Is the “enemy within” about to cause irreversible damage to western economies and markets?

I will excuse myself for not having as many charts in this update as I usually do. Doing this with my broken and casted hand is particularly challenging. Please feel free to reach out if you need additional details or if you wanna chat about a pattern in a particular index.

The market has been acting rather negatively this past week and we can only wonder what’s going on; I mean we’re supposed to have a Santa rally in December aren’t we? What is the market trying to tell us ignoring the positive seasonality at this time of the year?

In my inner circle I have maintained since late 2015 that DT will make it, that his election will give us a wave 5 rally and that in the end he will prove to be too little too late for the level of domestic corruption all Western democracies are currently succumbing under. I am not entirely sure of the timing of the second part of the forecast – it may play with or without a DT 2nd term – but based on what I see at the moment it is distinctively possible that in 2019 and beyond the “enemy within”, i.e. corrupt career politicians, are about to run western markets and economies literally in the ground. Let me explain.

I grew up in communist Romania and the mid-to-late 1980ies were a period in time I’ll never forget. As we were getting poorer and poorer as a nation and a bloc our wise communist leaders would tell us every day that everything, from agricultural to industrial production and retail sales and everything else in between was booming; employment was high and we were making fresh progress every day towards the socialist ideals which in the end were going to take us to the promised land of communism. We the people of course were watching those despots in shock asking ourselves if everything went so well why the hell were we so poor. In the end, the economic and social collapse was so bad that revolutionary changes swept across all of Eastern Europe; all countries ended up abandoning the idiotic ideology of communism and moved towards western-oriented political and economic systems.

Fast forward 30 years later. The western political establishment has been telling us that free trade and open borders are noble ideals that will make our countries better – in fact, according to globalists these practices have already improved the West massively for 3 decades at this point. Meanwhile, we the people watch them in shock and wonder why our standards of living have been constantly eroding for so long if these policies are that good. We are being told to have faith in the globalist ideals which will create nothing but opportunity for all of us. By any objective measure that assertion is based on fantasy at best and unscrupulous lying at worst – it is simply not what is happening.

A fundamental difference between the former communist bloc 30 years ago and the West today is that the democratic form of governance made the election of anti-establishment candidates possible. The establishment used every dirty trick in the playbook to prevent both the Brexit vote and a Trump Presidency but they have failed as massive popular support went behind both. We are now facing, however, something far worse.

In the UK a major Brexit betrayal is underway. In the US the democrats are all but taking the knives out to finish off DT. Exactly how successful the two attempts will end up being is difficult to predict, but what I know for a fact is that they will both create lots of turbulence and uncertainty. I do expect a rather negative reaction from markets. European indices have definitely topped, US ones are a bit more hopeful but as I said before dropping below the 2200 area in the SPX will dramatically complicate the situation in the States too.

As I was reading the press this week-end I came across this: Schiff previews new line of attack against Trump: Deutsche Bank ‘laundered Russian money’. I’ve never been impressed with Adam Schiff’s vision, morals or intelligence but this endeavor is particularly dumb. The reason is Deutsche Bank has a wealth of other problems and the last thing it needs right now is being involved in a PR scandal of this magnitude. The point is, absolutely zero will come out of this endeavor for the democrats as I am absolutely sure there is nothing to be found in the Russiagate file – Mueller poked at it for many years and really got nowhere; but for Deutsche Bank to become the focus of attention in a file that involves such negativity is beyond undesirable considering that the stock market is already suggesting the bank will face serious survival issues. As my father used to tell me all the time, “it’s tough to talk reason to guys that don’t know what they don’t know”. Even for somebody anti DT to its fingers this is not bright – this is a project that has only downside and that will fuel nothing but bearish energy for markets and at some point the democrats will get at least some of the blame.

In the end the point is this. The emotional charge of the current political fights is unusually high. In spitting on the democratic will of sovereign people and in potentially creating massive uncertainty for economies and markets by attempting to abusively block political projects that have considerable popular endorsement and legitimacy, our western political class can only be deemed as the enemy within. Like the old soviet elite they are desperately fighting to conserve their privileges without any regards for the interests of the people and the country. Like the old soviet elite they break all and any rules, even those of their own making. Like the old soviet elite they are in complete disconnect with the population they seek to govern. The stupidity of their endeavors and actions is in perfect sync with the wave count in the major stock indices and is one more reason to just stay defensive for now.

