Hundreds of articles have been written about investing in marijuana (cannabis) companies. The one theme that echos throughout the majority of those articles is that investing in marijuana companies is risky business. A large portion of the companies trade OTC (Over the Counter) and thus do not have to file audited financial reports with regulators. The stocks are also highly correlated, meaning that the majority of the time they trade in lockstep with the broader industry. One of them goes down and the rest follow. The SEC actually suspended a handful of cannabis companies for fraud in 2014 and issued an investor alert to warn investors of the potential risks in holding these companies.

The SEC bulletin can be viewed here:

Investor Alert On Marijuana Related Companies

One way to guard against the risk of owning individual stocks is to purchase an ETF. Unfortunately, no exchange traded fund exists, at least for now, for the marijuana industry. One helpful site to keep an eye on an index is available however…

After doing your due diligence and understanding the risks involved (as you should with any investment) you have some choices. If you do want to speculate on OTC names I would highly advise buying a basket of several and spreading your bets around. Not all of those companies are going to survive and seeing your marijuana flyer going to $00.00 will result in your wife questioning the sheer stupidity of your investment thesis. As we all know, I can speak from experience.

If you want exposure to the more legit companies, you have some choices such as $ZYNE, $IIPR, $CARA, $INSY, or $GWPH. I am going to break the technicals of these down below.

1. $GWPH GW Pharmaceuticals is the largest of the components of the Index at a market cap near 3 billion. Goldman issued a buy rating on the stock late last year.

GWPH is off its all time highs of about $140 and in my view is nearing a decent spot to initiate a long position. Back in September of last year it gapped up from $110 to $117 and has been consolidating since then. I would look to start a position from $108-110, adding to it should it fall further. I would add more around $100 and round out the position should it get back to its volume point of control down at $90. Buyers around $110 will be looking to defend so I wouldn’t expect it to fall much further, but in the event it might, buy 1/3 of the position at a time.

2. $ZYNE Zynerba Pharmaceuticals

Oh my. I want you to read something: Cup & Handle Pattern

This may take a while but I think it’s actionable right about now. To be safe I’d once again look to buy a full position in pieces. I’d initiate the first third here around $17, the second at $14 and the last at $10 if given the slight chance.

3. $IIPR Innovative INDL

A relatively new issue, makes this name extra ̶h̶a̶z̶a̶r̶d̶o̶u̶s̶ fun. It is forming a symmetrical triangle pattern, which technical analysts refer to as a coil. Most often after this period of consolidation, the stock will break out in the direction of the primary trend. If I were to initiate a position in this name I would buy here, and then at $17. One thing is for certain – this stock is going to move soon. My bets are on up but with an issue this new we don’t have a lot of historical price action to analyze.

