One of my favorite traders puts out a weekend video on his YouTube channel that I never miss. Peter Reznicek of ShadowTrader is a market profile expert, proficient technical analyst, and an astute options trader. A couple of weeks ago on his weekend video, he was pitching the idea of getting long some of the beaten up cruise line stocks. Before detailing the trades, he took a moment to preface the opportunity by explaining to would be critics the difference between price action in stocks, and the underlying companies:

“ If you are thinking of writing me and saying well actually. the balance sheet of that company won’t survive so your idea about that one actually doesn’t make sense because actually that one is probably going to go out of business. While that may very well be true about any of these companies I will mention understand this: The reason that fundamental investors have to have such a long timeframe, is because their timing is often so horrendous, and also because price action often doesn’t care one iota about fundamentals.”

What Peter just explained above is something you likely wouldn’t understand unless you are a trader. It doesn’t make sense to most that a company that is facing possible bankruptcy or a dire financial situation could have its stock sitting on huge potential. But this happens time and time again when the stocks of companies become divorced from the business itself. Peter’s trade weeks ago in the cruise line stocks is one example that is starting to work as we speak. I have one of my own for you: Retail department stores.

Wasn’t the mall dead before the pandemic? Hasn’t the news done nothing but cover how dire the financial situation was for department stores like Dillards, Nordstrom, Macy’s, etc.? There is no question that the Amazons of the world have stolen a great deal of business from old school retailers as we know them, but this has nothing to do with their stocks, especially in the short term.

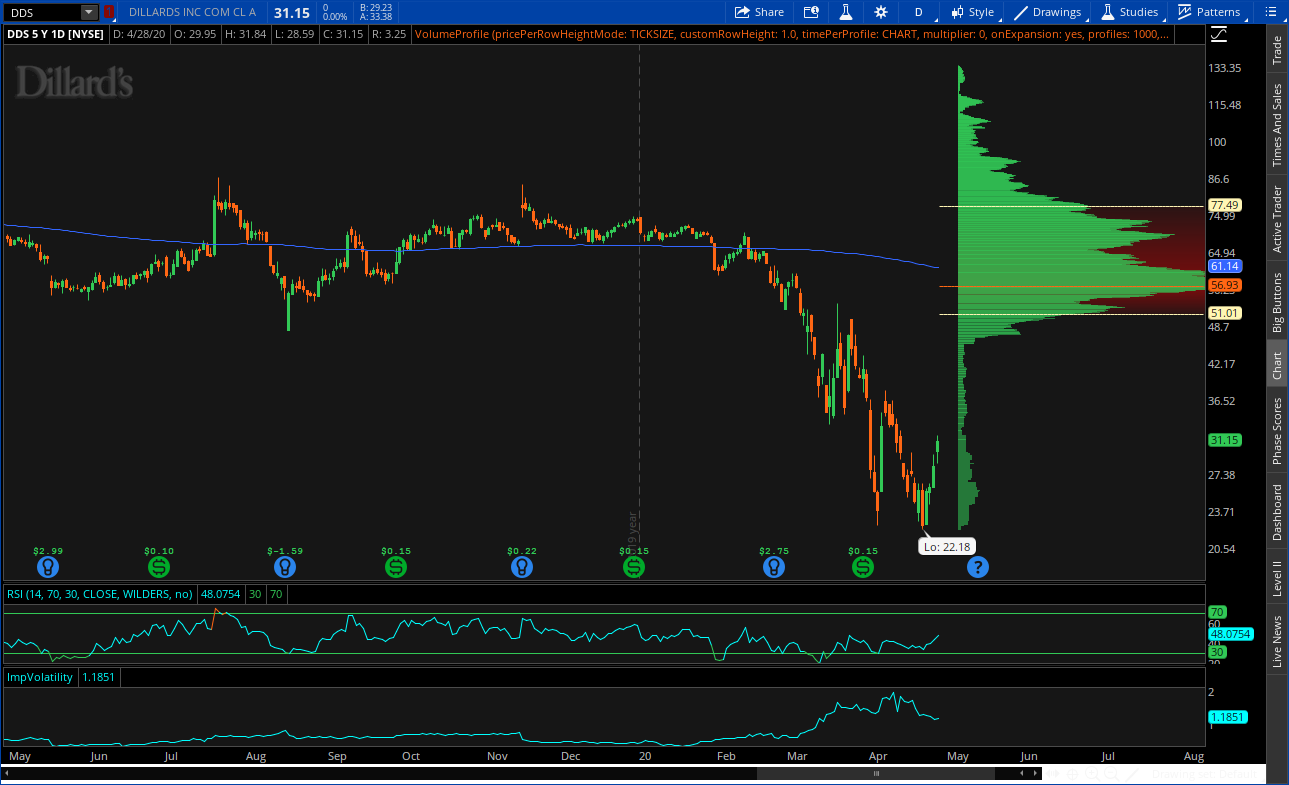

Take a look at Dillard’s, probably my favorite of the bunch. Before I bought this for a friend’s account I manage I reached out to preempt him:

“You are going to wake up this week the proud owner of Dillard’s stock.”

“What????? WHY?”

“You’ll see.”

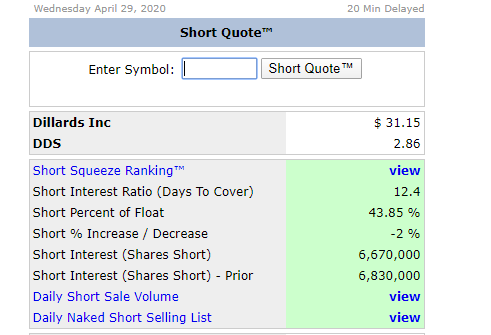

Volume profile tells us there is little resistance above until $50. From where I entered the stock, that would be a double. Price jumped up above its 20 day simple moving average yesterday and a close above it this week bodes well for more upside. One other thing that bodes well for more upside is the short interest:

High short float when a stock starts an upward trajectory is added fuel to the bullish fire. Some of my best trades ever came from getting behind a stock with high short interest which was just beginning to trend.

I have been in for several days now and have locked in a nice gain. If you wish to play along I would use the 20 SMA as your downside risk level. A close below that would get me out at this point. Also, keep your eye on May 13th as that is when Dillard’s reports earnings. I don’t want any part of that so will be out by that time.

This is an example of a skewed risk/reward opportunity that traders look for every day. Defined on the downside, plenty of room to run on the upside with an added kicker of high short interest known to get things moving quickly. So while actually, Dillard’s may end up being in trouble financially I like the stock right here and now.

Trent j Smalley, CMT