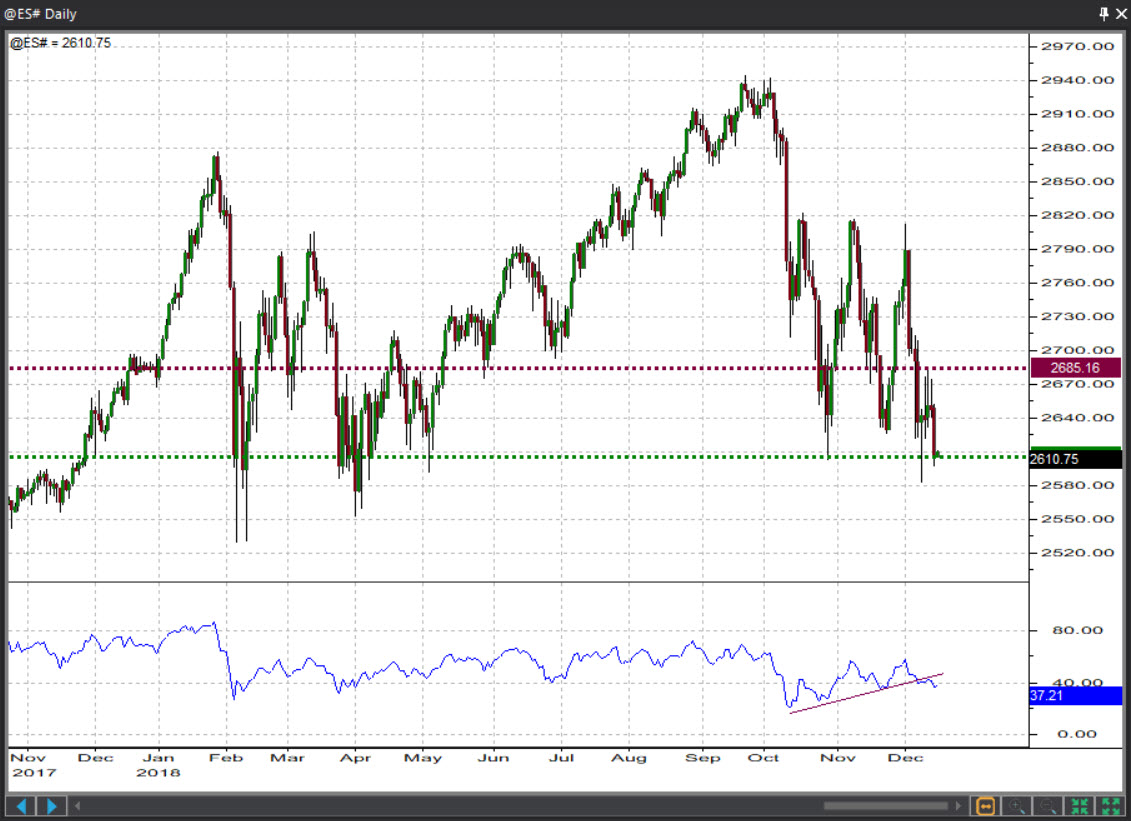

As the current situation relates to the SPX, I have this to say. In the past year or so we only had 3 worse closes than the one we got Friday. In all cases, the subsequent daily close was sharply higher, almost suggesting bears had attempted to push the market lower but ultimately failed. If we do not get a meaningful bounce above at least 2650 / 2685 early in the week, the decline may just continue or even pick steam. If we do bounce one more time we’re still looking at prices to stall around 2720-2740, with an allowance towards 2820. Either way, the best this market can have right now, seems to be a bear market rally of some nature. It really takes a push beyond 2820 to conclude a larger degree low has formed.

