In times of market uncertainty, there are areas of the market where traders and investors flock to safety. If the world goes to hell in a hand basket, people are still going to buy Clorox, they will still pay their light bills, and health care will still be needed. Before they fully panic and go to cash, which is an asset class in times of turmoil, they rotate into safety. You’ll see money come out of high beta, high short interest stocks, and dumpster fire garbage names I like to play in from time to time.

Several places of safety should be trading higher after this recent sell off, right?

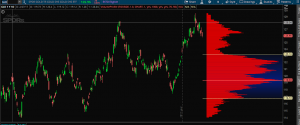

Here is Gold, a usual safety play, utilities, healthcare and consumer staples:

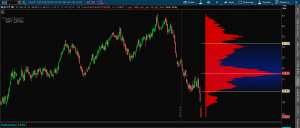

And also importantly, is a chart I have long paid attention to. The LQD ETF or the investment grade bonds. I would expect fund flows into this over the past week, leading it to trade significantly higher:

Down, crashing, meh, down, down.

Most interesting.

OC