One of the most important skills one can possess in trading and investing is developing an eye for sector rotation. If your goal is to make money in the market, a great way to go about doing that is to figure out where the institutional money is going to flow to next. That way, you can position yourself to get involved in a sector before the majority of other market participants, and be along for the ride as they bid up stocks or option premium.

There are several ways to do this including watching the economic cycle for clues, studying seasonality, checking institutional fund flows , or my preferred choice of study, intermarket analysis and chart patterns. Relative Rotation Graphs are another excellent tool to forecast fund flows as well.

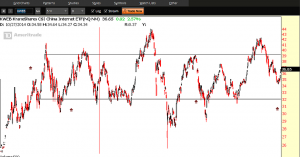

Once you have an idea in mind, the next thing I like to look at is the ETF of the group I am interested in. Some time ago, we started to see what we thought was a rotation into Chinese Internet stocks. For a look at the group you can use the ETF $KWEB which is the Kraneshares Trust China Internet ETF. Here is a look…

Over the past 5 years this group has traded in a range. The goal would be to get into these stocks at the lower end of the range, and sell them or short them towards the upper end of the range. Once you near the lower end of the range look into the group for individual names (or you can keep it simple and buy $KWEB).

If you are interested in the holdings of the group you can see them here: KWEB Holdings (Morningstar)

Since I choose to speculate with Equity Options, I need to find ones which are liquid. Generally for me to be interested they will need to trade an average volume of 750k shares. Once I filter out those which trade thinly I take a look at the technicals. Check $SOHU – nice falling wedge pattern…

Protip: Don’t buy these. Why? Because you are too late.

I was in them for the up move and sold them to lock in profit. One thing I learned about this group of stocks early is to make sure not to overstay your welcome. These stocks are volatile, high beta pieces of shit (in most cases) that will leave you stranded naked in the middle of the street, looking for your mother. Not where you want to be… Go check some charts for other names which may not have moved yet. Ideas like $JMEI, $BZUN, and $JD come to mind.

Over at Trading Addicts when I was brand new, I remember loading up my account with calls on these companies some summers ago, and waking up to 75% of them down about 50% leaving my trading account in tatters. If you missed these, DO NOT buy them up. They will have their day once again. Let the sector cool off if it’s overheated and find where the money is going next. I don’t even know if these are real companies with earnings. I don’t care either. I use them for spec trades, win some and lose some. Position size right to limit your risk and pick a few you think are the next big winners.

@omahacharts