Evolutionary biology is a historical discipline: large evolutionary changes take place over long time‐scales and thus cannot be studied directly. One of the most important tools in the arsenal of scientists studying the evolutionary past is phylogenetic comparative biology.

All technologies are born out of purpose. For example, search engines were created to sort through the massive amounts of data online. With each new upgrade technology compounds existing technologies to create something better than what was previously used before. And on and on it goes.

Stone pictographs, the development of papyrus, paper and wax and the printing press in the 15th century. Walking to the mailbox to drop in a letter, leaving a voicemail, and now talk to text to send an instant message to a loved one.

Each of the above are examples of evolution. As common as the passage of time, yet mind bending if you dare to contemplate.

The figure of speech “Evolve or Die” is a truism whether in biology, communication, or technology. The same figure of speech holds true with regards to asset management, the search for alpha, and the capital markets in general.

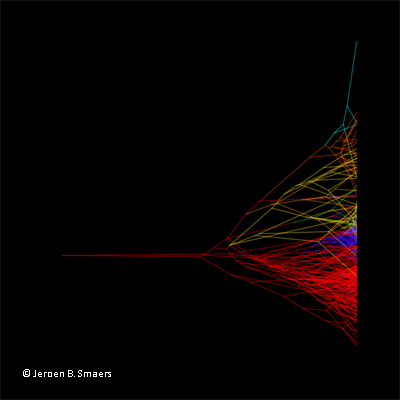

Personally, the past couple of months have been evolutionary with respect to my process in trading and investing. You might have noticed a slow down in the number of blog posts as I have been spending more time learning, testing, retesting, and evolving. Like any other discipline, evolution in my approach to markets comes in fits and starts. I research and find something that hopefully works to generate excess alpha for a short time, and circle back when I see that what I am doing is no longer profitable. My discretionary swing trading approach, using options (buying) to profit from directional moves was beginning to fail. I’m the first one to admit when my process fails. I’m also the first one to tell you that you can bet your sweet ass I’ll fix it when it does.

As a technical analyst by trade, I will always stay true to my roots. In the Church of Market Technicians I’ll always be a devout member of the congregation. I’ll still be there every Sunday reading the word of John J. Murphy, Charles Dow, and the so many other greats who paved the winding road of price charts and indicators for us. It is after all the laws of supply and demand that govern the World of finance and beyond. The difference is I will be present with other ideologies in mind as well that I feel will serve to help our cause. I’ve opened my arms to fundamental analysis, and specifically those factors that prove to move stocks in the intermediate term. I’m learning what institutional asset managers rely upon to make investment decisions. I’m deep in quantitative analysis that I don’t fully comprehend at this time. But I will soon.

Don’t assume that if I mention the likes of book value, accelerated earnings growth, return on equity, and free cash flow that I’ve abandoned ship. Quite the contrary. I’m simply bringing “new” tools that we can all benefit from in time and I’m planning to share them with The Church once I am confident they are safe for us all to wield.

Thanks for standing by as my most recent foray into the ever long evolution of process nears completion.

Trent J. Smalley, CMT