I was sent a post over the weekend which may confirm something I started seeing early this year: A breakout in fertilizer related stocks.

You can read the full post here: Fertilizer Related Stocks Start Showing Green Shoots

(H/T) To Alan Cohen @al_xdpg

For those following along, I started buying Intrepid Potash Early this year in two different long term accounts, I have continually added to these positions, making them over sized in both.

When I started the position I was met with the typical, “Why buy into a stock that has been left for dead?”

Now that $IPI has returned 55% in 2017 I am being met with, “Isn’t it time to get out and take gains?”

My answers to these two questions would be that I typically don’t and definitely not, respectively.

Take a look at my post on $IPI from a couple of weeks back: Don’t Sleep On Intrepid Potash

I’ve gotten more questions about this stock than any other which is interesting. I am guessing due to the fact that it is inexpensive (dollar wise) so more people are participating, and because it has become highly volatile. In my experience stocks that have gone from “dead asleep and dreamin” to volatile means that they are setting the stage to make a move, one way or another.

Let’s take a look at the updated charts:

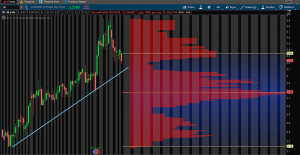

Uptrend in price, confirmed by RSI.

Breakout with bullish volume accumulation. What does that mean? Simply that it isn’t chumps like you and me buying, but rather highly likely that institutional money is taking notice and beginning to pick up shares.

Intraday Chart: Still in an uptrend

I won’t bother with adding Fibonacci Numbers to the chart above but $3.18 will be a level I’d be willing to bet we see buyers if we trade there. (38.2% retracement)

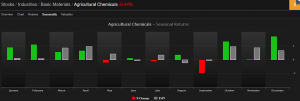

From a seasonality point of view, September is a rocky month for the Agricultural Chemical Space, but if you can stomach the tumult you will be treated to a strong Q4.

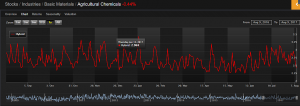

And an Oscillator of the space (Think Overbought Oversold) shows we are closing in on a bounce:

In sum, don’t go out there and hurt yourself over a stock. I’ve done that, sadly more than once. For every big breakout in $IPI learn to expect a retest and a pullback. Stocks don’t go straight up, they will do what they can to shake you out of them. However, if you hang tight through the turbulence it is my belief that $IPI has the potential to reward you handsomely for staying put.