4. $CARA Cara Theraputics

#WorldTradeCenter

$BIDU

$DX Dollar Index Futures

$ELLI

$FCX charts technical analysis copper gold silver

$FI

$IBB Biotech Pennants

$JKS

$KMI

$KWEB

$LULU

$LVS

$QQQ

$USO

$VALE

$VIX CBOE Volatility

$WTIC

$XBI Biotech Market Sentiment

$XME

2017 Charity

2018 Predictions

2018 Stock Market

9/11

A Long In Cern

AAII Sentiment

Acampora

Agricultural Chemicals

Agriculture

Alaska Air

Altaba

Amazon Stock

Amgen

Anxiety

Apple Earnings

Apple Stock

BAIDU

BackPain

Baker Brothers

Banking

Being A Trader

Berkshire

Berkshire Hathaway

Bernie Madoff

Biggest Trade

Billions

Biotech

Biotechnology Stocks

Bitcoin

Bitcoin Futures

Bitcoin Penny Stocks

Black Monday

Blockchain Penny Stocks

Breakout Stocks

Bubbles

BulletProof Stocks

Buying Ethereum

Buying stock

CFTC CoT

CMT

CMT Omaha Chapter

Caddyshack

Calendar Spread

Calls

Canada Goose

Cannabis

Casinos

Chart Art

Chart Summit

Chartered Market Technician

China

China ICO

Coffee Cup and Handle Futures

Cognition

Consciousness

Continuation Gaps

Corn Futures

Creativity

Crude Dow Jones China Trump Tower

Crude Oil

Cryptocurrency

Cryptocurrency Buy

Cryptocurrency Crash

Cyber Attack

Dan Loeb

David Einhorn

David Letterman

David Lynch

Disney Stock

Dodd Frank

Don’t Look Back In Anger

Earnings Trade

Ellen

Energy Sector

Enlightenment

Eric Scott Hunsader

Euphoria

Exodus December Stocks

Exodus Market Intelligence

Fear

Finance Twitter

Financial Crisis

Financials

Ford Long

Futures

GPRE

Gaussian Distribution

Get The Reps In

Getting Rich

Global Markets

Goldman Sachs

Gray Television

Green Plains Inc

Growth Versus Value Stocks

Halliburton

Helix Energy; Oil Trade

IPO

IQFeed

Independent Beers

Initial Public Offering

Intermarket Analysis

Internet

Intrepid Potash

Intro To Profitable Trading

It’s gonna be May

James Altucher

Jesse Livermore

Joe Rogan

Keanu Reeves

Kinder Morgan

Kirk Northington

Krishnamurti

Las Vegas

Laszlo Birinyi

Leon Tuey

Loneliness and Investing

Lonely Trading

Long $LN

Long Elon Musk

Long Oracle

Lululemon

Lumber Liquidators

MTA

Mamis Sentiment Cycle

Margin Call

Marijuana Stocks

Marissa Mayer

Market Map

Market Selloff

Market Tops

Market Trends

Mayday

Mean Reversion

Measuring Gaps

Metals and Mining

Michael Lews

Mobile Apps

Money

Motivation

Moving Averages

NYC

NYMEX

Nanex

Netflix

No Country For Old Men

Noise

Nostradamus of Bitcoin

Omahacharts

Optex Bands

Optuma

Pattern Recognition

Pennant Patterns

Penny Stocks

Pharmaceutical Drugs

RRG

Radical Transparency

Radius Health

Ray Dalio

Reformed Broker

Resorts

Retail Stocks

Risk Management

Rite Aid

Rule Based System

Sears Closing

Seasonal Trends

Sectors RRGs Relative Rotation Graph Optuma Market

Semiconductors

Short Interest Stocks

Slumpbuster

Snapchat

Stock Analysis

Stock Market Crash

StockX.com

Stocks

Stocks For Kids

Stocktober

Symmetrical Triangle

Systemic Risk

TD Ameritrade Record Accounts

TM

Technical Analysis

Tesla

The Undoing Project

Tony Soprano

Trader Education

Trader Expo

Trading Addicts

Trading Lessons

Trading Through Difficult Times

Tradingview

Twitter Earnings

VBSR

Valentines Day

Vanguard

Vivint Solar

Volatility

Volatility Based Support Resistance

Warren Buffett

Winning Trades

Winning Weekly Trade

Yahoo

back pain

market internals

oil and gas

option trading

successful trading

summer trading

trading for a living

trading mentors

trading setups

Love Me Some LN

May 11, 2018

The Important Matter Of Pattern Recognition

May 9, 2018

Venturing Into The Unknown

May 7, 2018

Our Recent Posts

Tags

Could Adding Some Marijuana Stocks Get Your Account To “High Times?”

January 30, 2017

|

Hundreds of articles have been written about investing in marijuana (cannabis) companies. The one theme that echos throughout the majority of those articles is that investing in marijuana companies is risky business. A large portion of the companies trade OTC (Over the Counter) and thus do not have to file audited financial reports with regulators. The stocks are also highly correlated, meaning that the majority of the time they trade in lockstep with the broader industry. One of them goes down and the rest follow. The SEC actually suspended a handful of cannabis companies for fraud in 2014 and issued an investor alert to warn investors of the potential risks in holding these companies.