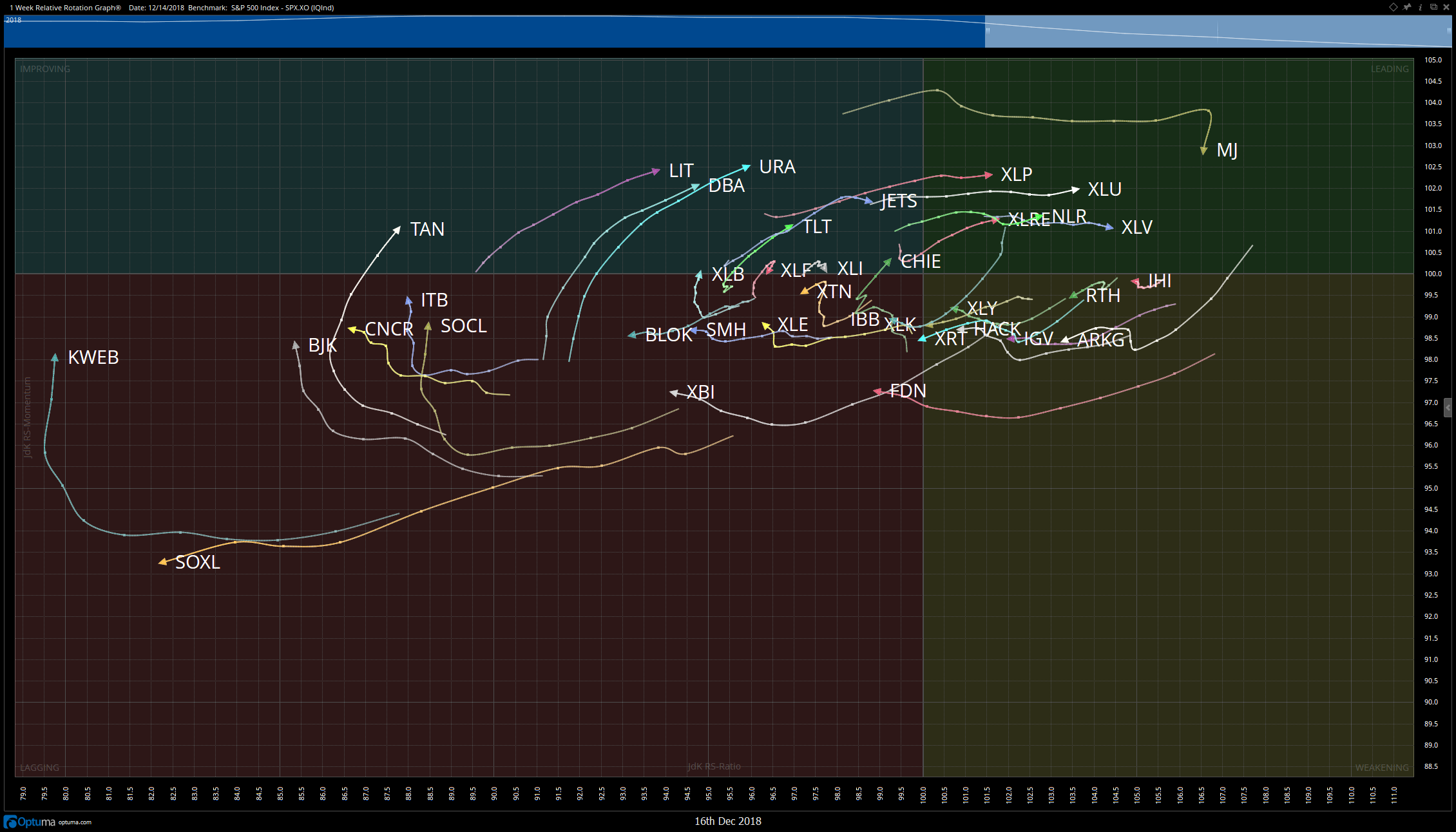

WEEKLY STOCK PICKS AND RRG

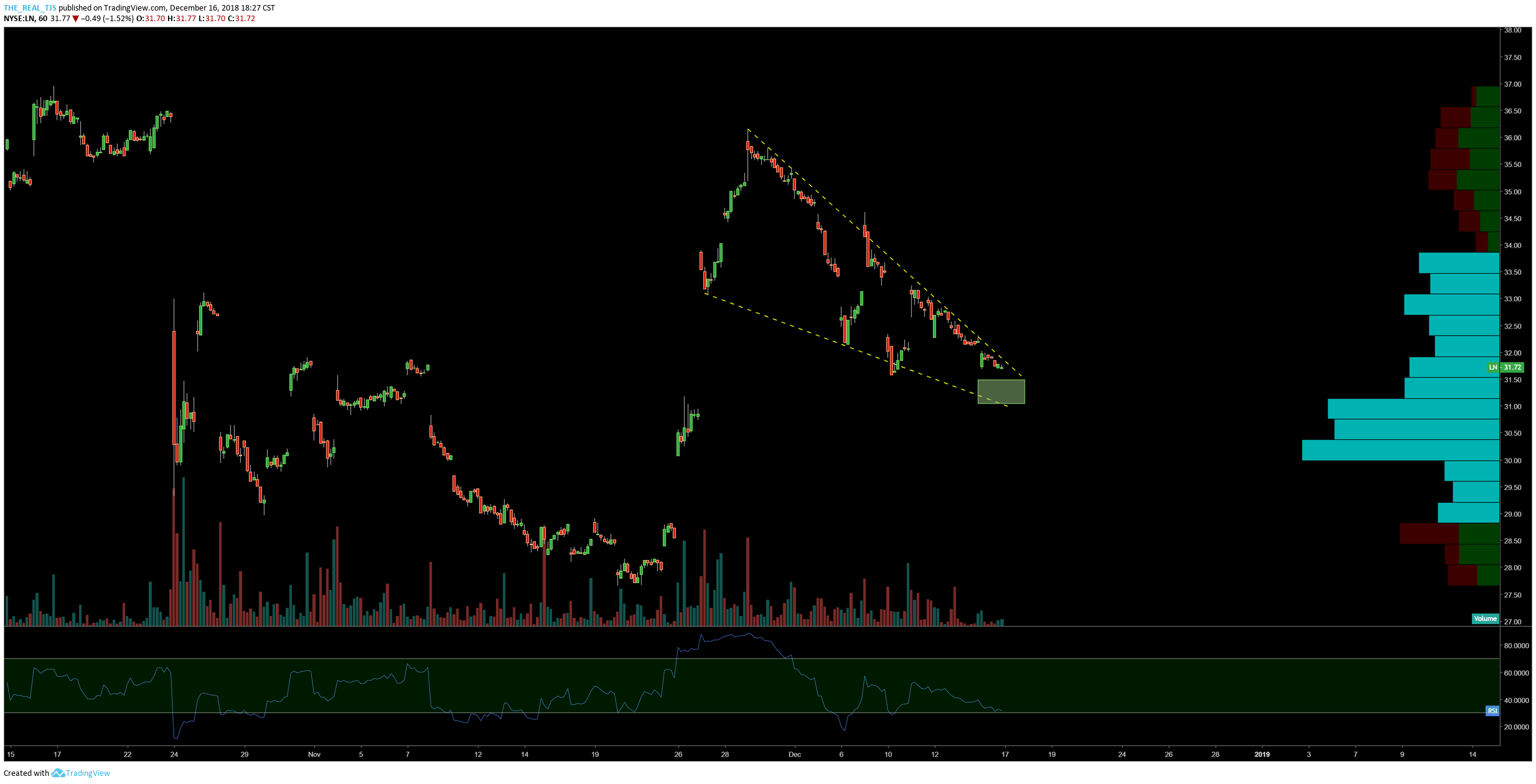

- LN

| DIRECTION | BUY ZONE | SELL ZONE | RISK/REWARD | VEHICLE |

| UP | 31-31.50 | 35-35.50 | -.75/3.25 | OPTIONS |

LN is wedging lower into intraday VPOC and I think the apex of the triangle highlighted provides a good entry here. It is coming back into an area of bullish support and I think the flag pattern will provide continuation to the upside.

