The bump in the road

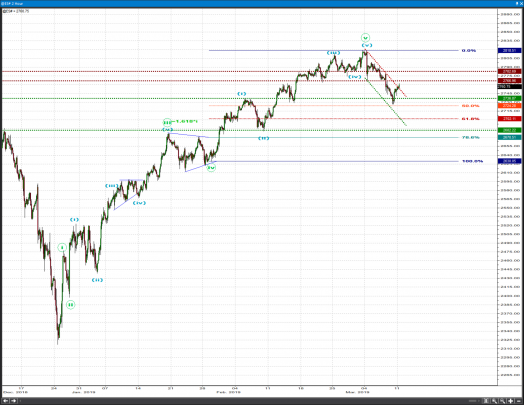

Over the past few weeks we have discussed the pattern and the associated internal technicals of the short-term S&P 500 uptrend. We concluded a correction was approaching and with key levels at last violated last week we must conclude that a correction is now underway.

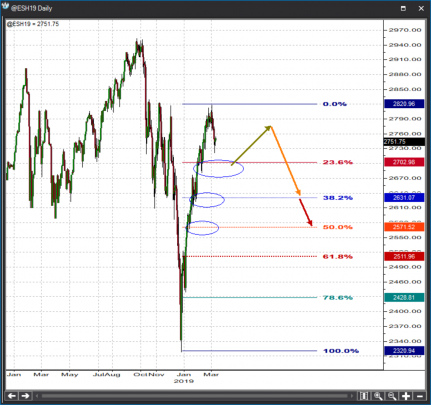

Please notice one thing right away: the corrective / counter-trend nature of the currently unfolding slide is not even disputed. For the SPX to run into exceptional mid-term trouble right away, it would have to accelerate lower below the 2428 – 2511 zone. Three major areas of support are likely to contain any near-term weakness before we even get there. They are 2685-2702 / 2612-2629 and 2560-2570. They are confluences of structural and fibo support where we simply are highly likely to get a reaction from the market. The question is which one is more likely to mark the final low?

The first zone of 2685-2702 is likely to bring the end of the first leg down of this correction because it represents a rather minimal percentage retracement and just the initial structural support. More typically the market would at some point extend losses into 2612-2629 but beware of an important nuance here. The market can establish an initial low at 2685-2702, can even go to retest the 2820 high and only then plunge into the 2612-2629 zone. Based on the V-type reversal we experienced in December it is highly likely that the current pullback may be buoyant overall and may give hints of an upside bias either in terms of internal form, in terms of pattern traced out or both. It is too early to confirm that is the case but we have enough reasons, based on previous price action, to believe that this will indeed be the case. If I am wrong to some degree about the overall buoyancy of this retreat the market will end up testing 2560-2570 before turning up in earnest; otherwise it will be contained at 2612-2629.

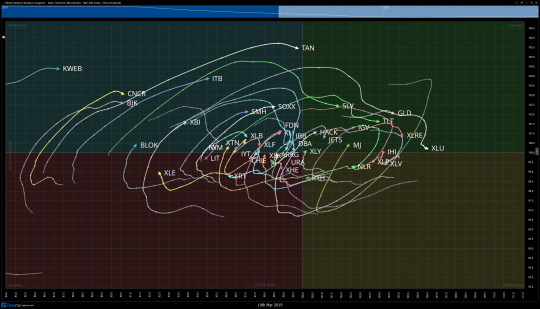

Near-term we’ll get a roller coaster. You guys know my opinions about Brexit and you will have had an opportunity in the past few years to see how the globalist mafia on the two sides of the Atlantic is trying to overturn 1. the referendum results and 2. the 2016 election results. Trump did, in my opinion, extremely well and if we add the internal political pressure and the hostility he faced ALL ALONG THE BLOODY WAY he is, by any objective measure, the most efficient US President ever. Brexit would be an opportunity for the UK to do the same – restore democracy, capitalism and everything that has been great over the past 4-5 centuries about the anglo-saxon culture. Brexit, instead, saw numerous attempts of being hijacked and this “last minute” charade is nothing but an attempt to do just that: this is project fear economics while bought-up career politicians disregard the vote of the electorate and try to deliver the establishment either no Brexit or at best BRINO – Brexit in name only. As I said from the beginning at some point the UK will exit without a deal simply because attempting a UK / EU deal is like attempting to make a devout wife stick around an abusive husband – she just doesn’t care how hard it will be to make ends meet on her own, she’s just tired of tyranny. Based on that, is march the 29th the date when the UK splits up for good from the fascist-communist EU? It could be, despite the attempted stitch-up by the establishment because at stake in the current “deal” is the actual integrity of the United Kingdom – which is why the initial vote lead to the biggest defeat ever in the history of the House of Commons. But let’s say the stitch-up will be delivered and we will get either a delay or BRINO. Either way, from a US stock market perspective there’s only one thing to expect: a roller-coaster over the next 3-5 weeks, overall weakness as the divorce terms become public and ultimately strength because people simply realize the US is a safe heaven for now. Over the next week or so, based on the chart below, the SPX will face resistance at 2767 / 2783 / 2802 / 2820 and then drop towards 2685-2702 to complete the initial leg down of this correction. At that point a bigger bounce will start but remember, as it stands now, this is a month-long correction that will likely not end before we test the 2612-2629 zone in the SPX……….

