by Trent Smalley, CMT | Jan 5, 2017 | Stock Market Analysis, Stock Market Commentary, Stock Market Trends, Technical Stock Market Analysis, Uncategorized

One of the most important skills one can possess in trading and investing is developing an eye for sector rotation. If your goal is to make money in the market, a great way to go about doing that is to figure out where the institutional money is going to flow to next....

by Trent Smalley, CMT | Jan 5, 2017 | Stock Market Analysis, Stock Market Commentary, Technical Stock Market Analysis, Uncategorized

HBO Films (who does a wonderful job on their documentaries might I add) is premiering Becoming Warren Buffett on January 30th at 9pm central time. My hometown hero still drives himself to work everyday, guzzles Coke by the barrel, and munches on peanut brittle....

by Trent Smalley, CMT | Dec 22, 2016 | Stock Market Trends, stocks to buy, Technical Stock Market Analysis

If you are looking for a more speculative energy play to add to your portfolio for the first half of next year, $HLX is one you may want to consider. With a Beta of around 2.75 this is a volatile play that should display a strong positive correlation with Crude Oil....

by Trent Smalley, CMT | Dec 20, 2016 | Stock Market Analysis, Stock Market Trends, Technical Stock Market Analysis

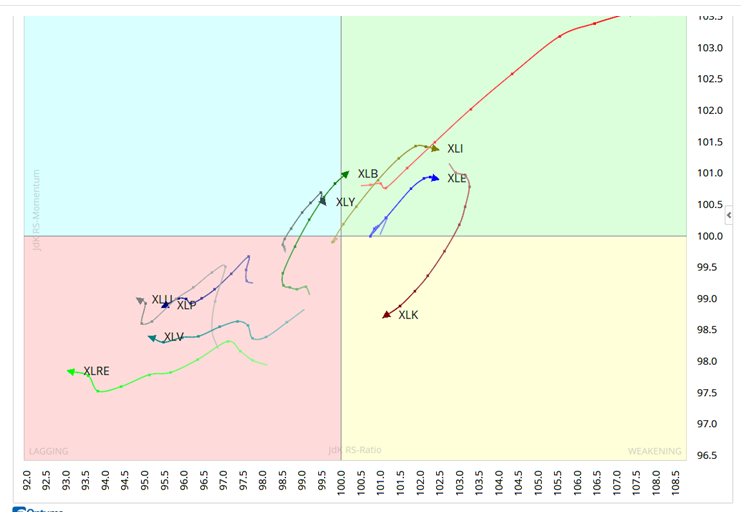

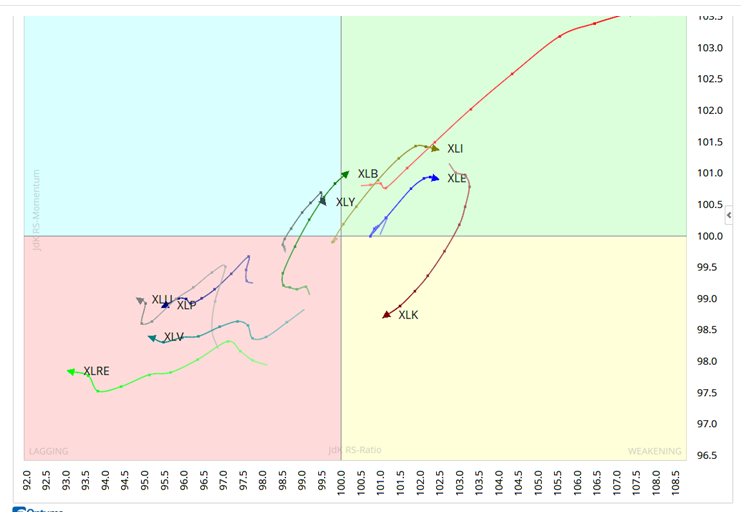

Relative Rotation Graphs (RRGs) are becoming a more mainstream tool among market participants and technicians. This type of analysis is only about a decade old as compared to some other technical tools we have made use of for over 100 years (or more). While this...