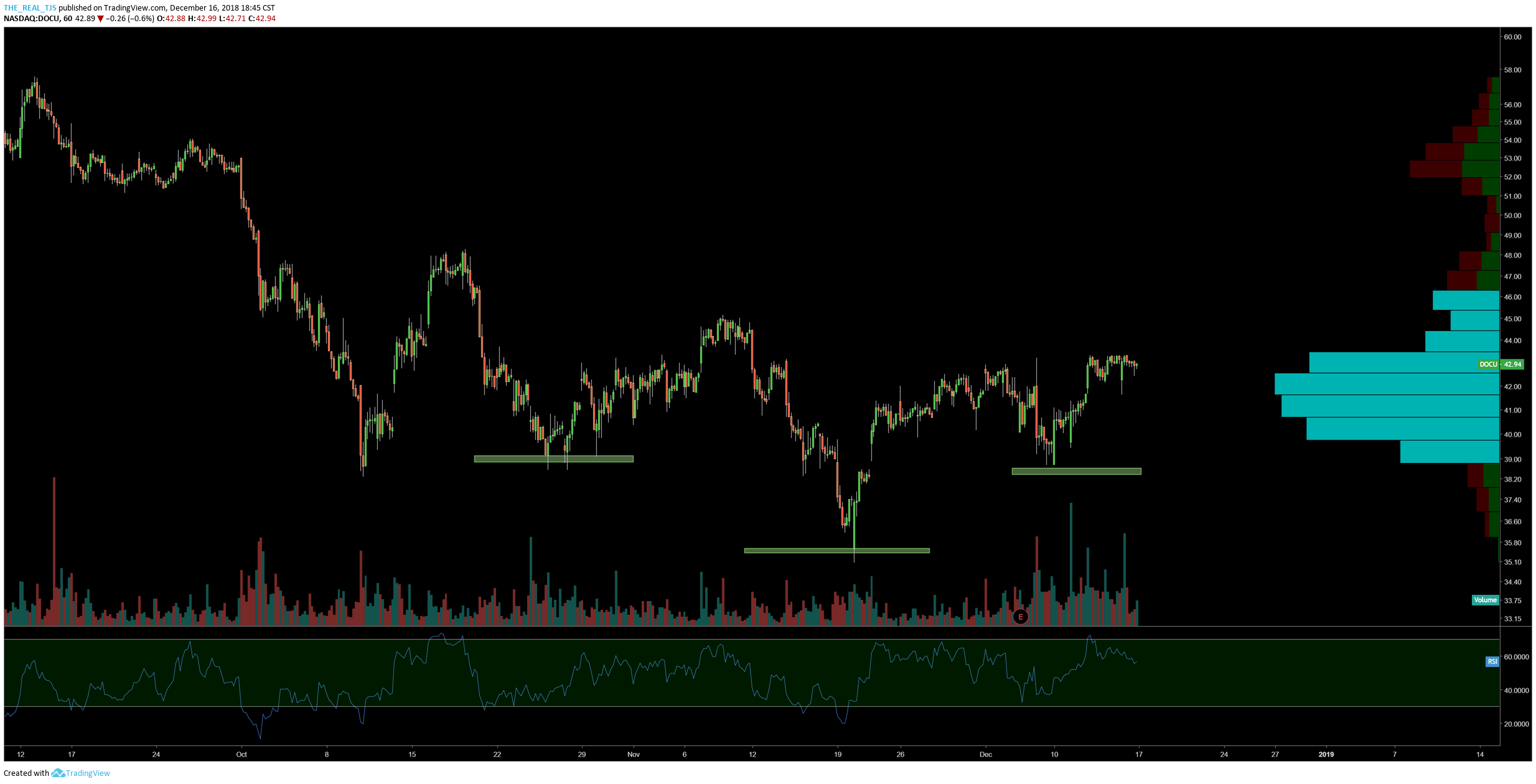

2. DOCU

| DIRECTION | BUY ZONE | SELL ZONE | RISK/REWARD | VEHICLE |

| UP | 42.50-43 | 51-52 | -.50/8 | OPTIONS |

DOCU is part of an industry group (application software) that has exhibited relative strength. On the daily it has traded above the yearly point of control (buyer controlled) and intraday here we show the makings of an inverse head and shoulders pattern, carving out the right shoulder just above VPOC. With a little strength early in the week, watch for this to get fast to the upside, even in the face of a tough market.

3. SEDG

| DIRECTION | BUY ZONE | SELL ZONE | RISK/REWARD | VEHICLE |

| UP | 38-39 | 47-48 | -.30/9 | OPTIONS |

SEDG is my favorite setup in the market currently. Part of solar, a group that has been strong relative to the S&P, SEDG recently broke out of a falling wedge pattern and has come back to retest the breakout area which coincides with the yearly VPOC. I am long this name already via December calls and will look to roll into January early this week.

4. PYX

| DIRECTION | BUY ZONE | SELL ZONE | RISK/REWARD | VEHICLE |

| UP | 14.25-14.5 | 22-23 | -.25/8 | STOCK |

Strictly a play on volume profile and depressed ATR. As price sits just above the VPOC on daily and intraday, ATR has fallen silent. With a little bullish price action, PYX has room to run, and quickly, to the upside. This is a name I am looking to build a longer term position in so stock is my preference.

