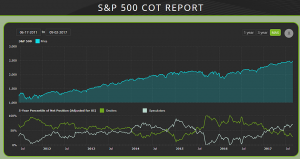

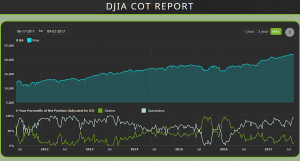

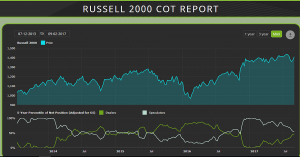

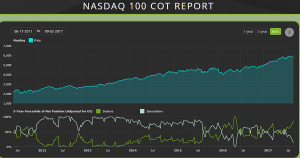

For those of you that pay attention to Commitment of Traders (CoT) reports I thought I would quickly share something I came across today. If you aren’t familiar with this data set or how it can be applicable to your process, I think the synopsis provided by freecotdata.com explains this well:

“The Commitments of Traders (CoT) is a weekly report released by the Commodity Futures Trading Commission (CFTC). The CoT report outlines how different types of traders are positioned in the futures markets. There are two main types of traders in a CoT report: commercials and money managers.

Commercials are the actual producers and users of a commodity that use the futures markets to hedge. A commercial producer in the corn market could be a farmer who sells corn futures to lock in his selling price. Commercial traders are thought of as the “smart money”, since they are in tune with the physical commodity business and likely have superior supply/demand information. The other main CoT trader type, money managers, is composed of hedge funds, mutual funds, and commodity trading advisors. These are speculative traders who have no interest in the underlying physical commodity business.

Investors and traders spend an enormous amount of time forming their own thesis about what to buy or sell. Less time is focused on examining how other market participants are positioned, and if their personal idea is already widely held or not. CoT data lets you see if you’re running with the herd and how “smart money” traders are positioned.”

I will leave it up to you to decide how you wish to incorporate CoT data into your trading decisions, if at all but this site provides some nice graphical displays of how the “smart” money is positioned relative to the speculators.

Some may have already been using this site but it is new to me and have it bookmarked for quick reference.

OC