Barron’s ran an article this past weekend entitled, “The End Of An Active Investing Era.” You can read the full article here: End of Active Investing.

An excerpt from the article touches on the reason for the never before seen amount of capital flowing into Index funds:

For the past 15 years, there has been no cumulative five-year period when average active managers beat their appropriate indexes. Consider these statistics from the Standard & Poor’s Indices Versus Active studies, which are the gold standard of such comparisons:

• The odds of a first-quartile manager being in that same first quartile cumulatively five years later are less than 20%.

• Managers have little hope of even equaling the appropriate index over five years if they aren’t in the first quartile over that whole period.

• For the 10 years ended in 2015, the Standard & Poor’s 500 index returned 7.3%. The average equity manager returned 6.2%. The first quartile large-cap core manager returned 7.5%. The second quartile returned 6.5%. The third quartile returned 5.8%.

• The low odds of success and the high costs of failure are consistent across all asset classes: large- and small-capitalization equities, developed international and emerging- market equities, fixed income, and so on.

• As active managers are added to the mix to execute globally diversified portfolios, the odds of success actually fall, and the underperformance rises.

In short, the higher fees paid for active management aren’t paying off. Hedge funds are closing, people aren’t picking stocks like they used to, and ETFs and Index funds are the beneficiaries of this. And for good reason. While this article isn’t going to get into the Active vs. Passive Debate (I’m not qualified to debate this), it is going to show why I believe we are in one of the best environments I have seen in years if you are an active trader.

Active Trading by the way, is a different ball game than long term investing. I wholeheartedly agree that 95% of people should invest in index funds for their retirement accounts. The data doesn’t lie. But for those of us who trade actively as a sole source of income or as a supplement to other revenue streams, we are living in a paradise of sorts.

Market of Stocks, Not A Stock Market..

.

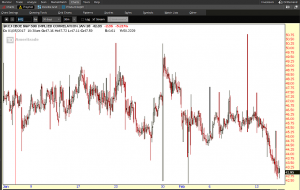

Courtesy of the good folks at the CBOE (Chicago Board of Options Exchange) and Think or Swim’s Prophet Charts we have the $KCJ. This is an implied correlation indicator we use to gauge if we are in a market of stocks or a stock market. I first began using this several years ago after Jeff Kohler at Trading Addicts pointed out its utility. While the specific reading of the indicator isn’t as important, we like to see the overall trend of the $KCJ down. If you want to become an expert on the calculations behind the indicator, give this academic paper done by a student at Boston College a look:

“On The Predictive Power Of The Implied Correlation Index”

OmahaCharts Cliff’s Notes Version: The lower the reading on this the better environment we have on our hands to pick individual stocks. When we get into a market that is “panicky” you will see the VIX spike, the $KCJ jump, and most stocks will begin to move in tandem.

In my early trading days I learned this the hard way. I came into a market situation fully loaded in a large number of positions (mostly high beta stocks), and the correlations between stocks spiked when the market went through a panic…. The guy whose money I was managing remembers it too as he questioned if I knew what the hell I was doing with his account. From a risk management perspective I didn’t.

I remember the day circled above well. The market had been in price acceptance mode over the summer in a market much like we have now. Then, that day in September the market reminded me that it still enjoys handing my ass to me on occasion. It didn’t matter which stocks I owned, they all dropped together, leaving my option positions in tatters. I got complacent, broke my risk management rules, and paid the price. From that experience I was taught a valuable lesson you won’t learn in any textbook, trading webinar, or from any paper trading platform. It was real money at risk, my own as well as someone who backed me. It was another deposit into the “Trader’s Tuition” fund that becomes all too familiar to those of us who play this game. If you ever plan to trade for a living you will make several deposits to this account so just get used to it.

All of that being said, we find ourselves once again in a market environment conducive to stock picking, buying dips, and letting winners run. The VIX is all but asleep albeit waking up a bit today, but still near historically low levels.

Despite U.S. Stock markets making all time highs, it still seems very few are interested at all outside of the finance community. I haven’t had any friends call with extra money asking for stock picks, and there aren’t any signs of euphoria out there that I can find.

A quiet market, with low implied correlation, low VIX, and nobody interested is a best case scenario for option buyers if you possess the ability to spot moves in stocks before they happen. Barring a price shock of some sort, I think this type of environment is here to stay for a while.

Enjoy it while it lasts, because it never does.