“Its just money; its made up. Pieces of paper with pictures on it so we don’t have to kill each other just to get something to eat. It’s not wrong. And it’s certainly no different today than its ever been. 1637, 1797, 1819, 37, 57, 84, 1901, 07, 29, 1937, 1974, 1987-Jesus, didn’t that fuck up me up good-92, 97, 2000 and whatever we want to call this. It’s all just the same thing over and over; we can’t help ourselves. And you and I can’t control it, or stop it, or even slow it. Or even ever-so-slightly alter it. We just react. And we make a lot money if we get it right. And we get left by the side of the side of the road if we get it wrong. And there have always been and there always will be the same percentage of winners and losers. Happy foxes and sad sacks. Fat cats and starving dogs in this world. Yeah, there may be more of us today than there’s ever been. But the percentages-they stay exactly the same.” – John Tuld, Margin Call

Looking at the market indexes YTD you wouldn’t notice it. Looking at companies of old, like oil, industrials, materials, and steel companies, you wouldn’t feel it. But imagine for a second you own younger companies, the up and comers of internet 2.0, SaaS stocks, and the leaders from last year. Companies who participate in thematic trends in which are just getting started, and maybe find themselves in the 2nd inning of a long ballgame that is likely to go into extra innings. You know the ones I’m talking about. And I know how you are feeling.

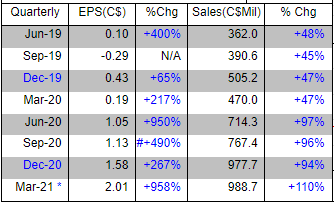

To handpick a few from this quarter let’s start with Shopify, a cloud based ecommerce platform and a darling of 2020. Here is a snippet of sales and EPS growth over the past two years:

Do you work for a company growing like that? Likely not, most don’t. Thankfully we get to invest in companies like these. Or sometimes not so thankfully. After smashing earnings in Q1, the stock…

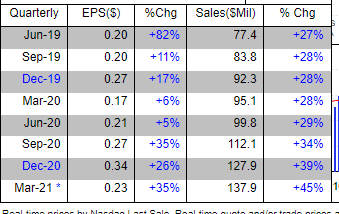

Next up, Five9 Inc, a cloud based software company that assists call centers with customer service, sales and marketing:

The stock post earnings?

And let’s not forget how the market is treating fresh breakouts. RVLV breaking out on above average volume – sold hard on even higher volume:

I have example after example of these, and it doesn’t stop with the newer, less established companies. Behemoths Apple and Amazon, both posted great quarters. Their stock prices fell victim to selling as well, both trading lower than their preearnings announcements.

The Goddess of growth investing, Cathy Wood of ARK Funds has seen her flagship ARK Innovation Trust lose 32% YTD. Untouchable just one year ago, her holdings recently have become “don’t you dare buys” and her style questioned by even her biggest fans and followers.

All the while, the market indexes (DJX,SPX,RUT,NDX) have seemingly made new highs week after week.

As investors, we are always trying to ascribe the reason behind a stock or asset class’s every move. Our human nature is such that we strive to find meaning amidst chaos. For tech and growth in particular you’ll find guesses such as:

“Interest rates are on the rise.”

“Money has moved out of tech and growth and into value, or cyclicals, or cryptocurrencies.”

“Investors are selling their big wins in preparation for paying higher capital gains.”

Whatever the reason is (and the reason doesn’t matter), you might find yourself thinking that the stocks you own will never go up again. You might find yourself worrying the account levels you once enjoyed will never been seen again. Some call that a pessimistic worldview. I call it something different:

Investing.

The best piece I have come across with respect to weathering account drawdowns was written by Morgan Housel some years ago. In his article “The Agony of High Returns” Housel took a look at the best performing stocks over the 1996-2016 period. A couple of snippets from this article are as follows:

“Monster Beverage (NASDAQ: MNST) was the best-performing stock from 1995 to 2015. It increased 105,000%, turning $10,000 into more than $10 million.

But this isn’t a retrospective about how you should wish you owned Monster stock. It’s almost the opposite.

The truth is that Monster has been a gut-wrenching nightmare to own over the last 20 years. It traded below its previous all-time high on 94% of days during that period. On average, its stock was 26% below its high of the previous two years. It suffered four separate drops of 50% or more. It lost more than two-thirds of its value twice, and more than three-quarters once.”

“It’s hard to grasp how the best-performing stock of the last 20 years could spend the majority of that time with returns that would make you want to vomit. It’s easy to think that the single-best investment to own is one that would make us smile every morning we woke up owning it.

But it wasn’t. It never is. And it never will be. That’s the nature of the stock market. On the way to making serious money, you spend a lot of time losing serious money. It’s a reality anyone investing in stocks, no matter what you own, has to face.

I looked at the 10 best stocks to own over the past 20 years. These are all cherry-picked for their stellar returns, and the stocks you would probably choose to own if you had a time machine. On average they increased more than 28,000%.

But they all spent a majority of the time well below their previous high mark. They all had multiple declines of 50% or more. A few had multiple 70% drops.”

In sum, the best investments (return wise) are almost always the ones that go through periods of making you want to swan dive off of a roof 50% of the time. (My words not Morgan’s) If they didn’t they wouldn’t be the best investments. Investing in anything with potential for high return is a bumpy ride, and now you have gotten to experience both sides of that coin, both the up part and the down part. Both parts of said ride get pretty wild sometimes, and of course the up part is more fun. You’ll experience the fun part again soon enough, and your worldview will return to optimistic.

That is called investing.

Trent J. Smalley, CMT

Please remember that past performance may not be indicative of future results. Different types of

investments involve varying degrees of risk, and there can be no assurance that the future performance

of any specific investment, investment strategy, or product made reference to directly or indirectly in this

newsletter (article), will be profitable, equal any corresponding indicated historical performance level(s),

or be suitable for your portfolio. Due to various factors, including changing market conditions, the content

may no longer be reflective of current opinions or positions. Moreover, you should not assume that any

discussion or information contained in this newsletter (article) serves as the receipt of, or as a substitute

for, personalized investment advice from JSPM LLC. To the extent that a reader has any

questions regarding the applicability of any specific issue discussed above to his/her individual situation,

he/she is encouraged to consult with the professional advisor of his/her choosing. A copy of our current

written disclosure statement discussing our advisory services and fees is available for review upon review.