[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

WEEKLY STOCK PICKS

TENB

| DIRECTION | BUYZONE | SELLZONE | RISK/REWARD | VEHICLE |

| LONG | 29.50-30 | 34 | -.50/4.00 | OPTIONS |

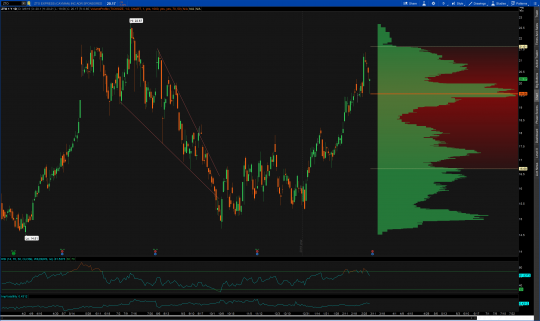

TENB makes the list once again as it is wedging back toward the one year volume point of control. The play worked well two weeks ago and I am looking for much of the same move here in the coming weeks. Provided price can close above VPOC Monday, I like the chances for a move to the one year Value Area High.

ACIA

| DIRECTION | BUYZONE | SELLZONE | RISK/REWARD | VEHICLE |

| LONG | 50-51 | 58-59 | -1/7.00 | OPTIONS |

The most recent earnings announcement sent ACIA higher and began the makings of the current flag pattern exhibited by the stock now. I have always been a fan of price action that is slowing coming back into price levels where a gap up on high volume occurred. Prices at these levels are most often defended, sending the stock higher once again. This is an easy target for April calls as price comes back into the 50 level.

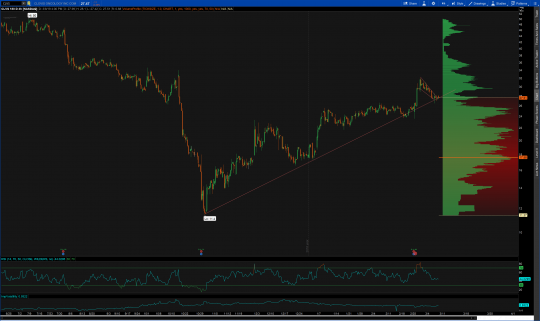

CLVS

| DIRECTION | BUYZONE | SELLZONE | RISK/REWARD | VEHICLE |

| LONG | 26.50-27 | 32-33 | -1/5.00 | OPTIONS |

CLVS has been putting in higher lows and higher highs beginning in Q4 of 2018. It has been respecting a basic trend higher and is wedging back into that line of support at these levels. Sometimes simplicity such as trading off of a defined trendline is as successful as a more complex strategy. One of the main tenants of technical analysis is that prices move in trends. We seem to have one here, why not play it?

EPZM

| DIRECTION | BUYZONE | SELLZONE | RISK/REWARD | VEHICLE |

| LONG | 11.50-12 | 14-14.50 | -.50/2.00 | OPTIONS |

Earlier this year, EPZM managed to break out above the downtrend that had plagued it since May of last year. It has since moved in defined patterns of price discovery, wedge, discovery and wedge once more. I like the chances of a move back to the 1 year value are high in the coming couple of weeks.

ZTO

| DIRECTION | BUYZONE | SELLZONE | RISK/REWARD | VEHICLE |

| LONG | 19.50-20 | 21.50-22 | -.50/2.00 | OPTIONS |

ZTO reports earnings on Tuesday this week and I am looking to take a small long here, risking the entirety of the premium. My rule of thumb is to play earnings trades at no more than 50% of your average position size. Some of the China internet stocks have reported stellar earnings and I like the risk / reward profile here.

[/vc_column_text][/vc_column][/vc_row]