 2020 | Stock Market Analysis, Stock Market Trends

“Long is the way and hard, that out of Hell leads up to light.” ― John Milton, Paradise Lost I’m certain I have started at least one blog post with the quote above in the past. That is perfectly fine as its relevance cannot be understated, especially...

by Trent Smalley, CMT | Jun 1, 2020 | Stock Market Commentary, Stock Market Trends

Welcome to June. It is hard to believe that summer trade is upon us. With everything that has happened thus far in 2020, I feel as though I’ve lived through the equivalent of 2 years in just 5 months. In a lot of ways, the past several months have been a blur....

by Trent Smalley, CMT | May 17, 2020 | Stock Market Analysis, Stock Market Commentary, Stock Market Trends

When I was a youngster, video games were an activity to pass the time. My neighborhood friends and I spent hours upon hours in front of our Nintendos, Segas, and Playstations. We were pretty competitive and some matches even got fairly heated. But at the end of the...

by Trent Smalley, CMT | May 3, 2020 | Stock Market Analysis, Stock Market Trends

Lost in the constant drone of the 24 hour news cycle are voices of reason. It would seem that if the story or the character telling it doesn’t have a political agenda, it runs the risk of not being told. Levelheaded and knowledgeable submissions are out there,...