“Maybe you could tell me what is going on. And please, speak as you might to a young child. Or a golden retriever. It wasn’t brains that brought me here; I assure can you of that.” – John Tuld, Margin Call

For some time, I have wanted to put together a short “series” on what I feel beginners need to know before they get started trading. When I got started in the markets I remember feeling overwhelmed at the sheer volume of information available on the subject. Websites, alert services, market gurus, training series, books, YouTube pages, etc. all offered their expertise on the subject. Some of the material out there is worthwhile and some not, but having to sift through immense amounts of information will lead to analysis paralysis. The following series will attempt to distill much of that into a consumable package that will teach you some basics, and help you avoid many of the pitfalls many new traders make.

In starting this, I promise it won’t be an exhaustive “all you need to know to get rich” guide. Rather it will give you a basis to reference in getting started and beyond. I don’t know how many parts to this series there will be, but I will try and lay out one or two lessons in each post. Because we are all busy, I’ll try and make it short and sweet while still making it worth your while.

Without further ado, let’s get to it…

The first thing you need to do is grab a fancy notebook and pen. Dedicate it as your trading journal. You are going to start writing things down by hand: Trade setups, stocks to watch, tips, your emotions when in a trade, etc. There are online journals and subscription services, but IMO nothing will take the place of a hand written journal or trading diary.

Near the front of this journal, perhaps after you write, “Jordan’s trading journal 2018” put it big letters, bold in your fave color… “WHY?”

The why is a great start to a trade plan. Why are you bothering to take on this endeavor? The majority of people you come across are going to say things like,

“Why would you throw your money away like that?”

“The market can’t be beaten, it’s all rigged.”

“It’s a losing affair.”

“Don’t waste your time put it all in an index fund and don’t touch it until you retire.”

Here is WHY you learn to trade…

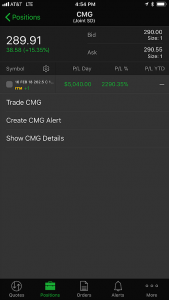

This was a trade of mine a month ago, my biggest percentage win ever in fact. Wins like this are of course the exception, not the rule but I’d learn to play any game where a 2000% + return is possible.

The WHY needs to be specific and defined in all truth. It won’t serve you well to have your why be to bank huge gains every week. Here are some examples of some ideas of an appropriate “WHY”…

I want to make an extra $300 per week to put away for a wedding.

I received some inheritance and want to grow it while learning to trade using proper risk management techniques.

I would like an extra $1000 at the end of each month to start finishing my basement.

You get the idea. The WHY needs to be more specific than, “I want to get rich like Jordan Belfort so I can see how many drugs I can ingest and strippers I can pay for on Friday.”

Actually, I’ll give you a pass for one of those nights actually. You gotta live a little. But you’ll be better served by keeping your WHY PG rated. And your health will thank you for it in the long run.

I’ll give you some time to come up with your WHY and will be back soon with Part 2.