…because isn’t that how it works? A little schadenfreude can go a long way. Well today is your lucky day. I am laying out an earnings trade in which I will almost certainly flush my hard earned money down the toilet, all in real-time for your viewing pleasure. Let’s see how this sets up…

After the bell this evening, Kinder Morgan Energy $KMI reports quarterly earnings.

Volume Profile

Should $KMI break out above the $23.50-$24 level, there is very little upside supply (read resistance) to $32. That is quite a move. Even if half of that is captured it would be a significant win, provided you put on the right trade.

Implied Volatility

The IV of $KMI going into earnings is historically low, meaning we can get into a trade without laying out high premiums. The expected move is running about Plus/Minus 70 cents, as given by the ThinkorSwim MMM.

(The bottom Indicator is the ImpVolatility)

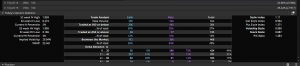

Option Stats

For earnings trades, as the day progresses I will keep an eye on the option statistics main screen in ThinkorSwim. Specifically I pay attention to the PC Ratio, Largest call and put buys, as well as if they are traded at the bid or the ask (this can make all the difference in gauging aggressiveness of buyers). Here is a look just after the open…

In the very early going there is a slight bearish bias perhaps. Because I want to be on the long side to take advantage if this stock starts to run, I won’t be paying as close attention to this today. Generally, I will watch for large block trades that come in just before the close to see where the big money is placing their bets.

$KMI and /CL

KMI and Crude have been in a slight uptrend, mostly range-bound but have traded fairly positively correlated. Overall I don’t want to blindly bet against strong trends. In other words if oil were spiraling lower, I wouldn’t be as eager to take a trade in $KMI assuming a positive correlation between the two.

So what is the trade? I’m so glad you asked. I want exposure to the long side, plain and simple. I could buy common stock, but from a risk management standpoint I don’t like the setup. Having to tie up that much capital to bet on earnings in which I have no edge, on a stock that most likely won’t move much doesn’t make sense for me. I will employ options for this strategy. I also don’t want to cap my gains if the stock would start to run so a bull call spread isn’t optimal for me. I’m going plain vanilla calls for this which will highly disappoint the option fanatics. I’ll save the ironcrackputcondorcreditspreads for another post. 🙂

On earnings trades I bet no more than 2% of my account value on the position. Due to $KMI being a slow mover I will buy a little extra time for the trade to play out. Looking at the chain I plan to take the February 23s which have 30 days to expiration, and are just out of the money. The great thing about options is they allow us to define our risk up front. You can adjust your Delta, and get as risky or as safe as you like.

Here is a timestamp of the trade so you can laugh at me later:

KMI FEB 17 2017 23.0 CallLimit0.46—-09:31:16 01/18/17

Godspeed.