by Trent Smalley, CMT | Feb 14, 2019 | Stock Market Commentary, Stock Market Trends

This is just one of many examples as to why I love this industry so much. This morning the US Census Bureau released the December Retail sales numbers. Here is a clip from Marketwatch.com: Scary right? One would assume after such abysmal news it would be reflected in...

by Trent Smalley, CMT | Jan 31, 2019 | Stock Market Commentary, Stock Market Trends

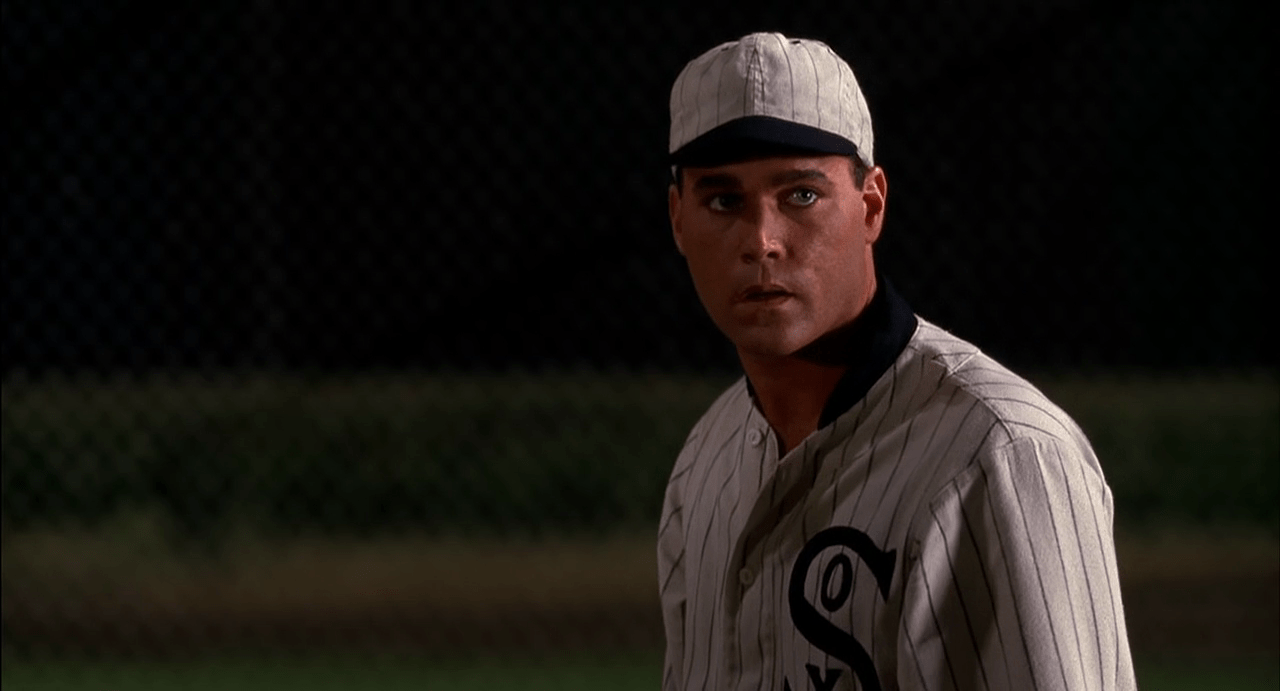

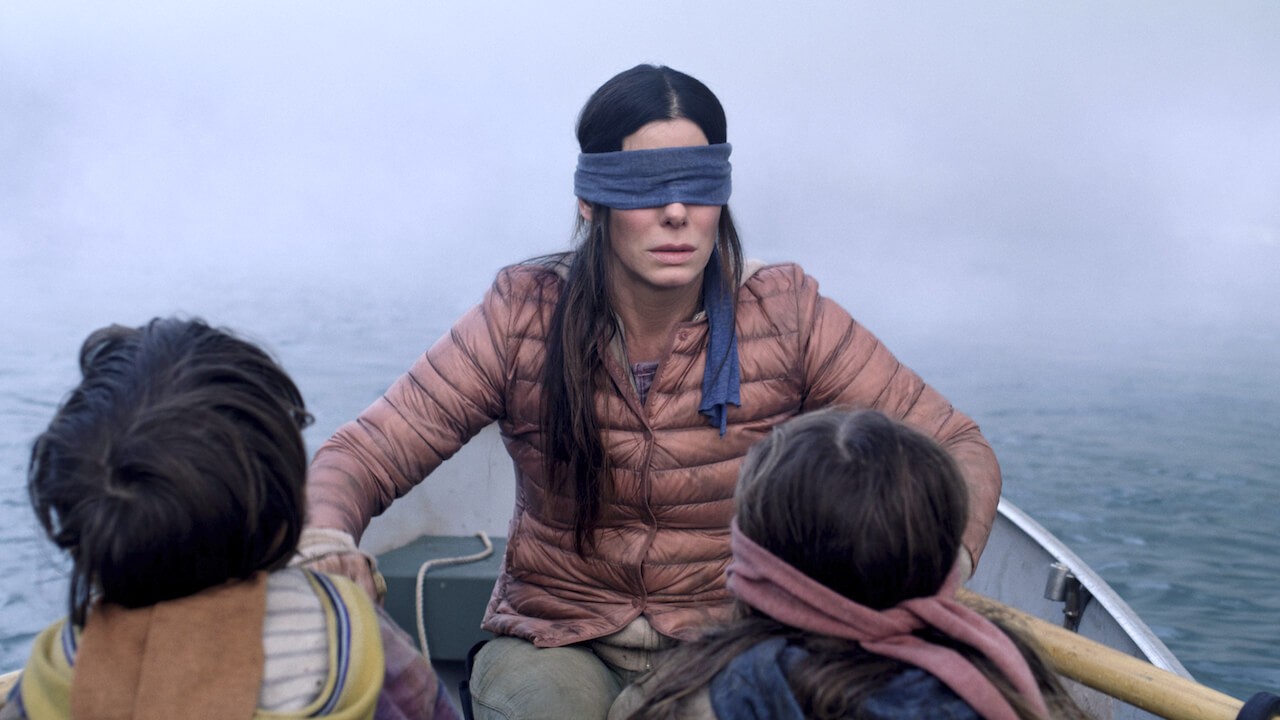

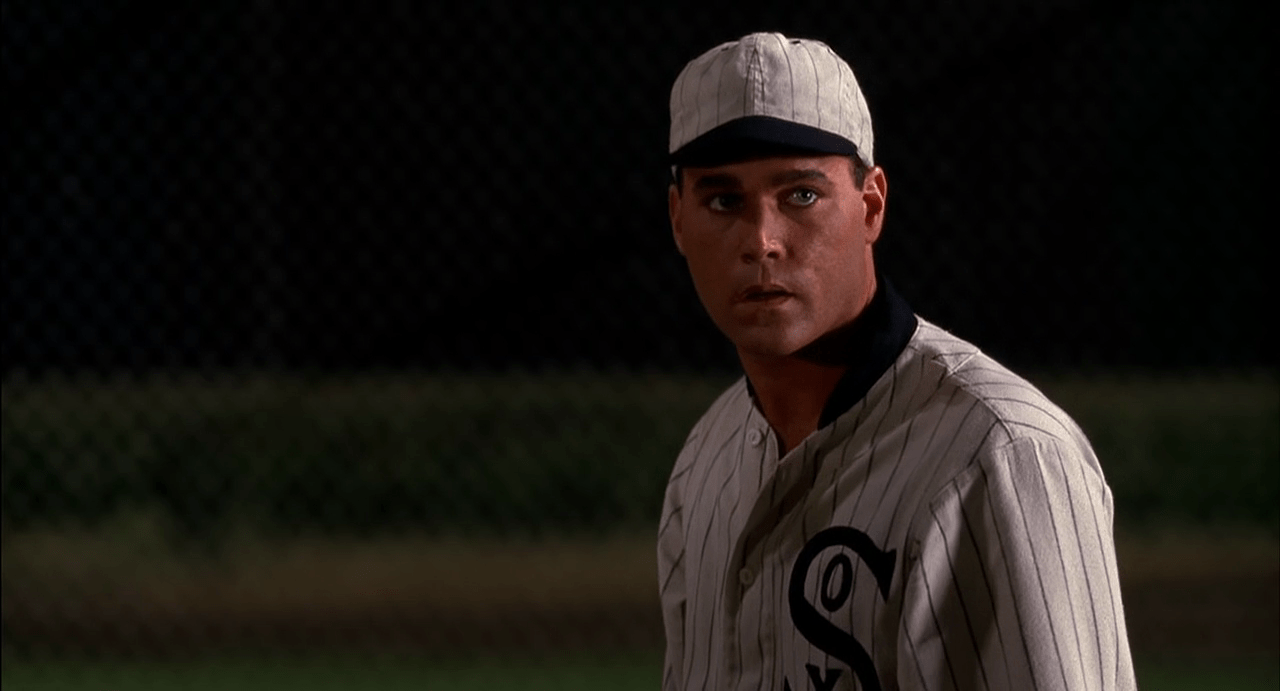

In the 1989 drama Field of Dreams, the legendary Shoeless Joe Jackson (or ghost thereof) coaches a young Archie Graham who is at bat against an intimidating pro pitcher… Shoeless Joe Jackson: The first two were high and tight, so where do you think the next...

