After a sharp sell off recently, the investment banking giant Goldman Sachs may be coming into a level where we can look to profit on the long side. Take a look at what I am seeing below:

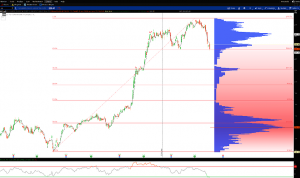

$GS is sitting right on the 23.6% Fibonacci Retracement Level of the most recent June to February uptrend. The stock has respected this level before, back on February 2nd. Volume profile shows this is an area where bulls are capable of defending the downside, which could lead to another bounce off this $227-228 price level.

In addition to respecting the aforementioned price and Fib level, the Relative Strength Index has recently moved into Oversold territory. The last time the OS level was breached in the name, was back in late June of last year in which a rally from $140 to $255 ensued. An oversold reading in the RSI doesn’t guarantee a rally of course (nothing is ever guaranteed) but when we get multiple confirming signs, it’s a level I like to take a shot.

Friday I took a position in $GS April 242.50 calls, looking for a bounce back up to the high volume node in that price area. I paid $1.40 for these, risking the full premium. If the $227-$228 level isn’t respected and the name should fall further, look for a move to $211.

@omahacharts