As we prepare to round out the year 2021, I wanted to put together a post going over the state of the market as it stands today. In a year marked by fierce rotation, headline risk, and bursts of volatility, it has been challenging to lay out any kind of a roadmap going forward, which is the general intent of these blogs I’ve been doing for the better part of five years. This year, by the time you’ve read these posts, the market has moved on to the next narrative du jour and the content has fallen stale. However, the following will give you an inside look at many of the market signals, market generated information, and macro landscape that I pay attention to. Much of what follows assists us in our portfolio construction of the multiple strategies we run at JSPM LLC.

Volatility

As I write, the VIX volatility gauge (measure of market fear) has just come off its near yearly high. In long term investing a high VIX reading simply means that the character of the market has changed from a market of stocks (where individual company performance matters) to a stock market (where correlation among individual names is high and everything moves together). The second reason this is important is the fundamental understanding that high volatility environments have separated more investors from their best long term investments than any other periods. Chaos is rarely a friend to human nature, especially in terms of our money. We like to put money to work when “the coast is all clear” near short term market tops, and panic sell when we see bursts of volatility and the market drops. It’s a cycle that never changes no matter how many times we’ve lived through it. One assurance however, is that volatility is mean reverting, meaning that these bursts of chaos come and go, and on the other side of these periods is an orderly, calm environment characterized by a market of stocks once again.

A Bifurcated Market

Never have I been a part of such a two faced market environment. The year 2021 had me seeing charts that looked something like this is my dreams (nightmares):

Since starting in this business in 2007, I’ve been through the full gamut of market environments. From periods characterized by euphoria, extreme fear, and everything in between I’ve seen it all. What I haven’t seen however, is a year in which the overall market indexes have lied so egregiously. The indexes as they stand YTD:

Taking the S&P 500 as the overall market benchmark, going back to 1926 the average return is approximately 10%. On the surface it would appear as though 2021 is a stellar year as the SPX is up nearly double the historical average. Under the surface however, individual stock performance borders on bear market territory or worse. Bringing in the tech heavy NASDAQ what we find is the following:

Far more than ½ of the stocks in the S&P 500 and the NASDAQ are down on the year.

The average stock on the NASDAQ composite is down over 30%. Wall Street defines bear market territory as a drawdown of 20%. This means that the average stock on the NASDAQ composite is 50% worse than the defining bear market drawdown (down 30% compared to 20%).

The NASDAQ 100 mega cap index shows the average stock to be down close to 17% YTD. How can that be? The NASDAQ 100 is a market cap weighted index meaning that the larger the market cap of a stock, the more impact it has on overall index return. If we remove AAPL, AMZN, MSFT, TSLA, GOOGL, and FB the average NDX 100 stock is down 20%. These six stocks are in fact bigger than the other 94 names in the index, so if you don’t have exposure to at least a few of these, you’ve had a difficult year as a tech investor.

Entire industry groups of the market were left for dead in 2021. Growth stocks struggled on the average even as many of the companies themselves beat earnings and raised forward guidance. We dealt with fear of rising rates, fear of falling rates, inflation, Covid leaving and a “reopening trade,” Covid coming back, and now fears of the Omicron variant causing global shutdowns again.

Three Misbehavior Examples

We can use a few examples of stock specific behavior to illustrate “misbehavior” happening in the current market. I cannot remember a year in which so many of these sorts of examples have piled up.

- PagerDuty

On September 2nd, PagerDuty reported earnings and the market liked what it saw sending the stock up nearly 15%. Two months later, PD has erased not only the entire earnings move, but fell back to levels the stock hasn’t seen since November of 2020.

- BigCommerce

On November 4th, BigCommerce reported earnings once again surprising the market. Liking what it saw, the market sent BIGC gapping higher by 30%. Just 30 days later the stock has reversed the entire earnings move, and is trading 10% lower than the pre earnings print.

- Bill.com Holdings

Perhaps one of the best examples of 2021, Bill.com Holdings has consistently surprised to the upside. The previous two earnings reports were both met with upside surprises, sending the stock significantly higher on both occasions. As of today, the price action shows the stock trading back down to levels not seen since before two earnings announcements ago.

My coverage of companies is littered with examples of the price misbehavior much like the examples above. My job as a portfolio manager is twofold: Being a good analyst of companies that fit the mold of our growth portfolio and managing risk around those investments if they indeed do meet the criterion to be included in the portfolio. Over the past two years I’ve surprised myself as to how well I’ve been able to pick companies that continue to exceed Wall Street expectations. This year though, on multiple occasions, picking winning COMPANIES, hasn’t been the same as picking winning stocks. Those days where winning companies mean winning stocks will come again, but this year has certainly been an outlier on multiple occasions.

What Changed and What’s Next?

