Happy President’s Day. With three day weekends comes extra time for market research, as well as catching up on all of the financial news I generally miss during the week. This weekend I came across a Forbes Article entitled, “Beating The Market Is Simple But Not Easy” and I wanted to take a few moments to discuss this topic. Almost taboo in nature, the investment advisory business by in large seems to shy away from discussing this notion that benchmark indexes can be beaten. Much more commonly heard are the traditional tenants:

Don’t try and time the market.

Invest for the long term and low cost indexing is the only way.

Active management rarely outperforms the market net of fees and expenses.

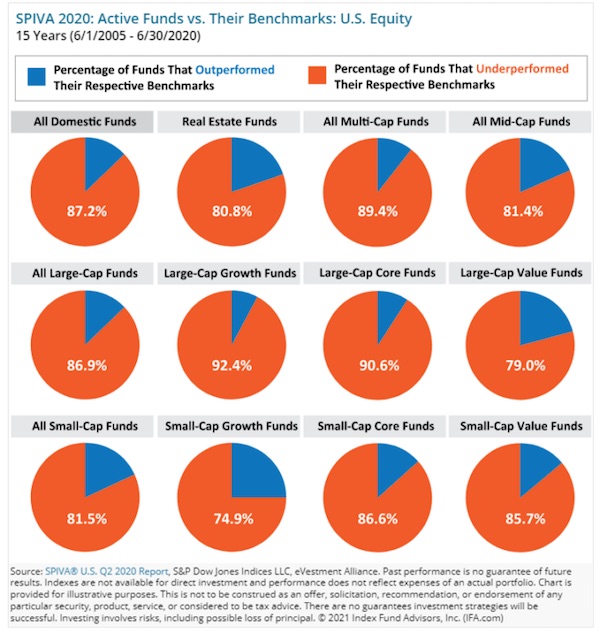

On one hand, those preaching the passive management or indexing strategy have a fair point. More than fair, in fact. The vast majority of active managers do not outperform the S&P / Dow Jones Indexes. In a recent post from the Indexfundadvisors.com a comparison of multiple active strategies was compared to simply investing in an index fund and calling it a day. The depiction below shows that various active management strategies failed to outperform the benchmarks over a 15 year period ending June 30, 2020.

The numbers don’t lie, assuming the study above over the past 15 years is accurate. I believe it is. From the above we can see that less than 8% of active managers running Large-Cap Growth Funds outperformed the benchmark. The best chance looked to be centered in the Small-Cap Growth Fund segment where still only about 25% of active managers outperformed the index.

The article goes on to note the following:

“As a result, if you were a patient buy-and-hold investor, this year’s second quarter probably didn’t look too shabby. Millions of active traders, though, bailed on stocks and wound up whipsawed by the market’s sudden turns.

Lagging performances by active fund managers aren’t a new story. As we’ve been chronicling for decades, leading market researchers know better than to listen to boasts about peer-beating results. Instead, they hold stock jockeys to a higher standard — namely, how they’ve done against their respective benchmarks.”

This is where my aforementioned agreement with the above article takes a sharp turn. Let’s break down the reasons why.

To start, let’s begin with “If you were a patient buy and hold investor this year’s (2020) second quarter results probably didn’t look too shabby.”

