Bloomberg ran an article last night about David Einhorn’s Greenlight Capital and its underperformance thus far in 2018. The main fund lost 6.2% in February extending losses to over 12% already this year. The benchmark S&P 500 Index is up 1.8% on the year.

Einhorn’s largest disclosed long positions are value themed (Brighthouse Financial, GM) while they have short positions in powerhouses like Amazon and Netflix. He goes on to mention that his fund is betting on a mean reversion in the outperformance of growth versus value stocks.

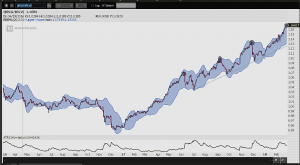

Let’s take a look at a ratio chart of $RLG/$RLV Russell Growth relative to Russell Value.

We can see that growth has outperformed value on a relative basis and that the angle of the trend has steepened. Further, when this ratio has approached the top band of the EMA Bollinger Bands, it has provided a good signal that a pullback in growth versus value is imminent.

I think Einhorn is correct to predict that it may be prudent to lighten up on some higher momentum growth stocks and place some bets in more conservative value plays.

Happy March!

OC