by Trent Smalley, CMT | Dec 7, 2016 | Stock Market Commentary, Technical Stock Market Analysis, Wednesday Morning Reads

http://www.marketwatch.com/story/apple-supplier-foxconn-plans-expansion-in-us-2016-12-07-71033352 Glassdoor’s 50 Best Places To Work: https://www.bloomberg.com/news/articles/2016-12-07/the-50-best-places-to-work-according-to-glassdoor TIME Names President-Elect...

by Trent Smalley, CMT | Dec 5, 2016 | stocks to buy, Technical Stock Market Analysis

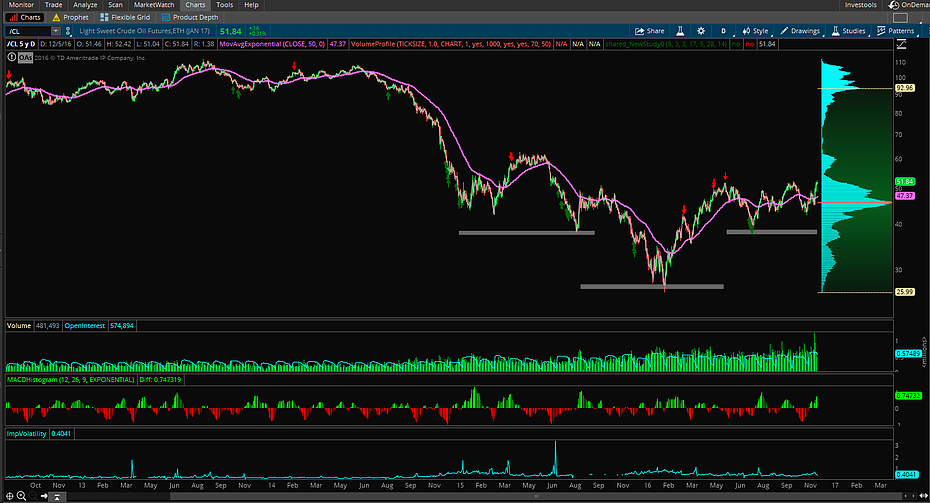

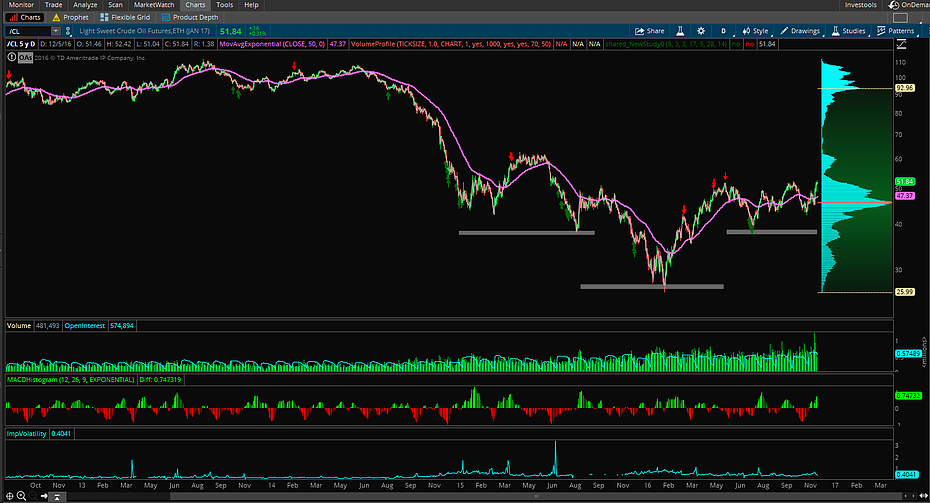

I would argue that Crude Oil is one of the most watched financial markets, period. Whether you are a commodity speculator, fuel buyer, risk manager of a commodity fund or even an equity trader, a chart of the Crude Futures is somewhere on your screen. Its impact on...