The SEC bulletin can be viewed here:

Investor Alert On Marijuana Related Companies

One way to guard against the risk of owning individual stocks is to purchase an ETF. Unfortunately, no exchange traded fund exists, at least for now, for the marijuana industry. One helpful site to keep an eye on an index is available however…

After doing your due diligence and understanding the risks involved (as you should with any investment) you have some choices. If you do want to speculate on OTC names I would highly advise buying a basket of several and spreading your bets around. Not all of those companies are going to survive and seeing your marijuana flyer going to $00.00 will result in your wife questioning the sheer stupidity of your investment thesis. As we all know, I can speak from experience.

If you want exposure to the more legit companies, you have some choices such as $ZYNE, $IIPR, $CARA, $INSY, or $GWPH. I am going to break the technicals of these down below.

1. $GWPH GW Pharmaceuticals is the largest of the components of the Index at a market cap near 3 billion. Goldman issued a buy rating on the stock late last year.

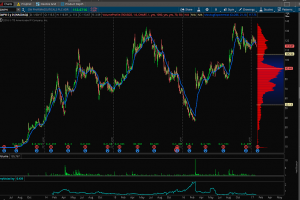

GWPH is off its all time highs of about $140 and in my view is nearing a decent spot to initiate a long position. Back in September of last year it gapped up from $110 to $117 and has been consolidating since then. I would look to start a position from $108-110, adding to it should it fall further. I would add more around $100 and round out the position should it get back to its volume point of control down at $90. Buyers around $110 will be looking to defend so I wouldn’t expect it to fall much further, but in the event it might, buy 1/3 of the position at a time.

2. $ZYNE Zynerba Pharmaceuticals

Oh my. I want you to read something: Cup & Handle Pattern

This may take a while but I think it’s actionable right about now. To be safe I’d once again look to buy a full position in pieces. I’d initiate the first third here around $17, the second at $14 and the last at $10 if given the slight chance.

3. $IIPR Innovative INDL

A relatively new issue, makes this name extra ̶h̶a̶z̶a̶r̶d̶o̶u̶s̶ fun. It is forming a symmetrical triangle pattern, which technical analysts refer to as a coil. Most often after this period of consolidation, the stock will break out in the direction of the primary trend. If I were to initiate a position in this name I would buy here, and then at $17. One thing is for certain – this stock is going to move soon. My bets are on up but with an issue this new we don’t have a lot of historical price action to analyze.

4. $CARA Cara Theraputics

Referring to #2 above, and now that you are an expert in Cup and Handle Patterns, do you see anything interesting here? Stocks of the same group tend to move together, oftentimes in the same patterns.$ZYNE is taking its time but do you see it now? $CARA is just further along. Look for $ZYNE to look just like this is a few months. I wouldn’t buy $CARA up here when I could buy $ZYNE pre-breakout. I would wait for $CARA to pullback to $12, put on half and then put the other half on at $10. I don’t buy stocks up, I wait for pullbacks or buy other stocks related to them that haven’t had their turn yet.

5. $INSY Insys Therapeutics

Great spot to initiate a long with a stop around $8.75 which buyers have defended for a long time. If I were to get stopped in this one I would stay out below $8.75. Initial price target would be $13 and longer term $20. Quite possible the stock could double from here if given time. Manage risk with a stop and this is a viable play from a technical standpoint.

6. $TRTC Terra Tech Corp (all around piece of lottery ticket shit)

Fancy yourself a flyer? This is my dark horse. This thing is volatile and in so many words, divorced from the ceremony of man – 100% fu*ked. But… if it’s not? Notice how the “animal spirits” can out of nowhere take this stock (if you can even call it that) from $.10 to $1.40 in a big hurry? The trick with this one is simply small position size. If you had 10k you planned to put to work in the marijuana sector. I’d put maybe 2% or 3% of that in a name like this. When and if it rips you have to be on top of it. It drops almost as fast as it pops when the buyers come to their senses realizing this company probably isn’t even real.

While it is always prudent to manage risk to avoid the loss of your hard earned capital, it is especially true in the marijuana sector. It’s a group that is still coming into its own, is highly affected by headline risk, and is pushed around by degenerate day traders (at least the penny stocks). However, with the extra risk will come extra reward if you can stomach the inevitable roller coaster some of these names will take you on. Set your position size before getting into any of these names, know what you are willing to risk, and take a longer term time horizon and I believe that you will be handsomely rewarded for your efforts.

@omahacharts