I am planning an entry into IHS Markit ($INFO) early this week as it satisfies all I look for in an investment opportunity. Let’s take a moment to go over which factors I look for when planning to take on new risk in the form of a longer term stock holding, both on a fundamental and technical basis.

A. Increase in Fund Ownership: When planning out individual stock selection, I like to know that I am in good company with regards to the ownership of the stock in question. What I want to see is an upward trend in the number of funds which also own the stock. That means the professional institutional investment firms also perceive there to be value in the name. From MarketSmith we can see this has been the case:

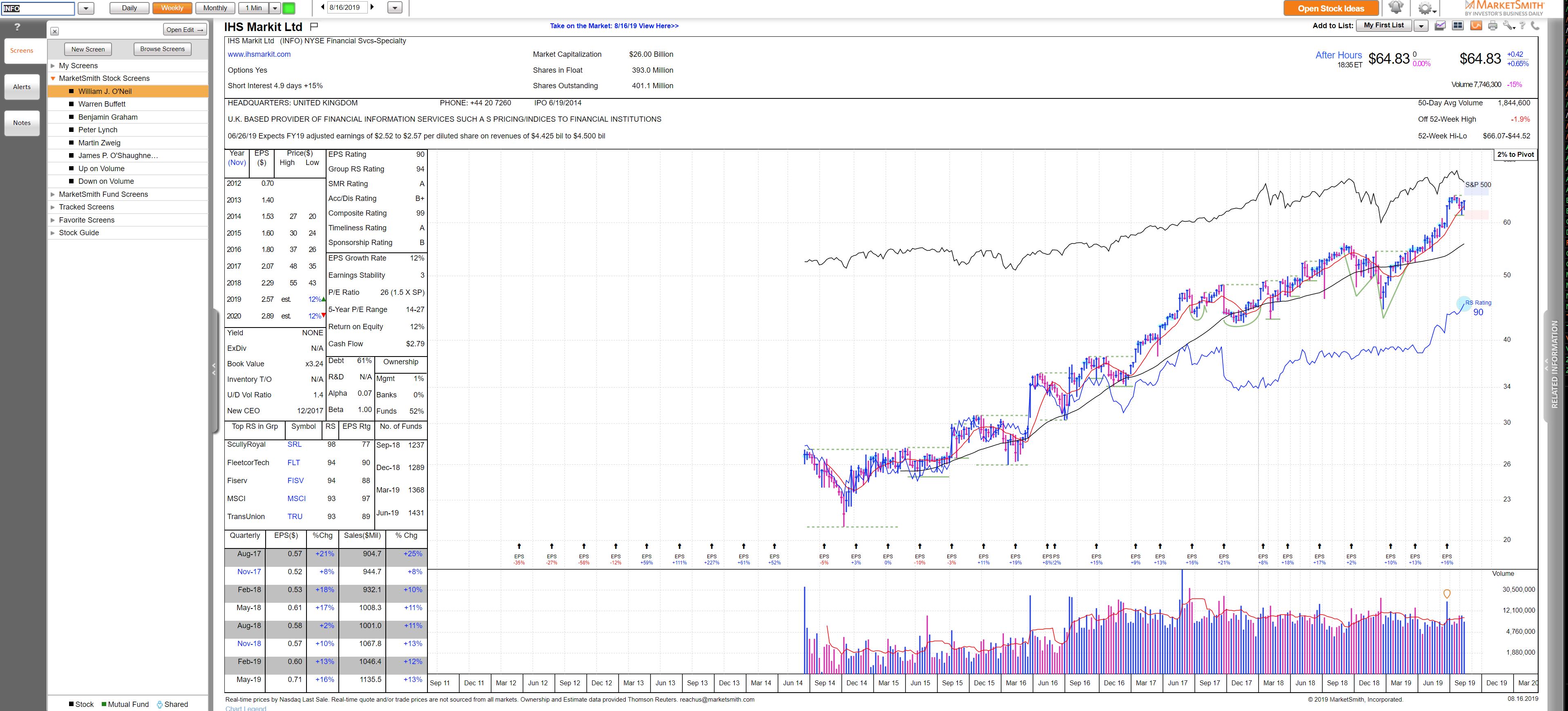

Over the past year we can see that the number of funds holding the stock has continually increased (1237, 1289, 1368, and now 1431). Put simply, more institutions are expecting this stock to provide positive alpha and thus have taken a position in the name.

B. Positive General Uptrend In Quarterly Sales: Just as fund ownership has increased, so has one of the most important overall fundamental factors in the health of a company, sales growth and EPS. Over the past two years, IHS Markit has grown sales quarter over quarter from 904 million to 1135 million. Sales are the lifeblood of companies and the upward trajectory of those are present in IHS. This upward trajectory is likely responsible for the increase in fund ownership.

C. Relative Strength: Relative Strength is one of the most important factors in my decision to invest (or trade) any stock. Fundamentals only tell half the story. A company can have stellar fundamentals and be firing on all cylinders but if their stock is lagging or just keeping up with the general index, there really isn’t a strong enough reason to invest in it. When investing in a single company you subject your portfolio to single stock risk, so we need to make sure we put ourselves in a position to reap the rewards of taking on that extra risk. Relative strength is a deciding factor in my investment process. MarketSmith has a handy built in RS Line and rating system. The relative strength value with a rating in the 90s shows that IHS stock has outperformed just owning the index which is essential. While the SPX has flattened out and even taken a more bearish short term tone as of late, this stock has continued to rise more / fall less than the index. This tells me that there is value in owning it versus just taking a long in the index.

D. Timing: The final piece of the puzzle of all prudent investing, and absolutely essential in trading. Poor timing can cut into a position’s profit so we need to adhere to strict technicals to plan our entries and exits. When I trade short term stock and especially options and futures, surgical entries are a must. When investing that is less the case but it is still important to make sure our entries don’t get sloppy. In other words I won’t be buying $INFO after it has an 8% up day or if it has run too far above its 10 week moving average or most recent base. I prefer to buy on pullbacks into the 10 week moving average shown in the chart above by the red line. We are very near that spot as we speak which is why an entry in this name is planned for early this week.

This example is a quick look at several of the factors I take into question when deciding whether or not I am going to plan my entrance into a new stock position in my portfolio. I think the opportunity in IHS Markit is worth the risk of owning it for the longer term.

I hope you all had a great weekend.

Trent J. Smalley. CMT