The larger cap marijuana stocks have been on the hot mess express since early this spring. The ETFMG Alternative Harvest ETF ($MJ) started off the year smoking (hehehe) but have come all the way back in to levels not seen since January. However, a near term bottom may be working itself out here and I think risk/reward is skewed to the upside. Here is a look at the $MJ ETF:

Since the start of August, price in $MJ has made a lower low while the RSI has made a higher low. This divergence is one traders look for as it can mean sellers are exhausted and new buyers are beginning to step in.

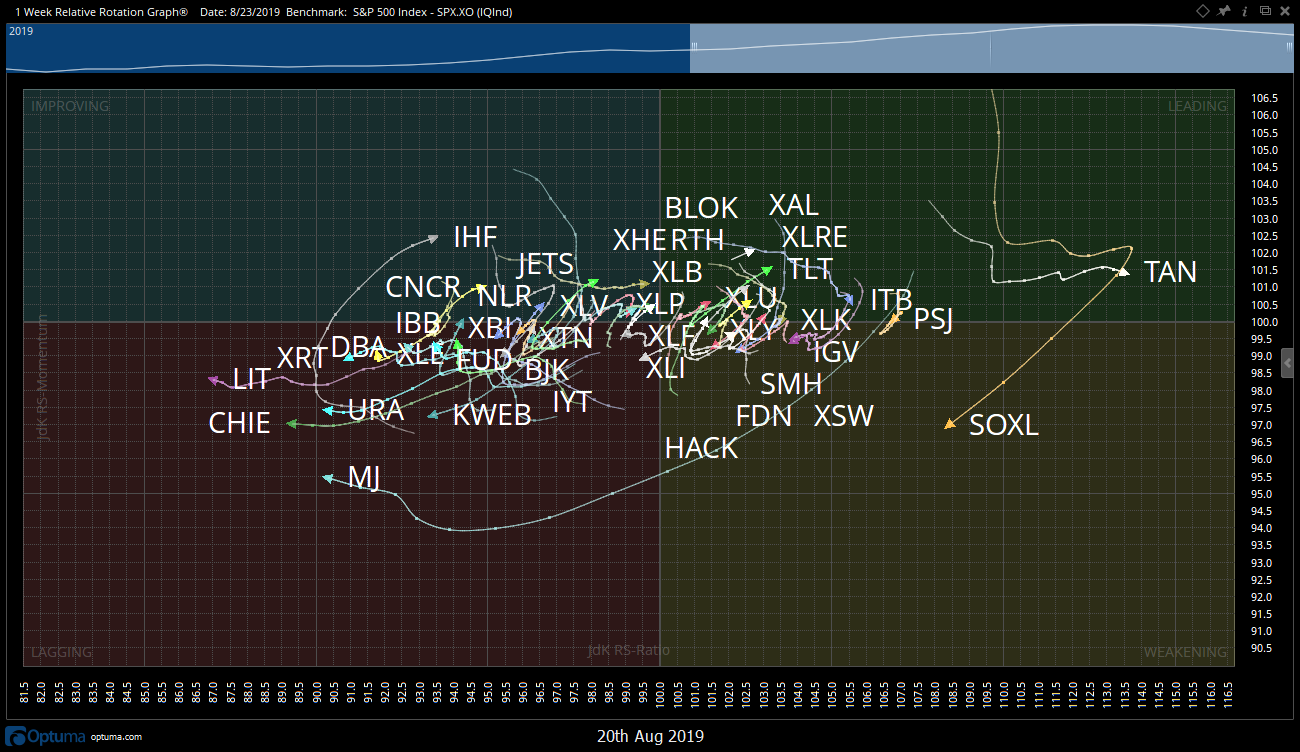

Further, the weekly RRG shows that $MJ might be trying to make the turn up from the Lagging Quadrant with its sights set on the Improving Quadrant.