by Trent Smalley, CMT | Jan 7, 2019 | Stock Market Analysis, Stock Market Trends

Good morning and happy Monday. After a thorough scan of markets over the weekend I put together a list of some of the best opportunities from a risk/reward perspective. One of these opportunities comes in the equal-weighted retail index XRT. Part of my analysis is...

by Trent Smalley, CMT | Jan 3, 2019 | Stock Market Analysis, Stock Market Trends

Last night Apple announced a rare cut to its sales forecast due to slowing iPhone sales in China. The World’s second largest economy, China has released numbers showing that parts of its economy are slowing and that is putting pressure on markets globally. With...

by Trent Smalley, CMT | Dec 24, 2018 | Stock Market Trends

Last Wednesday I did a post on the recent strength in Bitcoin, highlighting a near term profit target of approximately $4200. This has been achieved swiftly. There is no asset class which adheres to technicals and sentiment / investor psychology than cryptocurrency....

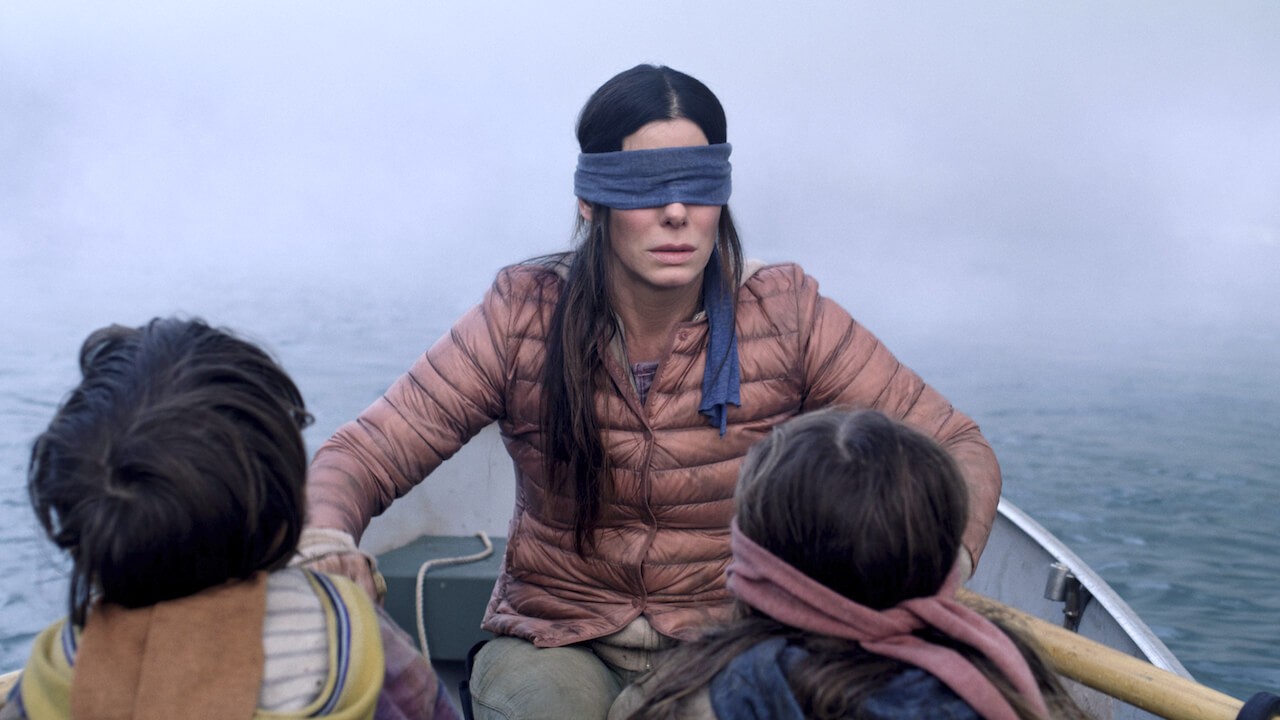

by Trent Smalley, CMT | Dec 18, 2018 | Stock Market Commentary, Stock Market Trends

Among the day’s top gainers are a handful of Semiconductor names, often seen as a market gets ready to lead a new leg higher in stocks. I wish I could say this was exciting, but I don’t buy it. For that reason, I am short ON Semi Corp. $ON. Would you take...