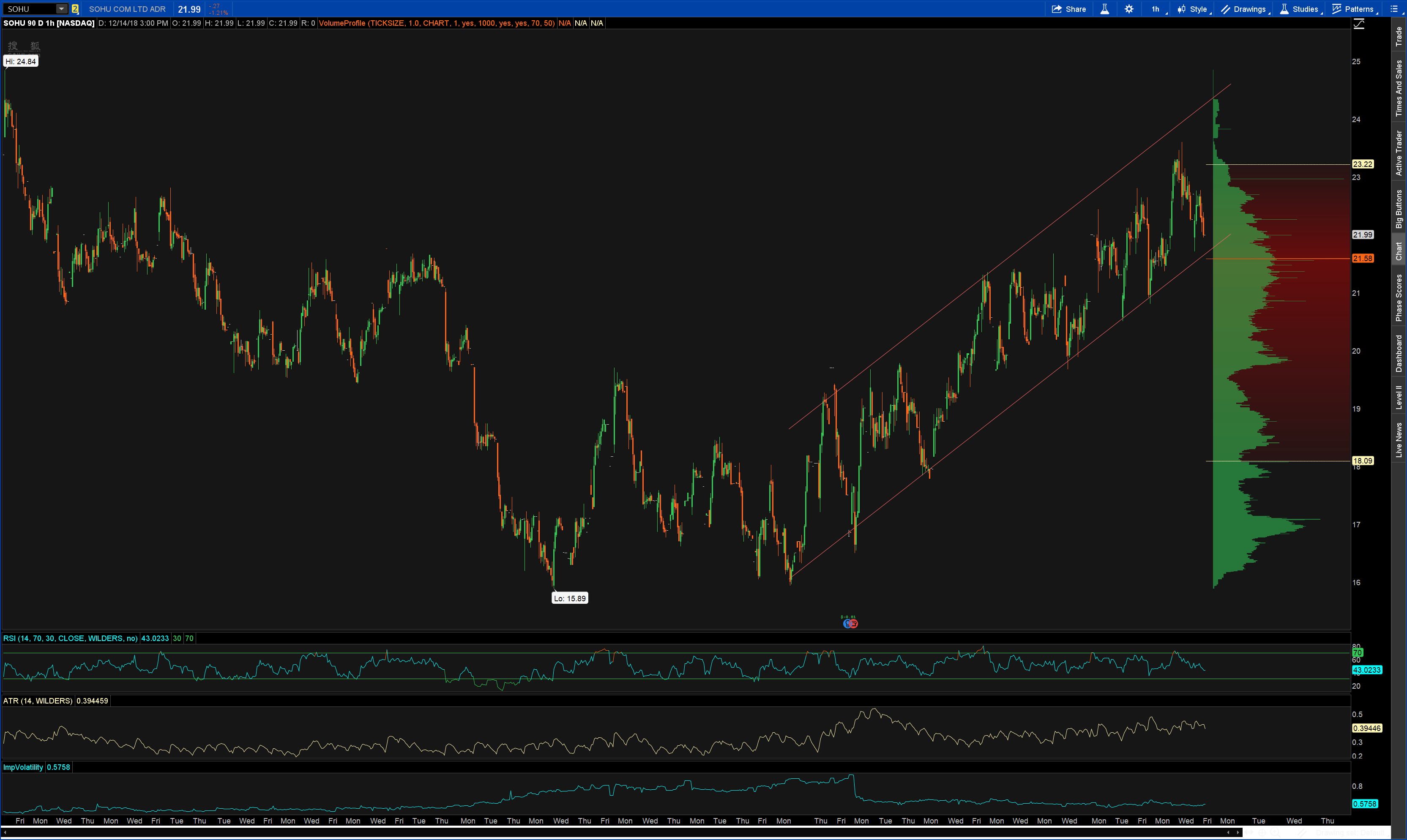

5. SOHU

| DIRECTION | BUY ZONE | SELL ZONE | RISK/REWARD | VEHICLE |

| UP | 21.50-22 | 23.50-24 | -.50/1.50 | OPTIONS |

SOHU is a China name making the list this week as it is trading in a defined channel pattern on the intraday time frame. The goal of course in channel patterns is to get long near the lower bound and sell as price approaches the upper bound, or to short as price approaches the upper bound and take profits when price falls back to the lower bound.