The ETF itself includes the following top 5 holdings which currently account for over 30% of the fund:

GWPH Pharma, Cronos Group, Tilray, Aurora Cannabis and Canopy Growth. Price action in two of these names in particular are setup in interesting places for a near term bounce…

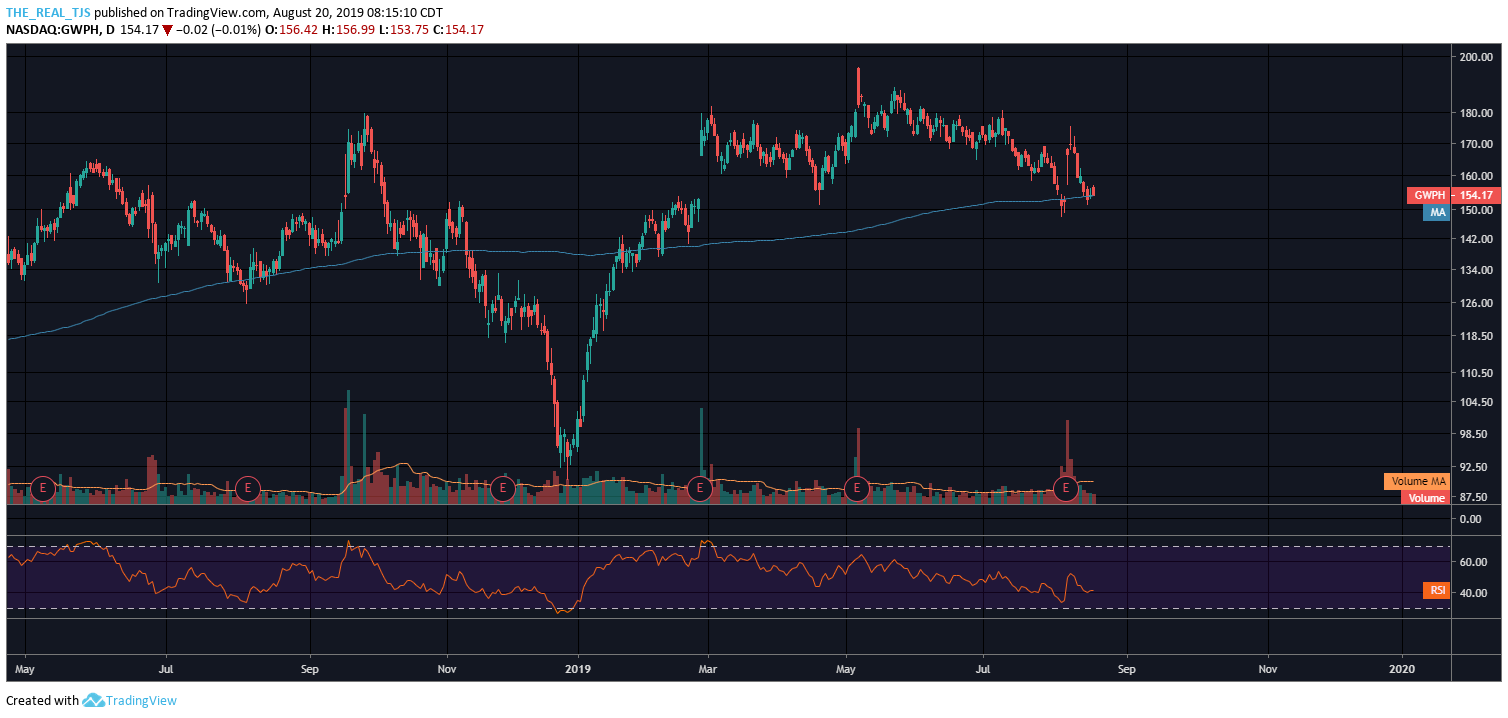

GWPH sits on its 200 day moving average here:

Cronos sits on its 5 year point of control with a slight bullish momentum divergence as well:

Keep an eye on this group if for nothing more than a short term relief rally. While gains achieved early in the year in this space went “up in smoke,” I think the industry has a great risk / reward profile in the coming weeks.

Happy Tuesday!

Trent J. Smalley, CMT