by Trent Smalley, CMT | Apr 23, 2019 | Investing, Stock Market Analysis

Happy Tuesday! For Day Two of our Five Stocks In Five Days Segment I want to focus on a different type of setup. Market technicians are often heard talking about two types of overall patterns: Continuation and Reversal. Yesterday’s CVSI was a continuation...

by Trent Smalley, CMT | Apr 9, 2019 | Stock Market Analysis

“There are no perfect symmetries, there is no pure randomness, we are in the gray region between truth and chaos. Nothing novel or interesting happens unless it is on the border between order and chaos.” ― R.A. Delmonico R.A. Delmonico was on to something. In markets...

by Trent Smalley, CMT | Apr 8, 2019 | Stock Market Analysis

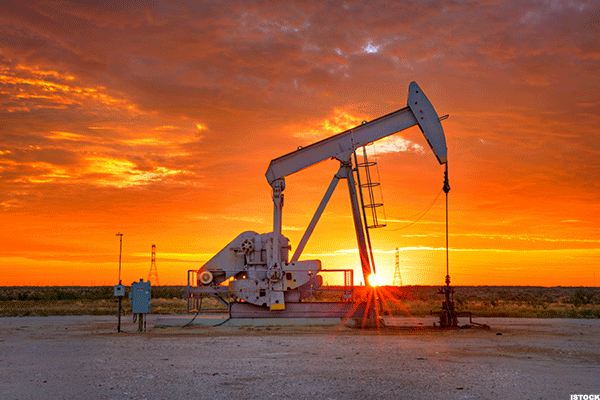

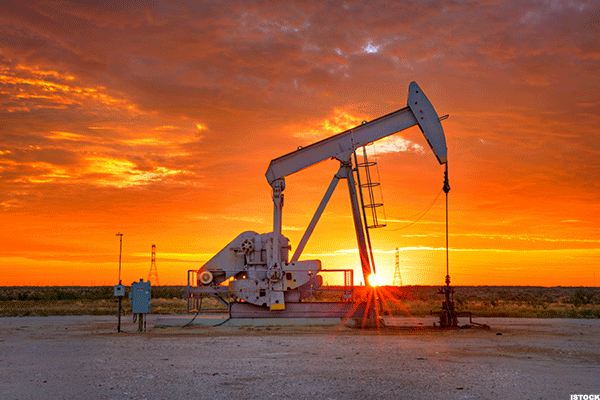

Over the past several years I have developed a love/hate relationship with the energy sector. Personally I have been underweight this group for some time as my attempts to time it have been unsuccessful in the past. Individual energy stocks are somewhat hostage to the...

by Trent Smalley, CMT | Mar 29, 2019 | Stock Market Analysis

It’s hard to believe that we are nearing the end of Q1 2019. It’s time to reevaluate our trade plan as well as begin formulating our strategy to get off to a strong Q2. Each year around this time I make sure to have at least some exposure to the Resorts...

by Trent Smalley, CMT | Mar 12, 2019 | Stock Market Analysis, Stock Market Commentary, Technical Stock Market Analysis

First off, thank you for the kind words about the last post where I gave some advice on trading for a living. If you missed that feel free to check it out here: “My Advice If You Truly Wish To Trade For A Living” It was by far my most read blog post to...

by Trent Smalley, CMT | Mar 4, 2019 | Stock Market Analysis, Stock Market Commentary, U.S. Stock Services Weekly Newsletter

The wisdom of implied volatilities Options are remarkable products that very few people truly understand. The less sophisticated players in fact oftentimes regard them as little more than directional bets on the market. From the professional trader’s standpoint they...