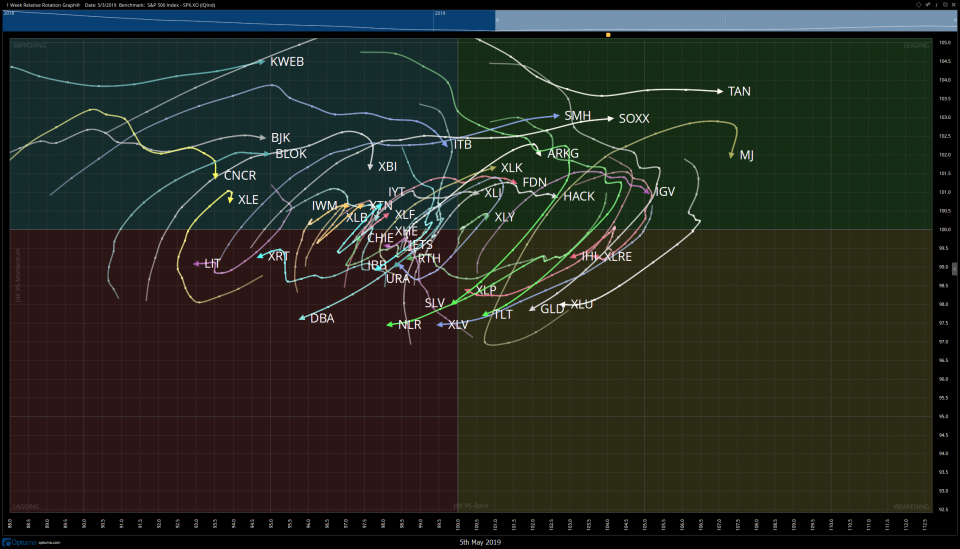

The weekly risk/reward setups were put together on Sunday morning, pre China / US Tariff headlines. Understand that implied volatility of options will now cause options premiums to become more expensive. I am planning to target calls in IWM, KRE, and possibly KWEB. Wave counts will be updated midweek.

- LULU

| DIRECTION | BUYZONE | SELLZONE | RISK/REWARD | VEHICLE |

| LONG | 177-178 | 195-200 | -3/20 | OPTIONS |

Post late March earnings, LULU gapped up on heavy volume and ever since has been walking a steady uptrend higher. I see no reason why this doesn’t continue and any pullback to, or just under the trendline should be bought. This is as simple as it gets and has a high probability of success.

2. DOMO

| DIRECTION | BUYZONE | SELLZONE | RISK/REWARD | VEHICLE |

| LONG | 35-36 | 42-43 | -2/7 | OPTIONS |

3. VRNT

| DIRECTION | BUYZONE | SELLZONE | RISK/REWARD | VEHICLE |

| LONG | 59-60 | 64-65 | -2/6 | OPTIONS |

I didn’t set out to find stocks this week that all are working off a gap higher, but it’s turning out that way. VRNT same story. That massive volume on the gap up is likely to hold the stock above $57. This may need some time to wedge lower, but ultimately it should resolve higher.

4. AN

| DIRECTION | BUYZONE | SELLZONE | RISK/REWARD | VEHICLE |

| LONG | 39-40 | 44-45 | -2/5 | OPTIONS |

5. LTC/USD

| DIRECTION | BUYZONE | SELLZONE | RISK/REWARD | VEHICLE |

| LONG | 73-74 | 88-90 | -2/14 | CASH |

I haven’t spoken much about crypto currencies in this letter in the past, however a setup is a setup. Where there are price and volume, it is all the same to me. I like the falling wedge breakout of LTC/USD and I think we see it come in a bit and it will be primed for a move higher. I have been in BTC, ETH and LTC for over two years now and sentiment became so poor they warranted a look recently.