As another earnings season prepares to draw to a close, we at JSPM LLC wanted to put together a post outlining some of the unique risk/reward opportunities we have our eye on as we move into spring. As you are all well aware, the markets have gotten off to a rocky start in 2022. Investors have been faced with a plethora of reasons to be weary: high inflation, Fed actions, additional Coronavirus outbreaks and variants, and most recently, geopolitical turmoil as the world assesses the impact of the Russian invasion of Ukraine. Individually, any one of these factors has the propensity to bring about worry and volatility. En masse, they have sent many fleeing risk assets altogether and into traditional safe havens.

In my last post, I wrote that across our actively managed growth strategies we have held higher cash levels than usual in an effort to sidestep some of the carnage that has taken place in growth areas of the market. This allows us to have capital on hand to deploy at lower levels when the evidence begins to reveal itself that tradeable bottoms may be near. I believe there is evidence that some of the beaten up growth areas are showing seller exhaustion, and that unique opportunities are once again starting to present themselves.

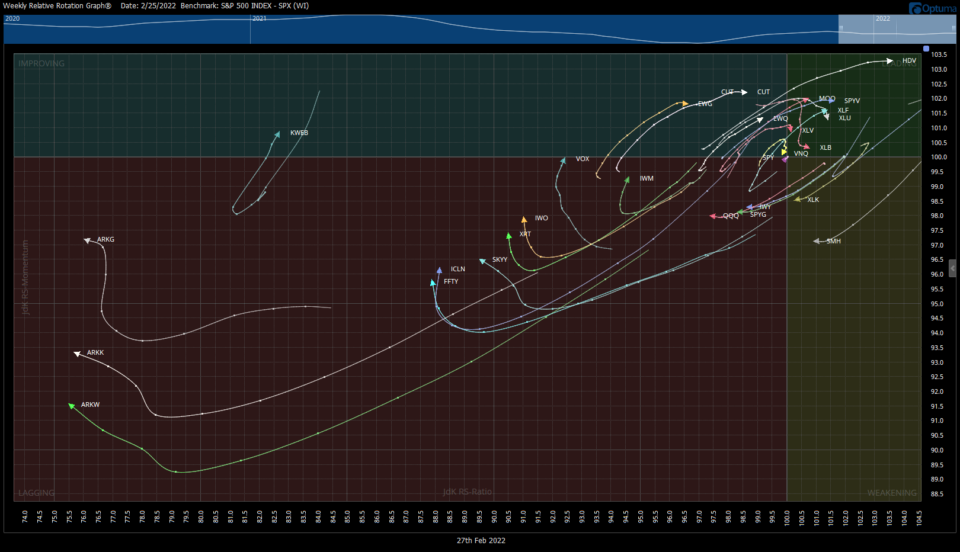

Starting at a bird’s eyeview level, we utilize Relative Rotation Graphs (RRGs) to identify areas of interest in the market as fund flows begin to show movement up toward the improving quadrant. For the first time in months, several of our tracked groups are showing the first signs of relative strength:

The IWO (Russell Growth), XRT (Retail), SKYY (Cloud Computing), FFTY (IBD Innovation), ICLN (Clean Energy), and the ARK Complex are finally showing signs of “looking up” toward an improvement in relative strength. With the exception of short periods of time in most of 2021, these areas of the market have undergone severe distribution. These subsectors of the market drastically outperformed in 2020 as they benefitted from the stay at home theme in the early innings of the pandemic. But what goes up must come down, and what goes up a sh*tload must come down a sh*tload. And come down a sh*tload they did.

As the growth areas of the market began correcting just over a year ago, other areas of the equity landscape began to take their turn. Deemed by financial media “the reopening trade,” cyclical stocks and value oriented names were bid higher throughout the majority of 2021. Further strength in cyclicals and consumer staples were bolstered by supply chain issues, high inflation, and an environment where the Federal Reserve has planned to raise short term interest rates and slow their bond buying purchases. Couple that strength in defensives with geopolitical turmoil we have seen over the past few weeks, and this past week gave us a possible final fear flush in the growth trade.

As portfolio manager of the JSPM Omaha Growth Strategy, my goal is two-fold: Have positions in the portfolio that are benefitting from current areas of the market exhibiting momentum, while simultaneously keeping an eye out for other areas ripe for a sharp rebound. Striking a balance of being invested in what is working now, with what may soon be working again, while always managing risk gives investors a great chance at long term outperformance. We’ve seen what has been working, but here and now my attention is focused upon what may soon be working. With that, let’s for a moment put on our contrarian hats and consider both market sentiment as well as some possible clues that the coming months may show a regime change across equities.

