“Long is the way and hard, that out of Hell leads up to light.”

― Paradise Lost

I’m certain I have started at least one blog post with the quote above in the past. That is perfectly fine as its relevance cannot be understated, especially with respect to the year 2020. Because this is a financial blog, I try to stick to the topic at hand. I am not dismissing in any way the hardships that so many across the world are going through.

Halfway. Already halfway? ONLY halfway. As an active manager of equity portfolios, the first half of 2020 was akin to being a physics student in Einstein’s class, or a high school freshman in Michael Jordan’s basketball camp when he was in his prime. The market is the ultimate teacher for those of us in active management, and the curriculum for the spring semester 2020 was nothing short of brutal. When in college, I remember one professor in particular who wrote exams so difficult almost no one could pass them. He took great pride in knowing his students were “getting their tuition’s worth” when they left the classroom on exam day wondering if they had purchased the wrong textbook. I was an excellent student and I always left feeling the same way, but when grades were passed out I often ended up pleasantly surprised.

The phrase “pleasantly surprised” is how I will sum my portfolios’ performance through the end of June. I am going to share these numbers with you all as you know I believe in accountability and transparency. The portfolios I manage are not “trading accounts” but I actively trade options in another account as well as a means of extra income. It is not a fair comparison to show those numbers versus how I manage a retirement account or someone’s non speculative money. I do make use of options for leverage and hedging in a few of the accounts and I will lay out below which ones include those.

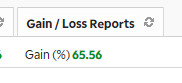

Portfolio 1 (Inception Jan 1, 2020) Includes options:

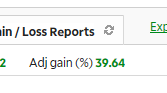

Portfolio 2 (Inception Jan 1, 2020) Includes Options

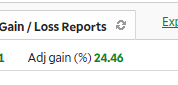

Portfolio 3 (Inception April 24) No Options

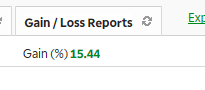

Portfolio 4 (Inception May 19) Includes Options

There is a fifth portfolio that was just brought over and hasn’t been in existence long enough to post any real numbers fairly, but it is outpacing the benchmark as well. Here is a look at the major equity indexes YTD as of the close just minutes ago:

Without a doubt, the number one factor in these portfolios’ success thus far in the year was risk management. When the markets began to collapse at the end of February I began selling. Selling names I knew and loved, names I knew would bounce back fast once the panic flee to cash ran its course. Longtime readers remember my Q4 of 2018, better known as Omaha’s final market tuition payment. Memories of throwing risk management principles out the window came rushing back and I began methodically selling even my best holdings. I side stepped the majority of the waterfall and began accumulating shares once again as soon as I had my signal. I blogged about that here.

Active management of risk is something I focused nearly all of 2019 trying to perfect, and it paid off. Beyond that, I have been fortunate to own some big winners thus far in 2020. Names like DOCU, SHOP, AMZN, FSLY, etc. I blogged about the setup in some of those here. Position sizing, understanding of fundamentals that drive stock price, and good old fashioned market timing via proper use of technical analysis rounded out the portfolios’ success.

With that, I have some exciting news (new to some of you) coming in a separate blog post shortly. It has been in the works for the better part of the past year and I’m excited to share that with you. Please stay tuned.

Here is to a happy, healthy, and prosperous 2nd half of 2020!

Trent J. Smalley. CMT