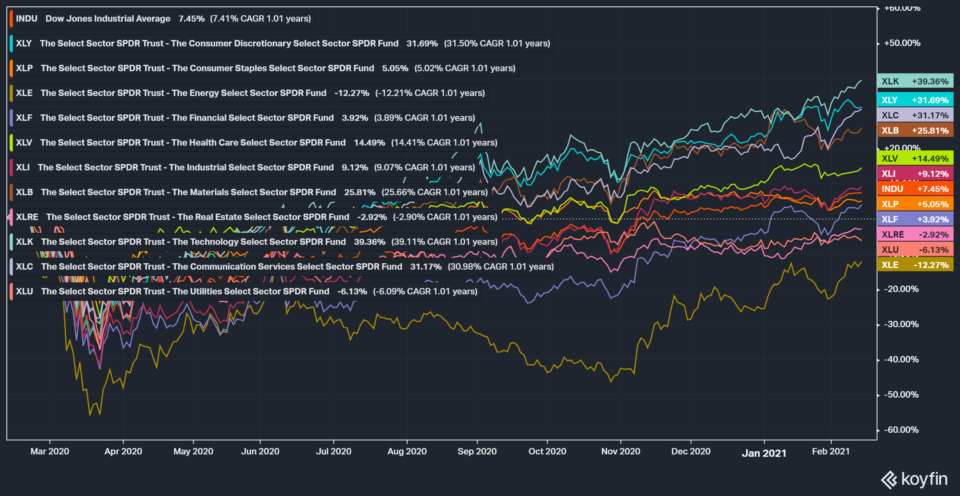

Depends who you ask. Going back to mid February of last year here are the one year returns of the benchmarks used for comparison, namely the S&P 500 and Dow Jones Indexes:

If you had been asleep for the past year, oblivious to all that has happened over the previous 12 months it might appear that returns were roughly as expected over a year’s time. Not bad. The problem? Of the 11 S&P 500 Sector Indexes, 3 of them (Energy, Utilities and Real Estate are still in the red year over year), and Financials and Staples just recently made their way into positive return territory.

Imagine if you would have been able to side step a significant portion of last year’s violent drawdown and were able to slowly get back into the market at much lower prices?

Some of us did, and it lead to outsized returns for 2020.

Imagine if you had been significantly underweight those areas of the market that still are in the negative one year later.

Some of us did (and still are).

Imagine if you had a system in place that pairs strong fundamentals with, (gasp) a market timing and risk management process that has demonstrated a higher level of accuracy of when to buy and not to buy.

Some of us do.

What if you were able to see in real time strong growth trends and relative strength appear in a segment of the market that benefitted from our new way of life amid a global shutdown? What if you could pick and choose those individual stocks that thrived during an unprecedented catastrophe, while leaving the others who have yet to see a year over year positive aside?

These things are not possible with buy and hold indexing. So many preach that you buy and hold forever, own all the bad with the good, and that is the best that one can ever hope for in investing. I absolutely disagree and our investors have come to understand they can expect more.

“Millions of active traders, though, bailed on stocks and wound up whipsawed by the market’s sudden turns.” In our industry the term “whipsawed” is often meant to mean that one gets shaken out of an investment, whether it be a stock, and index, whatever, and then doesn’t get back in all while sitting on the sidelines with their cash and getting back in much higher at inopportune prices. This does happen, and believe it or not there are still investors that haven’t come back to the market since the 2008-2009 Financial Crisis. I hate hearing stories like that, because good asset mangers have systems in place that can and do give us signals that slowly putting risk back to work is a good idea. I talked about this last year in a blog posted on April 6th:

Leaving individual stocks aside, take a look at where the S&P Index was on the date of my blog post (April 6th):

Did I pick THE bottom? No. Did selling out of 75% of my holdings in early March and slowly getting back into the market on April 6th assist in my 2020 returns? Without a doubt. Last year more than almost any other I’ve been a part of flashed two very clear signals: The first being to significantly reduce exposure to stocks, the second being when to begin to put money back to work. Was I “whipsawed?” I guess that depends on your definition of whipsaw. If last year’s sudden collapse and strong rebound was a whipsaw, I’m more than happy to have another couple of those. Just no more pandemics, please.

One final point from the article warrants mentioning:

“This study’s findings highlight that even during extreme bouts of market volatility, active management simply hasn’t delivered on its claims of outperformance. This is a bit ironic considering that fund managers typically justify their higher management and transactional costs with claims of protecting wealth during times of severe market stress. As one S&P analyst observed in a recent SPIVA study:

“Active managers sometimes seek to soften the conclusions of our regular SPIVA reports by arguing that, while index funds may have the advantage in rising markets, it’s in volatile downturns that active management can prove its worth. Historical data argue otherwise, and most active managers continued to underperform in 2020.”

