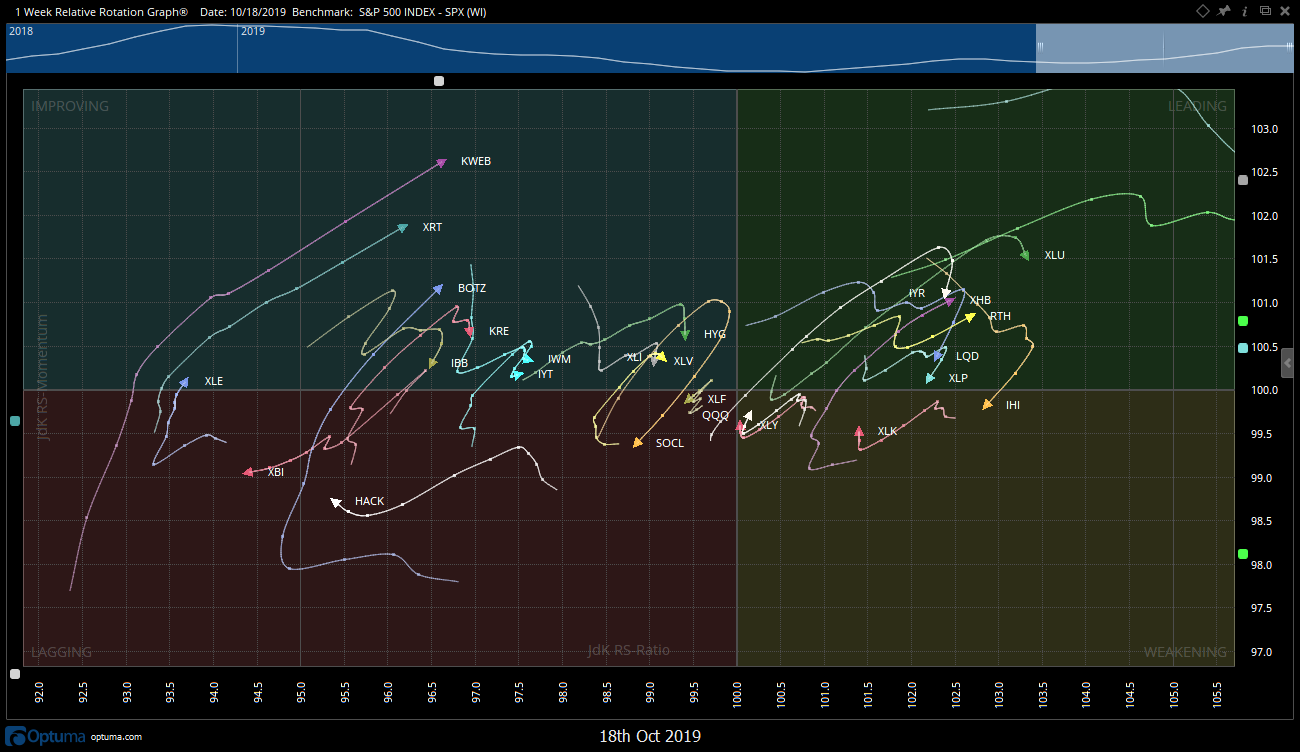

As my main focus has been centered around overall portfolio management and building trading systems as of late, I still want to point out individual stocks from time to time when the risk/reward objectives are positively skewed. One example of this is a stock I entered yesterday, $FRAN. As the U.S. consumer has remained strong amidst global economic slowdown, I have been paying attention to the retail group specifically. On the Relative Rotation Graph shown below, the XRT ETF (tracks retail stocks) has been making a swift move into the improving quadrant:

I spent some time drilling down into retail names yesterday, coming across a highly speculative name with Francesca’s. This stock has had a rough few years to say the least, falling from the mid $200s to single digits. One thing it has done constructively however is build a big base down at these levels:

The selloff all the way down has been fairly orderly, and price has spent little time at any particular price point above. In terms of volume profile analysis, this means that there is little resistance above. And what is really interesting, is the stock’s high short interest position. Over 40% of the shares are held short, meaning people have borrowed shares and sold them, hoping that the stock continues to go lower. When price trades higher, this forces the short sellers to cover, and can act as gasoline on an open fire further propelling share price higher.

Manage risk to the downside appropriately and this one might pay off in a big way. I’m long from lower.

Happy Friday!

Trent J. Smalley, CMT