The 14th of September is my birthday. That unbearable sound you hear is the Earth making a man out of a boy. At least it’s trying.

Birthdays make us think and reflect. Something I have tried to spend more time doing as I’ve “aged.” The following is a list of thoughts and observations, marketwise and otherwise from this past year…

1. The more I learn about the market, the more I realize I don’t know – and neither does anyone else.

I’ve studied markets for 10 years this year. When I began having some success in trading I thought I had it all figured out. When I began losing, I felt like I knew nothing. In losing the market was either “rigged” or the man behind the curtain had it out for me. In reality the market doesn’t know who I am or care about me in the least. It just “is” and I choose to participate in it. Now I believe I know what I don’t know and have found my strengths thanks to a great couple of teachers along the way.

2. The number of market pundits, alerts services, newsletter writers, and self-proclaimed “gurus” dwarfs those who have any real experience in trading or managing money.

Everyone is anxious to give you their opinions and charge you for them. Few would put their own money (if they have any) behind their own forecasts. As the market continues higher, and the rise of Cryptocurrency trading ushers in a new kind of trader, these snake oil salesmen will multiply. Watch out for any one who proclaims to see the future. Follow @guruleaks1 on Twitter to see how sophisticated some of these scammers have become.

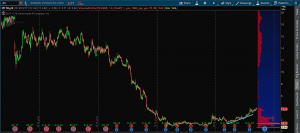

3. This is what opportunity looks like:

4. The ability to control emotion paired with correct position sizing is as close to a “Holy Grail” in trading you are ever going to find.

If you are trying to find some combination of indicators, market theory, or other principle by which to enter and exit positions, you are only half way there. Even if given tomorrow’s newspaper today, most people would over time go broke trading. Why? Trading real money is part science part emotional and psychological warfare. And we aren’t programmed mentally to succeed. Overcoming the mental highs and lows is just as important as your strategy.

5. So much information about what “the market” is going to do can be gleaned through overall investor sentiment.

My trading mentor likes to call this “the brother in law indicator.” When your brother in law who doesn’t trade calls you and asks if he should get into Bitcoin, we are nearing at minimum at short term market top. Buyer beware.

6. I would have been fired by JP Morgan Bank.

7. Presentations build buying resistance. Conversations lower it.

Read that 20 more times.

8. We are all going to die. Find the thing that you love the most and let it kill you.

This was a quote I wrote down late last year. I don’t know who came up with it but I like it.

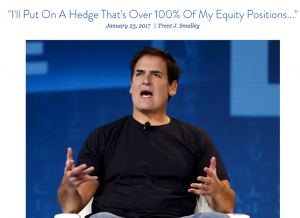

9. Even (Especially) The Masters of the Universe can get it wrong…

While chumps like me get it right…

10. Ceres Cafe at the Chicago Board of Trade building serves nuclear drinks.

Jesus H. Tapdancing Christ could I get a little cranberry juice with my cranberry vodka? I didn’t plan to black out at 4pm.

11. Paying attention to old market omens is good for entertainment value only.

Hindenburg Omens, Death and Golden Crosses, etc are fun to quote and good click bait for headlines. Basing investment decisions solely on them is a poor idea. Someone smarter than me said that in the next several years, all of the classical technical analysis books will need to be rewritten. I tend to agree. Try trading a moving average crossover system and see how it works for you. Algo trading knows all the classical methods and knows how to shake weak hands out.

12. Spending time every day doing some form of meditation pays dividends.

I learned Transcendental Meditation in January of this year. Does it “work?” Yes. Do other forms of meditation “work?” I am sure they do but I haven’t done them. I would recommend some form to every one. In today’s world all of us can benefit from some quiet time.

14. The number 13 is weird so I am skipping it, just like most hotels skip the 13th floor.

15. Stocktwits is a great tool for checking sentiment and emotion of “the herd.”

Don’t be like the herd.

16. If you read 3 books on trading this coming year, I highly recommend it be these 3:

17. Other “Masters of the Universe” make horrible trading and investing decisions, too…

Remember Bill Ackman and Valeant? Dude rode a stock down into the hole due to an ego problem. It’s hard to admit you are wrong – in all aspects of life. That’s the beauty of evidence based technical analysis. Had he used TA and some common sense, he wouldn’t have lost his investors billions due to being stubborn.

18. In trading, learn to get comfortable with being uncomfortable.

Some of the best trades I have ever had are the ones where it felt downright wrong putting them on. Some of the worst trades I have ever made were the ones I was most eager to put on.

19. In life, learn to enjoy being uncomfortable sometimes.

Get out of your comfort zone. Try something new. Surprise yourself.

20. Passive management of money is king… but for how long?

There is an overarching theme that active management, trading or taking a hands on approach to money management is detrimental to long term wealth. “The market can’t be timed.” This might be true, but the day will come when active management of funds will outperform again. And there will be a need for money managers with a skill set that few have. The ones who do will be rewarded with lucrative opportunities.

21. CUBS WIN!!!!!

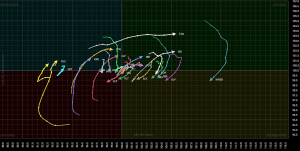

22. Relative Rotation Graphs are one of the most dynamic, underused tools in all of technical analysis and you should be using them.

To learn how to use them, check out my blog post on them: Add RRGs to your toolbox

23. Dennis Gartman is a national treasure. 9/10 times is pays to do the EXACT opposite of whatever he says on CNBC.

24. It doesn’t matter how much money you make or fame you attain. You won’t be fulfilled until you learn to find happiness within.

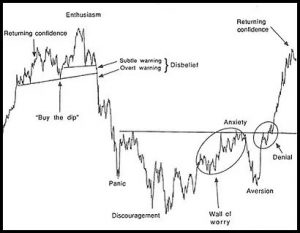

25. The sentiment chart in the book “The Nature Of Risk” by Justin Mamis should be taped above every traders desk.

26. Those who can live solely off of trading profits are the elite among us. They are few and far between and it didn’t come easy to them either.

In 10 years of being around the market and talking to tens of thousands of people who have tried their hand at this game, I have met a dozen or less who are truly successful. Nearly 95% of them would however tell you that they are.

27. I have this quote from the great Jesse Livermore hanging above my desk and so should you.

28. There are illusions of the mind that are every bit as real as optical illusions.

Time spent studying behavioral finance is time very well spent. Humans suffer from countless cognitive pitfalls and none of them are helpful in trying to be successful in money management.

29. Pairing traditional forms with technical analysis with a statistical, evidence-based approach greatly improved my P&L.

Technical Analysis will always suffer criticism that it’s art and not science. This book will help with that:

30. I completed the CMT Program this year. I’ve been using TA for 10 years but wanted to gain the theoretical background a formal education in TA could provide. It was worth every penny.

31. I’m 34 now and still feel too immature to have children.

What is wrong with me?

32. My brother in law helped me put together a proper trading computer this past year. I spent way too much on it but it was worth every penny.

33. GOAT

34. Buy the fuckin dip. BTFD