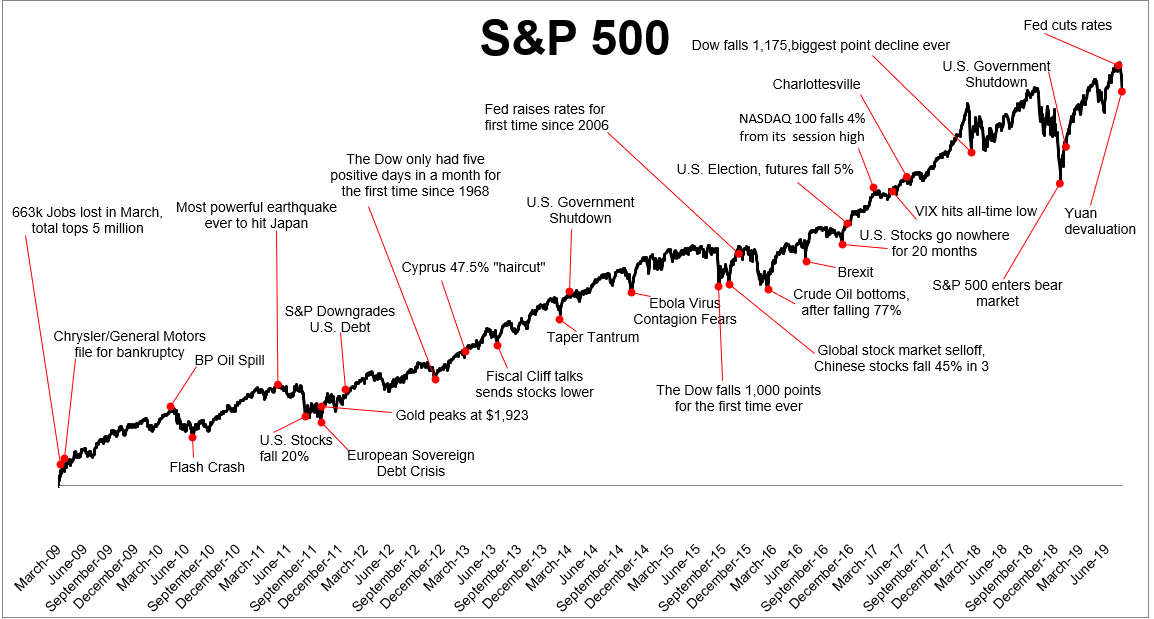

Global equity markets fell hard yesterday on the back of the Chinese Central Bank devaluing their currency amid escalating trade tensions. No matter what the reason, days like yesterday serve as a reminder that these things happen in markets. While not routine, the sell off yesterday was far from rare. I will spare you the statistics as they don’t pertain to this post.

What does matter is how we react to such sell offs. Do we sit there in awe of the snowball of distribution, panic hit the sell button and swear off investing “until this blows over?” History shows that is least prudent of all. These setbacks are temporary in nature, a part of the game, and something you will have to get used to especially in a market where everything moves faster now. Faster on the way down and faster on the way up. Sharp selloffs and V-Shaped recoveries. Extreme greed to extreme fear.

A chart shared around the financial twittersphere yesterday serves to remind us that, “There’s Always Something.”

Back to what you do on days like yesterday. My preferred exercise is to seek out stocks exhibiting relative strength. In its most simplistic form this means finding names which have fallen less than the index over a specified time period. Take a look at SPY over the past week:

