In an effort to put together something coherent in terms of what is happening in the Global Markets, I’ll take you through some of the things I am watching, reading, etc. throughout the day. Many of my followers don’t watch markets closely daily, and that is a good thing. There is no need for 90% of people to do so. But, when historic sell offs like what we saw yesterday, and which started last week occur, everyone tunes in. Emotions start to run high because people are emotional about money. It always has and always will be that way.

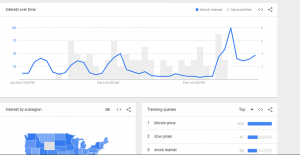

Here is a look at Google Trends, which is a cool site to check out to see what the world is searching for on the online search engine.

You can see the extreme spike yesterday when the market began to collapse. In fact, the S&P Index and Dow Jones Index were the 6th most searched for terms on Google Trends. The VIX Volatility which is the market’s “fear gauge” also made the top 10. This is rare, and only happens when markets go haywire.

This just tells me that emotions are high, and both sides are initiated here. In other words, everyone is watching and reacting emotionally which can and likely will lead to more volatility to come.

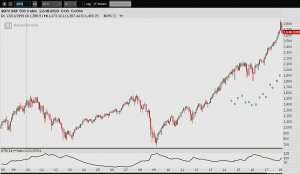

To put things into perspective, here is a chart of the S&P Index, which is the benchmark to which most all money managers are measured.

You can see along the way, a nice uptrend, two pull backs at the end of 2015 and start of 2016, and a resumption of the uptrend. Most recently, we started to see what some would deem as market euphoria, where everyone wants to put money in the market because “it’s just going to go up no matter what.”

Friday and yesterday, you can see two significant pull backs. When something extreme happens, the best you can do is find another period in history where something similar has happened. You really have to go back to 2008-2009 to find a similar monthly candle.

This doesn’t mean we need to prepare for another financial crisis like we saw in 2008. That was an event we likely won’t see again in our lifetimes, but it doesn’t mean there isn’t more downside to come.

For those who are a bit more nimble, Josh Brown has a strategy which I agree with. Go in and put GTC orders in on some stocks you would like to buy at a hefty discount. For example, maybe you haven’t any Apple in your portfolio and you want to own it long term. It closed yesterday at around $156. You can put in a buy order underneath the market at say, 10-15% lower just in case it might fall that far (doubt it especially with Apple) but you get the point.

Here is his article on that: Josh Brown OG Strategy

Just this morning, Jim Cramer tweeted this picture with the following:

“Whenever the trucks are down here, just go find something to buy. Got me? Greatest indicator ever in my 36 years down here.”

He means the selling is getting overdone, to expect a near term relief rally and to go find something you’d like to own at a discount price. In short lots of good stocks are on sale because they were taken down with the rest of the market in a panic situation.

For the vast majority of you who have money in 401ks, IRA, long term accounts etc, there is little reason to act today, or tomorrow or the next day. When market headlines make the news, we tend to discard the one element that gives us the ultimate control of our financial future: Time.

A relief rally WILL come. And likely this week. If you have money you might need in the next several months, wait for a bounce and take some off the table. If you aren’t sleeping at night, also a good reason to take some off the table. Anything you can do so you aren’t highly emotional or stressed is worthwhile.

One thing that may help put this into perspective is a stat I came across:

There have been 34 double digit drawdowns on the S&P 500 since 1950. 22 of those occurred outside of a recession.

A market draw down of the double digit variety happens more often outside of recessions. We aren’t in a recession and none of the indicators that have historically worked to point us to an oncoming recession are present.

Throughout the day, I will try and update with some charts of interest, and things I am watching. We are set for another extremely volatile day.

Sit back and “enjoy” the show.

OC