Good Morning. And there you have it; the benchmark S&P 500 index has made a new all time high. I saw headlines in the local news and several non-financial media outlets that against all odds, stocks have V recovered. This is not a bad thing of course, unless you sat on the sidelines and missed out on one of the best times to put money to work in recent memory.

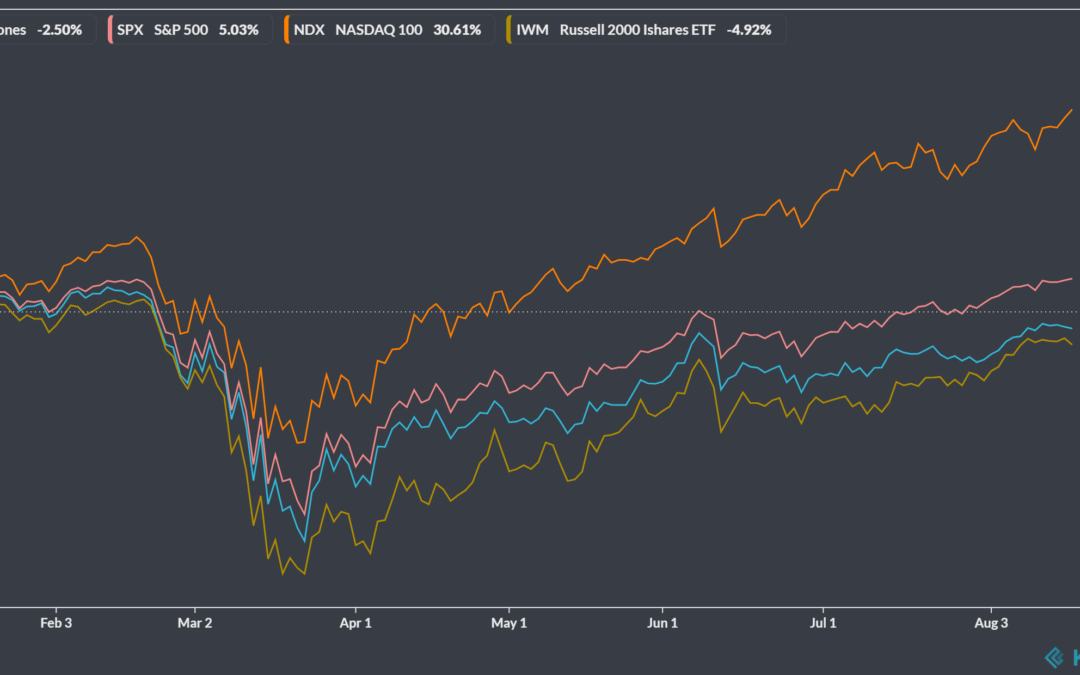

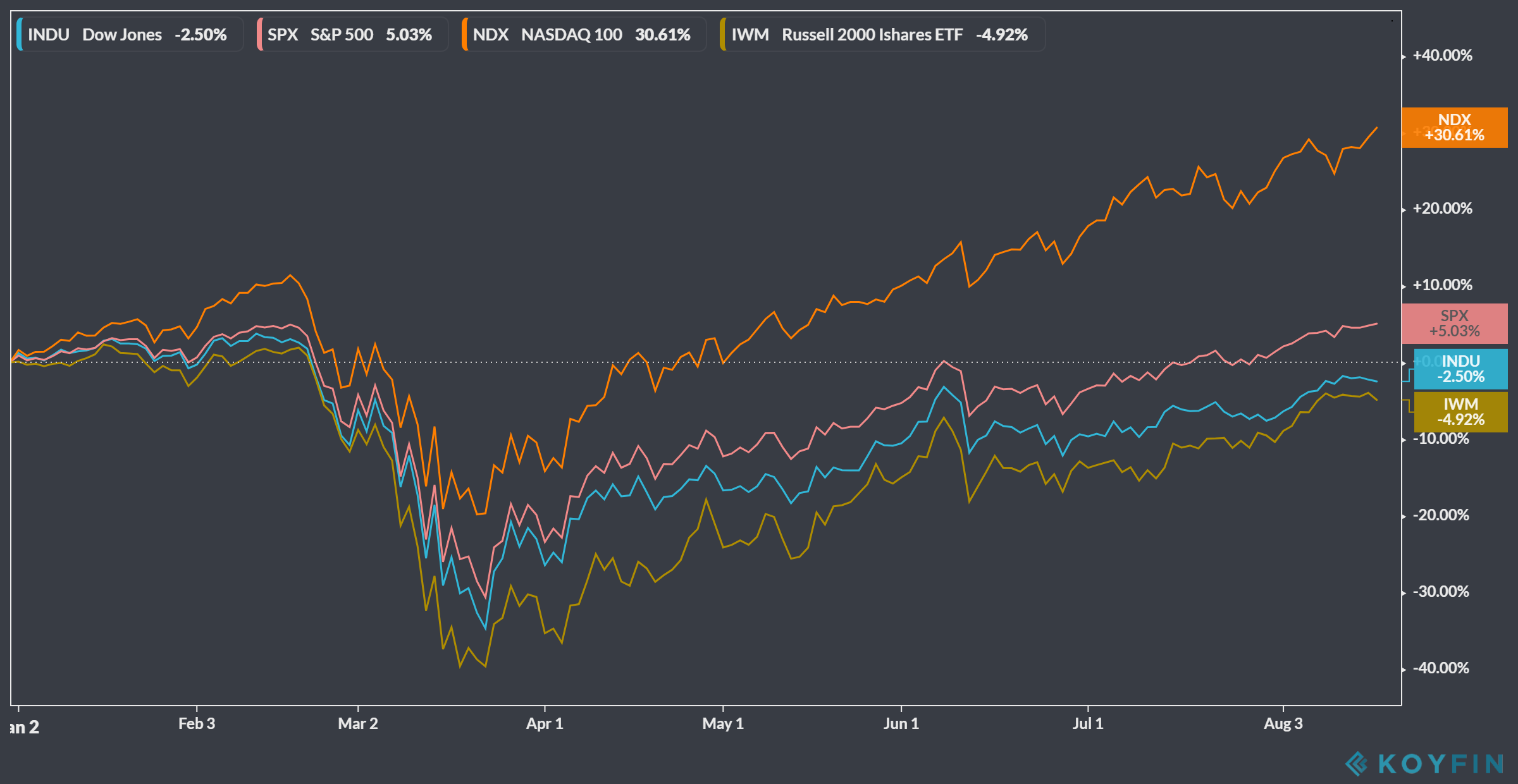

If you did miss out, I do believe you will get a chance to get in at better prices and that may happen sooner rather than later. Those who follow markets know that the technology sector has been responsible for leading the way out of the depths we saw in late March. Take a look at where the indexes stand YTD:

While we continue to wait for the Dow Jones Industrial Average and the Russell Small Caps to break positive for the year, we can see that the tech heavy NDX has left the rest of the market in the dust. There are good reasons for this but for the time being I believe we can expect this to need a breather. The technical reasons are twofold:

For years I have employed a software called Optuma, and one of their indicators called Optex Bands. If you want to read more about how these were constructed see here: Optex Bands Part 1. I use Optex bands on major market sectors and default to weekly charts. Take a look at where we are:

You can see that the QQQs have found their way up near that “running hot” zone. You can also see that in the past once this indicator finds itself in this overbought area, short term pullbacks are often in the cards. Sometimes the pullbacks are deeper or more severe than others and we can’t know for sure what the upcoming dip will bring.

The other technical component of this comes in the form of Fibonacci voodoo you’ve come to know and love from your years of reading Omahacharts:

From the chart above you can see the QQQs are very close to the 161.8% Fibonacci extension of the market free fall we experienced just 5 months ago. Taking both the Optex indicator along with this Fib extension we have a confluence of signals that at the very least warrant caution for this overall sector of the market.

Does this mean that the tech sector is about to undergo a major sell off? Nope.

Does this mean that even if the overall sector sells off that all stocks in this group will fall? Nope.

Does it mean that this area HAS to sell off? Nope.

Does it mean that we should go shorting tech stocks with reckless abandon? God no, good luck with that.

What this means is that if I had new capital to put to work, I wouldn’t be excessively aggressive to add new money. It means that if I had out sized gains in some of the names that lead I would look to take some profits. It means that we should expect profit taking because it’s healthy and necessary for markets to continue higher.

Short term caution is warranted in this area of the market. Don’t be surprised if we see a pullback and be ready to put some cash to work if you missed out last time. Welcome these dips and take advantage of probable sale prices in the weeks to come.

Have a great day and trade well.

Trent J Smalley, CMT