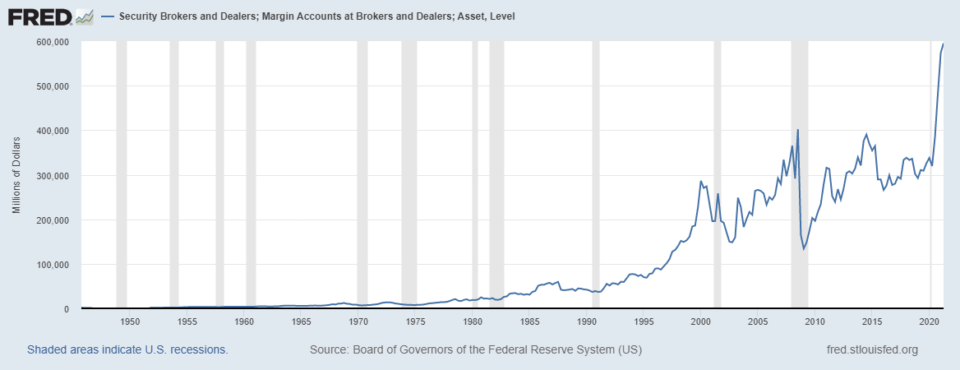

A big part of the erratic nature of stock volatility this year is due to the use of margin across security brokers and dealers. Margin allows the use of leverage (buying stock and options with someone else’s money). When leverage piles up in the system as the use of options and margin debt balances rise, moves going against you are met with forced selling. Leverage is good when things are working in your favor, and catastrophic when they aren’t. Areas of the market hit particularly hard when margin balances are high include growth stocks and cryptocurrencies. These so called “crowded trades” unwind and as those investors using borrowed funds are forced out as their losses are amplified to the downside. We can expect tumultuous waters across risk assets until a significant portion of the leverage has worked its way out of the market.

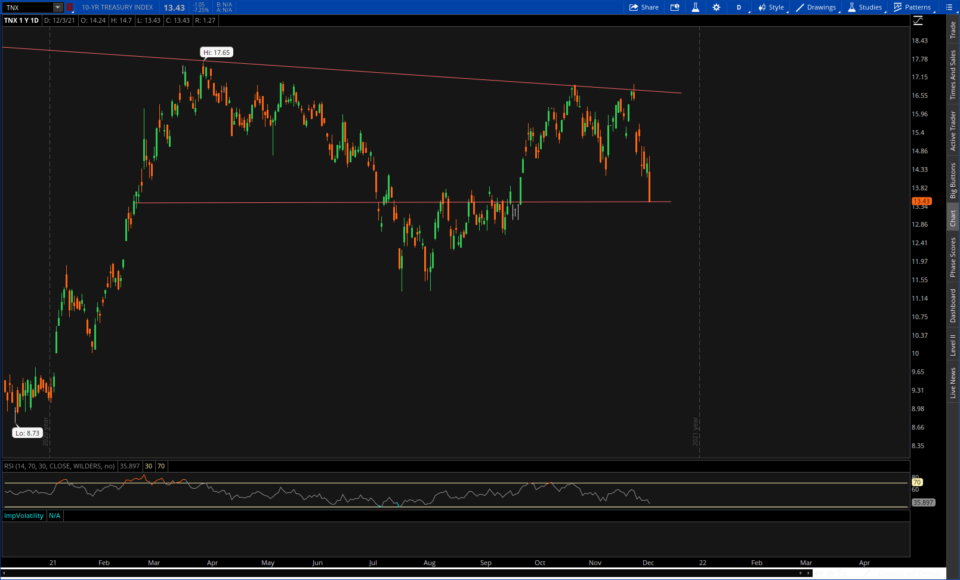

Rates. Earlier in 2021, much to do was made about the upside rate of change in short term interest rates. In Q1 of this year, growth stocks were hit especially hard as the 10 year treasury yield rose from under 1% to a high of over 1.7%. Since that time the 10 year has been unable to hold those levels, dropping back most recently to 1.3%

So all within one year we’ve worried about rising rates, then worried about them falling again, and then started worrying about the possibility they rise again. In sum, we worry a lot. Those trading with leverage and on margin worry even more (and they should). They don’t know anything about companies, they know ticker symbols. And when the market acts erratically they are forced to sell their ticker symbols at outsized losses. I suspect as we enter the final two weeks of 2021 we see more of the same. More outsized moves that have nothing to do with individual companies. More fast market movements in both directions. More leveraged market participants get hurt. And more disbelief that your “tickers” can and will go much lower than you thought possible. But with these conditions renders something else: opportunity.

You may or may not remember something I wrote in the final post last year: “Please don’t expect another year like this for a while.” 2020 was incredibly unique. 2021 maybe even moreso. 2022 will see individual companies outperform market indexes once again. The hours of research will pay off like they have in previous years. JSPM LLC continues to grow and there is a lot in store for 2022. We would like to wish you all a safe and happy holiday season and we will talk to you soon.

Trent J. Smalley, CMT

Visit our websites: (MyPortfolioFix)

Please remember that past performance may not be indicative of future results. Different types of

investments involve varying degrees of risk, and there can be no assurance that the future performance

of any specific investment, investment strategy, or product made reference to directly or indirectly in this

newsletter (article), will be profitable, equal any corresponding indicated historical performance level(s),

or be suitable for your portfolio. Due to various factors, including changing market conditions, the content

may no longer be reflective of current opinions or positions. Moreover, you should not assume that any

discussion or information contained in this newsletter (article) serves as the receipt of, or as a substitute

for, personalized investment advice from JSPM LLC. To the extent that a reader has any

questions regarding the applicability of any specific issue discussed above to his/her individual situation,

he/she is encouraged to consult with the professional advisor of his/her choosing. A copy of our current

written disclosure statement discussing our advisory services and fees is available for review upon review.