Be extra careful when buying into companies and industries that are the current darlings of the financial community. – Philip Fisher, Common Stocks and Uncommon Profits

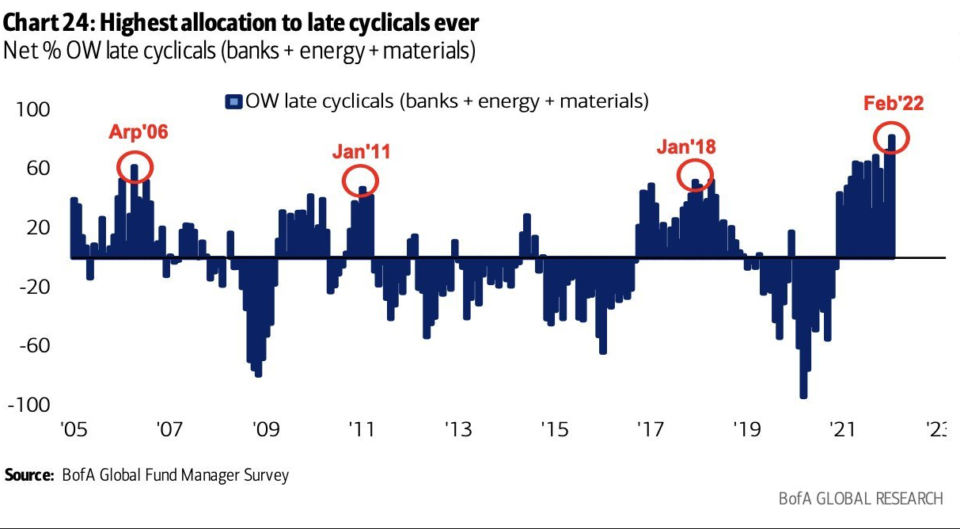

In the February 2022 BofA Global Fund manager survey released this past week, data showed the highest ever allocation to cyclicals. Banks, set to benefit from an expected rising rate environment, energy stocks currently benefitting from high crude oil prices, and materials are a very crowded trade. This isn’t to say these areas won’t continue to work, but the easy money has been made here. I would be looking to secure profits in the coming weeks in any cyclical holdings.

Continuing with a contrarian theme, we see also from the Fund Manager Survey the highest number of fund managers are bullish value over growth ever:

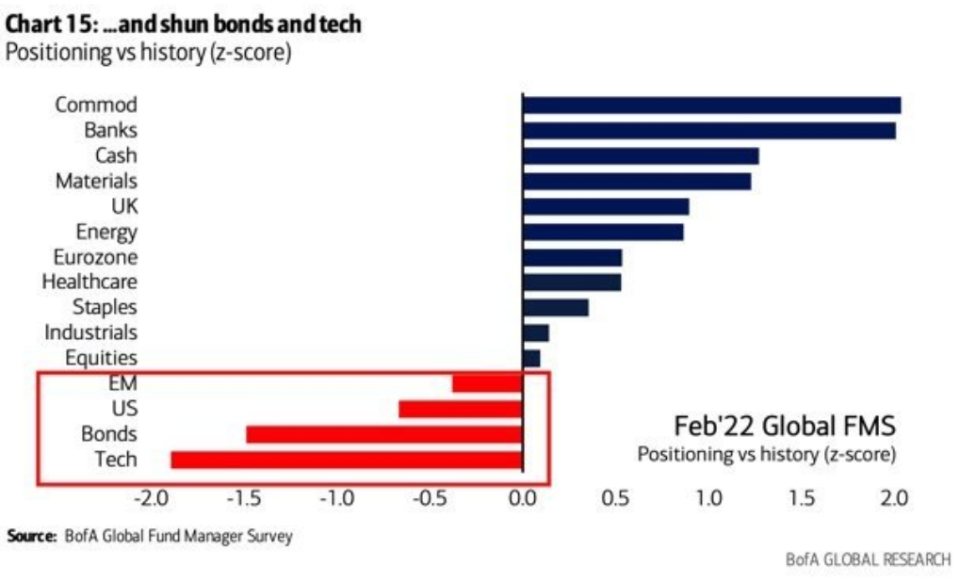

And unsurprisingly, when we see such a crowded trade in cyclicals and old economy stocks:

Allocations to tech stocks are near a -2 standard deviation vs. historical norms.

