The above image is perhaps what comes to mind when you picture the name Lululemon. The quarterly results just reported by the company however, look more like this…

Headlines read as follows:

“Lululemon shares crater on weak outlook.”

“Lulu shares crash 17% because its spring leggings are boring.”

“Bland clothes cause surprising decline in Lulu.”

I should have seen this coming. My wife has complained for months that their new colors aren’t appealing. So now that the company will begin damage control, is it a good time to take a look at getting long the name? Let’s take a look…

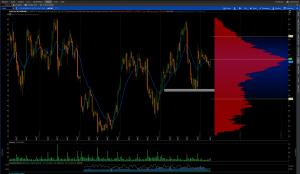

An after hours chart of the name looked ugly:

The chart kind of looks like the guy above, no?

After hours trading shows the stock trading at $54.70. Since that is quite a drop from the former level in the mid $60s we will want to look for zones of underlying support that might stop the decline. Just below I drew a rectangle around the next logical level of support.

If buyers fail to defend there, you’d be looking at the $50 level as the next area of support.

Thomas Bulkowski in his Encyclopedia of Chart Patterns studied the results of over 2,000 earnings surprises to the downside and came up with some surprising findings which may prove to be useful in this situation.

A. About 50% of the time, stocks after a bad earnings surprise will bottom in less than a week. In other words look for a swift, sharp breakdown.

B. More decline generally follows patterns that exhibit a wider intraday trading range on the day of the earnings announcement.

C. Bad earnings surprises generally fall further if the stock was already in a downtrend, or a bear market environment.

D. The majority of the time a bad quarter will follow a bad quarter.

E. If price gaps down but the price gap is small, price may retrace upwards over the next few days and cover the gap.

Watch tomorrow and more importantly the close of the weekly candle to see if the $54 level is respected and holds. If that is the case, I would be comfortable trying a long trade there via options to define risk. If that level doesn’t hold we are likely to see further downside to the $47-$50 level which is the next line in the sand. I expect $LULU to firm up above $50. It wasn’t in a downtrend and retail I believe has bottomed. I’m interested in taking a shot here on the long side provided the $50 level is defended.

Good evening.