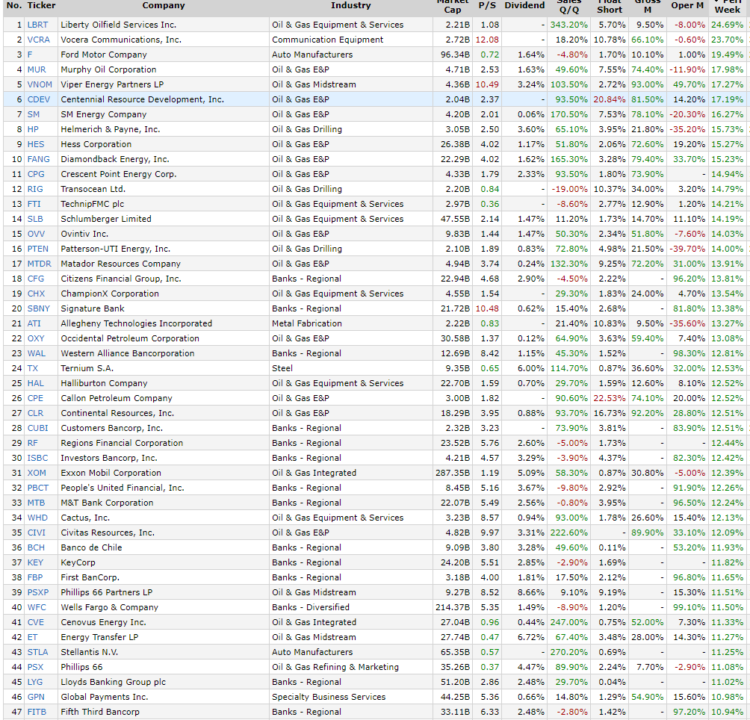

In just one week into the new year, we find ourselves in a bit of an uneasy predicament with regards to the overall market landscape. One exercise I have done for years now is to take a look at where money is rotating to in the first couple of weeks of the year. I screen for stocks over two billion market cap and take a look at the best and worst performance at the end of each week. Now that the first week is behind us, take a look at the winners:

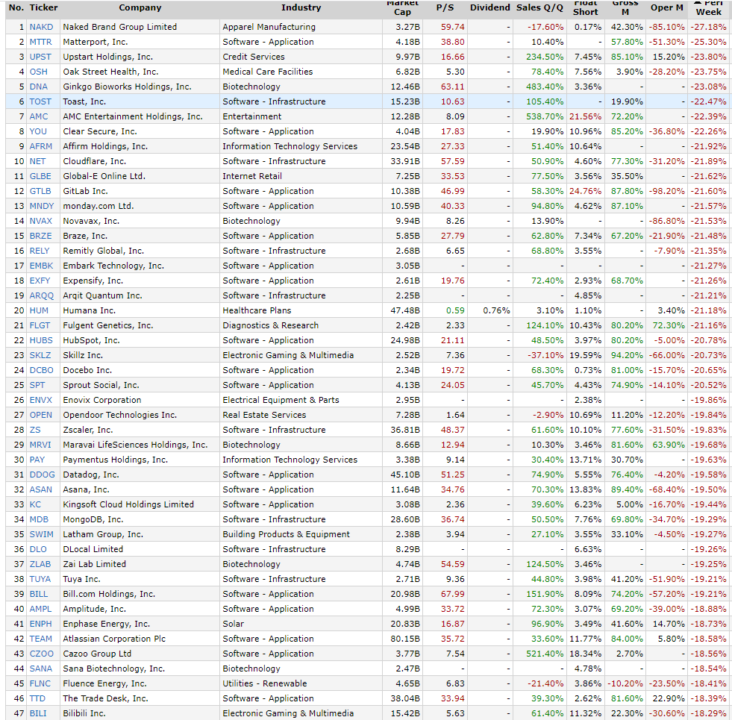

And now the losers:

A quick glance at the above would lead one to believe software as a service is no longer necessary and there is a global oil shortage. Also, banks had a good start to the year as interest rates finally found themselves breaking out above key resistance levels going back nearly a year:

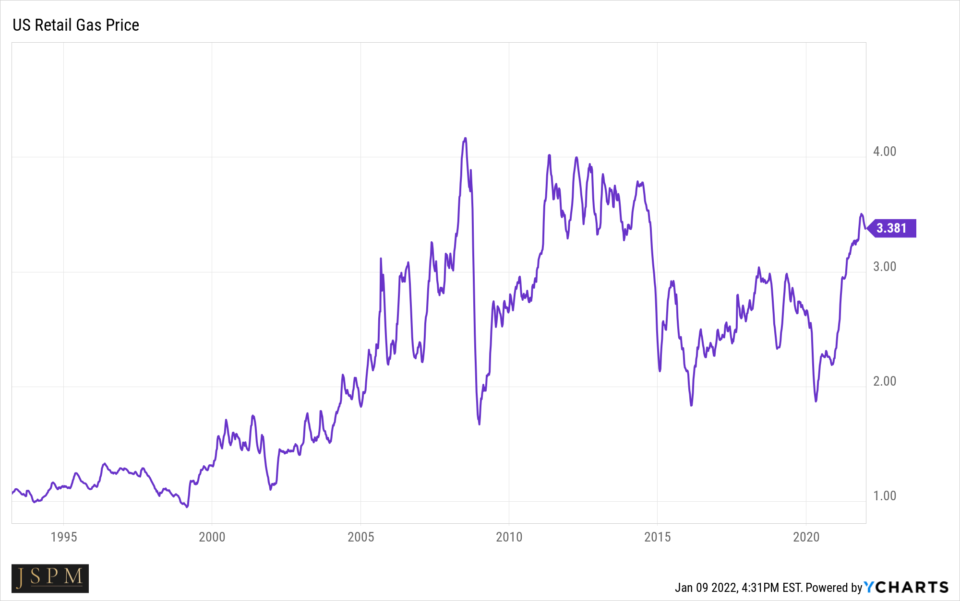

Oil and gas companies are tied to the price of crude oil and outperformance in this industry group raises some red flags should it continue, especially at its current pace. When the price of crude is high, the price of gasoline is also on the rise:

Retail gas prices can give a good overview of how much discretionary income consumers might have to spend. If gas prices are too high for too long, this can slow consumer spending on other goods and services, thwart vacation plans, and cause an all around global slowdown. Before prices get out of hand (or sometimes after), the Federal Reserve steps in and attempts to curb inflation via tighter monetary policy. In the near term, this doesn’t generally bode well for stock prices especially those without a positive cash flow.

I’ve argued that the average stock in the U.S. Market has been in a bear market for nearly a year. Take a look at some of the former leading industry groups and the priceaction over the past several months:

Growth stocks, solar, biotech, china technology, and the list goes on. It is in these macro driven environments where it’s best to take a step back and wait for sellers to run their course. There will continue to be pockets of strength in some old economy type stocks (banks, oil, miscellaneous consumer staples, and utilities) but the majority of previous market leaders have already fallen fairly dramatically. To paint the overall market with a broad brush, this is what a “risk off” environment looks like. The JSPM-Omaha Growth Strategy is holding the most amount of cash it has since inception. Position sizes have gotten smaller, and defense is being played to protect investor capital until we get a signal that investor appetites for growth companies rebound. Little of what is going on is company specific and hasn’t been for some time.

Coming into this week our eyes will be focused on the start of earnings season as well as December inflation readings. Now isn’t the time to get aggressive with longs. Those days will come again, but I’m not an eager buyer of anything at this particular moment.

Have a great week and back with more soon.

Trent J. Smalley, CMT.