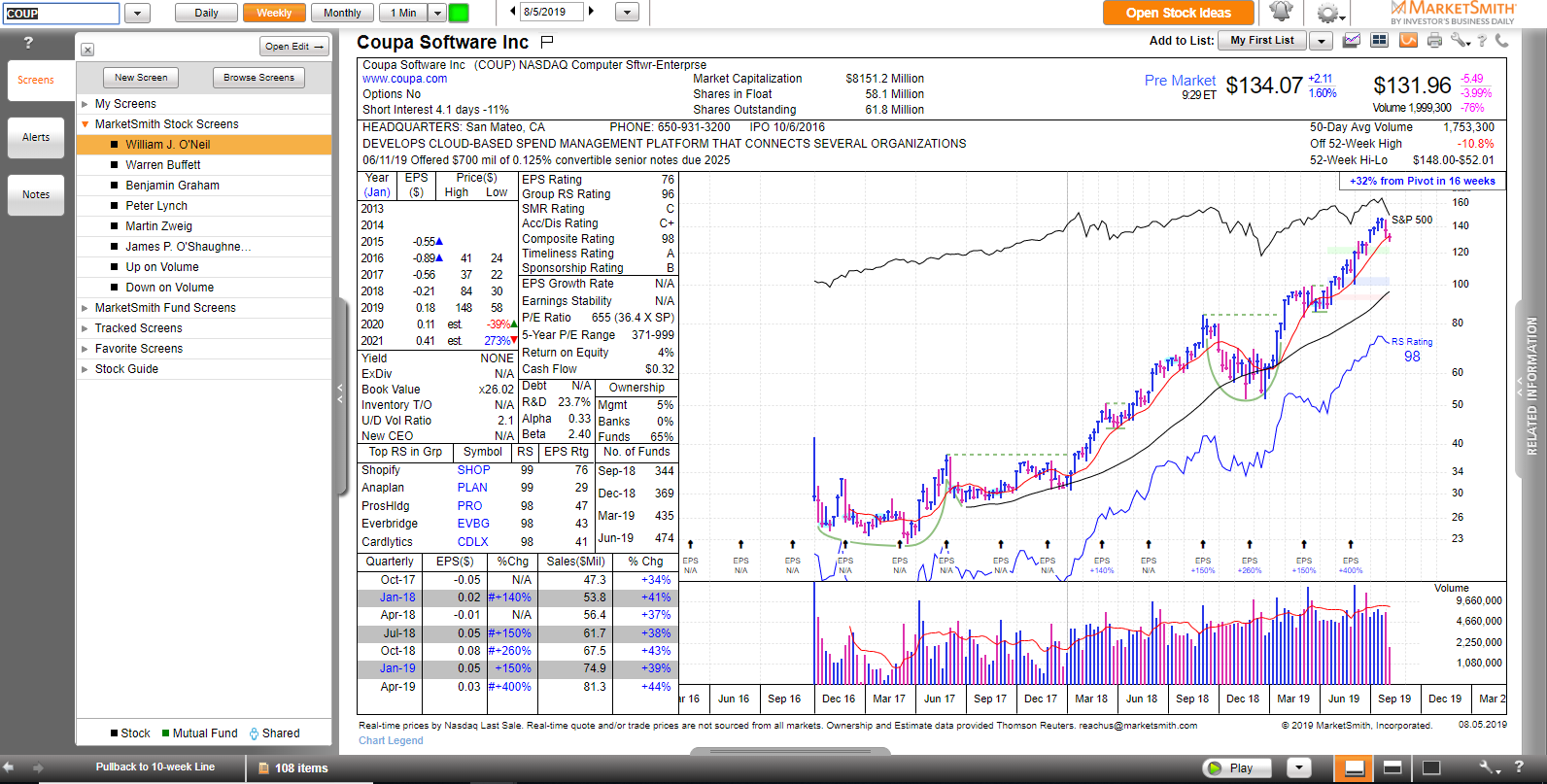

Pretty sharp distribution on above average volume. Take a look on the other hand at Coupa Software ($COUP):

Some slight selling (down less than the index) on lower than average volume. This signals that the institutions were unwilling to part with their position in $COUP even in the midst of a panic selloff. That is relative strength at work.

Why have big funds been unwilling, at least thus far to begin selling a stock like $COUP? Stellar fundamentals as evidenced by an upward trend in sales growth quarter over quarter, fund ownership, and the industry group with which $COUP is a part of displaying extreme relative strength.

While it is true on fast down/fast up market moves correlations increase among stocks and the market indexes, on sell offs in particular stocks with cream of the crop fundamentals don’t get thrown by the wayside. They simply get sent to the sale rack.

Don’t be afraid to shop the sale rack.

Trent J. Smalley, CMT