I’ve demonstrated how my system allowed me to step aside from a good portion of the market drawdown last spring. But what about recently? What about the statement that index funds have the advantage in rising markets? That would be the environment we find ourselves in now…

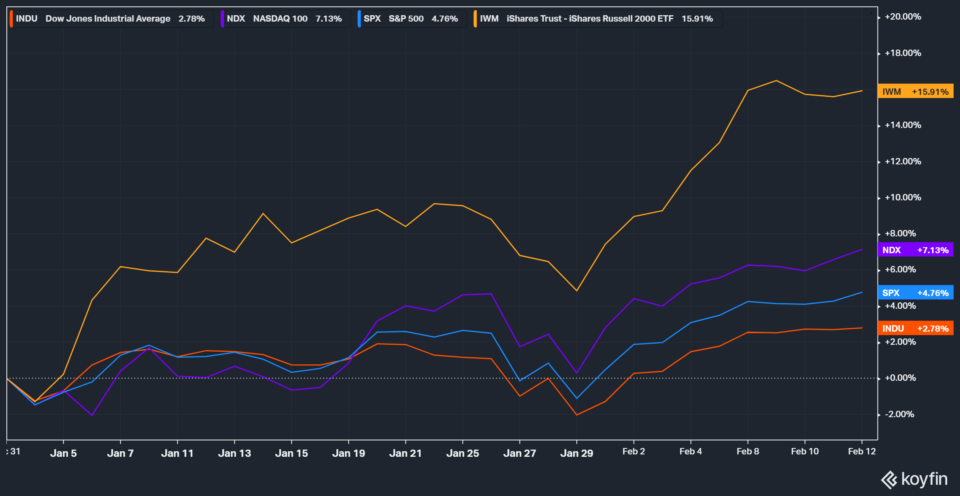

Let’s talk very recent performance. Below are the major US Indexes and their returns thus far YTD.

The Dow Jones (2.78%), SPX (4.76%), NDX (7.13%), and look at the extreme outperformance for much talked about small caps thus far (15.91%). It is going to be difficult for any active management strategy to compare with an index that is up over 15% this early in the year…

But some do.

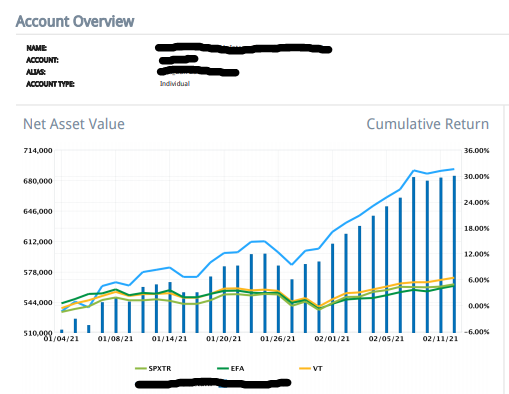

JSPM-Omaha Growth Strategy YTD Performance 2021 from Jan 4-Feb 13. (31.63% YTD)

Not all active managers are created the same.

Stay warm.

Trent J. Smalley, CMT, Portfolio Manager JSPM LLC

Have a portfolio in need of attention or want to know more? Visit us at JSPMLLC / MyPortfolioFix

Please remember that past performance may not be indicative of future results. Different types of

investments involve varying degrees of risk, and there can be no assurance that the future performance

of any specific investment, investment strategy, or product made reference to directly or indirectly in this

newsletter (article), will be profitable, equal any corresponding indicated historical performance level(s),

or be suitable for your portfolio. Due to various factors, including changing market conditions, the content

may no longer be reflective of current opinions or positions. Moreover, you should not assume that any

discussion or information contained in this newsletter (article) serves as the receipt of, or as a substitute

for, personalized investment advice from JSPM LLC. To the extent that a reader has any

questions regarding the applicability of any specific issue discussed above to his/her individual situation,

he/she is encouraged to consult with the professional advisor of his/her choosing. A copy of our current

written disclosure statement discussing our advisory services and fees is available for review upon review.