The above charts should have fund managers with a contrarian nature’s attention.

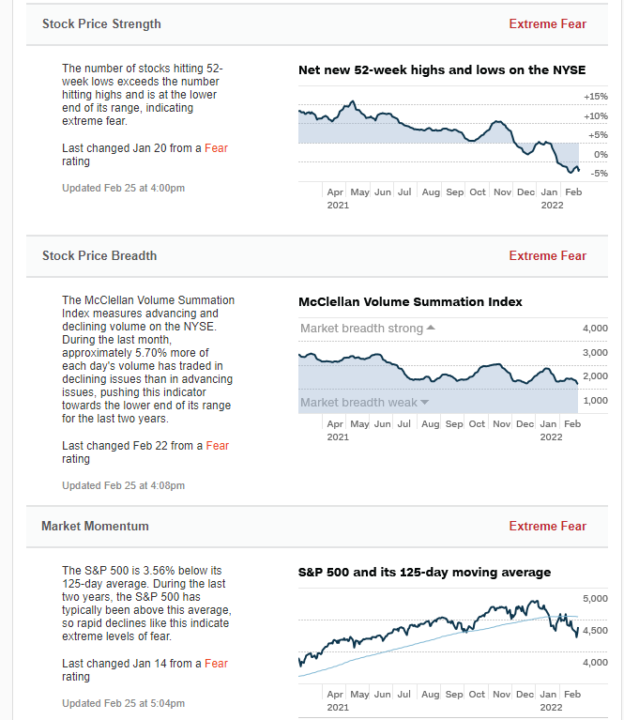

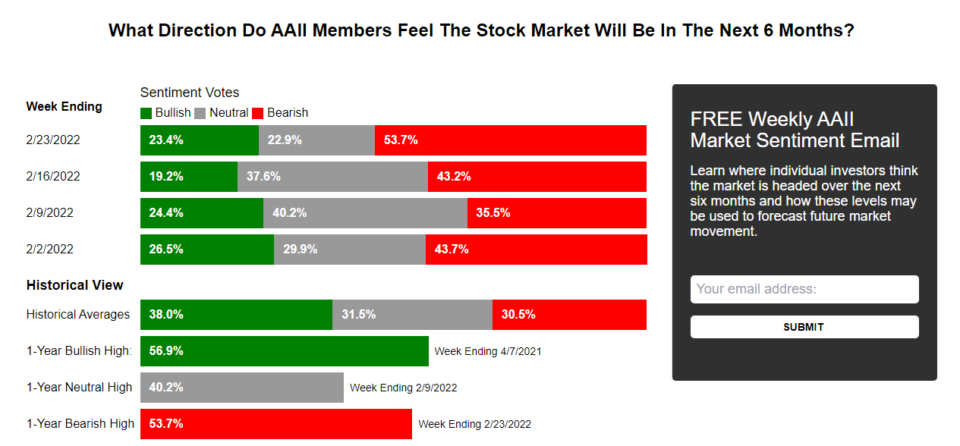

From an overall market sentiment perspective, it comes as no surprise that there is no shortage of fear, uncertainty and doubt:

Crowded trades, extreme pessimism and worry, and severly underinvested areas of the market are a few of the themes we have our eye on as I write. We are continuously monitoring risk while being aware that unique opportunities for reward will present themselves in the days to come.

Stay safe friends and we will be back with more soon.

Trent J. Smalley, CMT

JSPM LLC is available for portfolio consultations. Visit our website: https://jspmllc.com/

Please remember that past performance may not be indicative of future results. Different types of

investments involve varying degrees of risk, and there can be no assurance that the future performance

of any specific investment, investment strategy, or product made reference to directly or indirectly in this

newsletter (article), will be profitable, equal any corresponding indicated historical performance level(s),

or be suitable for your portfolio. Due to various factors, including changing market conditions, the content

may no longer be reflective of current opinions or positions. Moreover, you should not assume that any

discussion or information contained in this newsletter (article) serves as the receipt of, or as a substitute

for, personalized investment advice from JSPM LLC. To the extent that a reader has any

questions regarding the applicability of any specific issue discussed above to his/her individual situation,

he/she is encouraged to consult with the professional advisor of his/her choosing. A copy of our current

written disclosure statement discussing our advisory services and fees is available for review upon review.