One of the things I enjoy most about running a blog is that it is a creative outlet. I always loved writing and from an early age won some awards for it. As we move into adulthood and find ourselves entrenched in our daily routines, some of our creative outlets fall by the wayside. Sadly, for a long time I didn’t write and lost a lot of my creative muscle. I try with this site to make a topic that so few find interesting, fun and entertaining. In doing so, I’ve gotten to reacquaint myself with my lifelong love of putting a pen (keyboard) to paper. It doesn’t matter to me so much if anyone reads it or not, I find it fun and relaxing.

Coming up with predictions for the markets for 2018 has been enjoyable. Some of these I had written down back in July already and have started to take shape. I included them anyway. One I left off because it’s already happened and much earlier than I could have expected. Cryptocurrency Explosion, not just price but general interest.

Here is what I think will happen in 2018 with regards to markets:

1. Marijuana Stocks Continue to Surge

Have a look at some charts like $TRTC, $CANN, $AMFE, $DIGP. Some huge moves already but still so much meat left on that bone…

2. There Is A Shift Away From Passive To Active Management

In response to major movements in marijuana and blockchain stocks, cryptocurrencies, and Bitcoin Futures, your everyday Joe is going to want to get involved. The cryptocraze is bringing interest to markets again and people aren’t content to sit in an index fund as they hear of millions being made in Bitcoin.

3. Intrepid Potash $IPI Takeover

The 2018 Merger and Acquisition activity will be strong. IPI in the Ag Chemical Space is ripe for takeover. Look for Syngenta, Potash or Mosaic to buy them out. My price target on the stock is $14 by the end of 2018.

4. Crude Hits $90 Per Barrel

Strength in the refiners, drillers and pipelines follow suit. Get a list of your favorite energy stocks ready and watch for pullbacks. $SN, $HCLP, $CHK, $CRZO are a few I have owned for a while and there are plenty out there who will benefit from higher WTI prices.

5. The Price of Gold Is Nearly Cut In Half

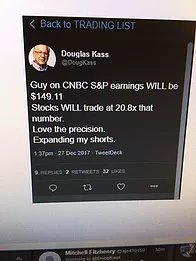

6. Doug Kass “Expands His Shorts” and Deletes More Tweets Than He Did In 2017

I am a hoarder of digital footprints. Specifically of emotionally charged responses to market action. I have folders upon folders of headlines, Tweets, articles, etc saved from years and years of being in this game. I very rarely use them against people because I am wrong often too. The game of speculation is not an easy one. The difference is, you’ll never see me delete a tweet and I run a blog where you can see how wrong I am when I fuck up.

Case in Point: When Omaha Fucks Up Big

It is amazing to me to see market veterans who still let their egos get the best of them. Don’t let it happen to you.

7. Bill Ackman Totally Redeems Himself With His Best Trade Ever

It has been a tough run for Bill and Pershing Square Capital from his $VRX blunder to $HLF, etc. but he’s a smart cat and will find his best trade yet in 2018.

8. Solar Gets Hot(ter)

The $TAN Solar ETF trades to $40 taking names like $FSLR, $CSIQ, $JKS, $SEDG, $SPWR and $TERP with it.

9. Snapchat Trades Above IPO Levels and Beyond

The type of trader coming to the market in search of riches will find $SNAP a safe haven stock after volatility in weed and blockchain stocks shake them out.

10. Spotify Goes Public And Triples In Value

Netflix and Spotify are two services I will likely pay for the rest of my life. I could be down to my last $15 and I would consider forgoing food for a month of streaming music service. I love everything about them and see them doing very well, no matter how they choose to IPO.