Any one that has been a part of investing or trading for any length of time, knows that there is no “Holy Grail.” However, before you call my title click bait, hear me out. I think the Holy Grail of trading, if there ever was such a thing, has to be unique to each individual. Our own personal HGs (Holy Grails) are sometimes the introduction of a finite trading plan, complete with dedicated risk management criterion. Other times learning a particular trading setup or style supported by confirming indicators may serve as ones Holy Grail.

In my own particular circumstance, I am past the point of needing someone to tell me how the market works. Hey, I’ve stared at these screens for 10+ years now and see this stuff in my sleep. I also over the past few years have worked out a trading system that works for my particular circumstance and what I am trying to accomplish, taking into account the market environment we are in. One day this environment will change and so will my system, but for now I’ve got things under control.

So what is my downfall as a trader and investor? I have a system in place, cash management rules, thousands of hours of screen time, and tempered emotions the majority of the time. So what’s the problem?

Frankly, it’s you people.

Don’t take it personally, I don’t mean any one of you in particular. I mean the collective “you” as a whole. To make me sound like less of an asshole, I’ll call replace the term “you” with the more accurate term which is noise.

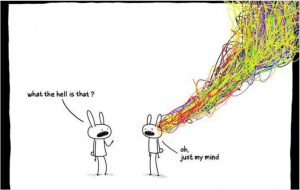

There is no better image than the one above that depicts what goes on in my mind daily. It’s partially how I am wired, and partially a product of the environment I subject myself to daily. For a long time I thought the more I am linked in and connected to heavy news flow, the better. Each morning around 630am I sit down at my desk and load up the following:

Twitter, Skype, AIM (Yep still use it), various company databases and customer service management systems, trading platforms, Spotify, Outlook, Excel, trading room, Go To Meeting, Podcast platform, Coinigy and assorted others. About 30 minutes into my morning the texts start hitting my iPhone, phone starts ringing, and notifications from other apps start pinging me for my attention. Monday-Wednesday I am pretty good at handling the firehose of constant information and interruptions. By Thursday and Friday I am irritated to the point where someone handing me a crisp $100 bill would be an annoyance.

This past week I was half listening to a webinar about why most traders fail. One of the slides had a bullet point that said something to the effect of, “I don’t care about knowing. I don’t want to be popular. Less noise.”

Less. Noise. Holy. Grail. (For me at least)

The business of finance, the machine that makes this whole thing “exciting” is the constant news flow around it. I’ll give you an example from my finance twitter stream right now…

Today in market history… who cares I’m not even going to finish this one.

Be sure to hop on our Premium Conference call where we go over why I think this chart is important.

Wall Street opens lower on N. Korea fears.

#FF these traders

Trump is a moron

I love Trump!

Apple is going to rip!

Apple is going to tank!

You get the idea. Noise. And I’d become a victim of it. This week I have tuned out. It has served me well. As far as the markets go, I listen to one, maybe two guys’ opinions and commentary. Because they are more experienced than me and point out ideas I may be missing. The rest of it is mostly garbage being peddled by people more interested in selling something than having an in depth knowledge of trading and or market mechanics. If they were trading would they be tweeting all day? Likely not. Over the years I’ve gone out of my way to meet a few of the internet famous.

“You got beat up a lot on the playground as a kid didn’t you?” was generally my takeaway.

At the end of the day if your goal is to profit via buys and sells, I believe it would serve you well, as it has me, to tune out. Even if you believe you are good at thinking for yourself, you run the risk of polluting your mind with other opinions that most likely don’t know as much as you do.

To sum it all up…

OmahaCharts, Holy Grail, Tune Out, Notifications Off, Think for myself, profit.

Back with more shortly.