For as many years as I have been in this business, I still hesitate to impart wisdom that I have gleaned from my experience. I am not sure if it’s just me personally or if other traders feel this way, but this profession has a strange way of keeping you from ever feeling like you are an expert. There are certainly days or weeks where I feel as though I am, but those are often met with harsh reminders that trading may be one game that is never truly mastered. Perhaps one of the worst things we as traders can ever do to ourselves is to claim expertise. For it is at that time that we stop learning, get set in our ways, and become lazy. That behavior path is akin to a market topping pattern, and those are met with inevitable downfalls.

So while I won’t ever claim expertise, I did want to share some thoughts here that I think will serve to enlighten someone interested in taking up trading to make a living. The following advice comes from being humbled by markets time and time again personally, as well as helping thousands of traders with technical tools, trade plans, money management, and the psychological components of speculation. This post isn’t meant to discourage anyone from pursuing their trading dream. Rather it is to encourage and prepare those who are financially and mentally fit enough to take on this endeavor. If I save one person some money or time then it will be worth it.

A rigorous approach is the only way to long term success. This I know to be a fact and you will never convince me otherwise. Life affords many of us the luxury of having a multitude of different hobbies. You can be a Sunday golfer, collect coins, argue politics with your family on Facebook, learn ball room dancing, or dabble in archery in your free time. Each of those can bring a level of satisfaction depending upon the person and his/her interests. I don’t know anyone personally who finds losing money satisfying and a trading hobbyist will do just that. I promise. Maybe not right away, maybe not 3 months from now, but I promise you will lose in the long run if you trade as a hobby. Most people who trade full time lose money, so your chances of making money doing it as a hobby are next to 0. So assuming you have decided to apply yourself, and you have decided which markets you are going to trade whether that be stocks, futures, options, Forex, etc. there is nothing more important than having a trade plan. Being more specific, a money management plan. Professional risk and money management strategies are the foundation for success. Essentially, money management tells you how many shares or contracts to trade at a given point. Money management is a defensive concept. It keeps you in the game to play another day. It also serves as a guide to realistic expectation. Trading IS NOT a get rich quick endeavor.

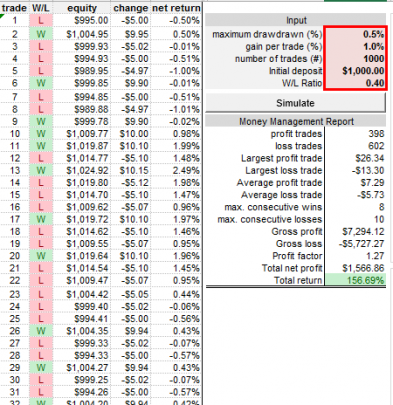

One of those looks like this and I would venture to say a lot of the “pros” haven’t seen one of these either:

If you are unsure where to begin with one of these a simple search in Google will get you on your way. I quickly found some Excel templates pre built as well. This plan is your meal ticket. Not whether you use technicals, order flow, fundamentals, or trade the news. Your risk management plan is everything. Get one.

With a risk management plan in place, know that you are already ahead of the hobbyist and some intermediate traders as well. The risk plan is mandatory and is the one thing that can save a trader from ruin. Also know that this plan will save you from another major obstacle that stands in your way of success: the trading guru.

It’s unfortunate, but the financial services industry is fraught with posers. I suppose these type of snake oil salesmen exist in a lot of industries but they seem especially prevalent in ours. In markets no matter what any of us believe, the future and especially the immediate future cannot be foretold with a high level of accuracy. When this is the case, it makes it fairly easy for the “guru” to circle overhead and prey upon the wide-eyed amateur. When we set out to learn something new it’s natural to look to someone with more experience than us. We marvel at their years of experience in this exciting game, and look forward to the day when we can jump out of a Lambo with our Gucci bags from only trading two hours a day. For every successful self-made trader, there are 100 “gurus” out there soliciting winning trade ideas and alert services in exchange for your money. Most of them started just like you did, gained some trading experience, had some big wins, some bigger losses and forgot the one thing you have already: the risk management plan. Make no mistake, they suffered losses. Many of them devastating enough to get them to switch from trading full time to selling trading full time. My intent here is not to put down anyone with a trading service. There are some good people out there that enjoy teaching new traders the ropes. Just be cognizant of how they are making their money. Is it from trading profits or selling a service that promises their members riches? Should you decide to subscribe to one of these make sure it is one that is heavily educational. Try to pick one that has a simple, repeatable process that can be tracked and quantified. Don’t ever, ever follow your guru into a trade without paper trading at least 10 of his recent trades. Match those trades with your own personal risk management plan. Ask yourself if his trading strategy is one that is viable knowing your own personal risk profile.

My last piece of advice with regard to your trading guru is to cut ties with him when you have learned all you can. Neither of you will be doing each other any good by sticking around. When a baby bird gets old enough to leave the nest he flies away. So that you can continue to grow as a trader, you need to leave the nest of your trading mentor. You will thank me for this.

Breaking away from your mentor will leave you feeling alone at first. But it is in these first weeks away where you were truly learn to make decisions for yourself. Once you are used to doing this you will have grown as a trader. It is at this time when I recommend finding camaraderie with a few other traders. Maybe it’s your Twitter trading family or someone else. Personally, I trade with two other guys who come from different backgrounds. Our skill sets from our combined 30 plus years in markets complement each other. We also serve as a form of checks and balances against one of us making poor decisions. The extra sets of eyes also help in spotting market rotation and setups that alone we may have missed. There are lots of choices in platforms to communicate with your trading team. We use Slack and it serves us well.

Next, I wanted to speak a bit about materials that I recommend to new traders. Hopefully your mentor helped you build a solid foundation in some form of technical analysis. Two years ago I completed the Chartered Market Technician Designation. This encompassed two years and three exams in addition to meeting the professional experience and having mentors recommend you to the CMT Association Board. While it isn’t necessary going to these extremes, their body of knowledge will provide you with professional level training and a rigorous approach to building trading systems. I personally can’t say enough about this program but only choose to pursue this if you are all in. I am following up this post with an Omahacharts book list that I believe will serve you well in your pursuit of professional trading. In the mean time, read everything over at Tradermentality.com as he does a great job of explaining many facets of technical trading and the psychology behind successful trading.

Finally, I wanted to round this post out with some tidbits that I wish I had known when I started. They probably don’t need much elaboration but I feel like their importance cannot be overlooked.

You are going to fail. You will blow up your trading account. Maybe more than one. In this game however, early drawdowns have had no correlation with long term failure. Many of the Market Wizards suffered early (and multiple) failures during their journey. Have a plan in place to bounce back when it happens. Because it will.

Have realistic expectations. We live in a get rich quick, lose weight with a pill, get famous because of one blog post society today. Get rich quick schemes don’t exist and trading is no different. I tell new traders to approach this with the same rigor as a first year student entering Medical School. Before you start making $200k+ you are going to spend a lot of money learning, testing, relearning, retesting, and it’s going to be harder than Medical School ever was. Why? Because unlike medical school there is no guarantee you will be successful. Still think you want to trade for a living?

Adapt or die. Just like medical professionals or accountants have to keep up on continuing education, so do you as a trader. What is working this year will be exploited by other participants and won’t work much longer. Market environments are in a constant state of change and your trade plan will need to be as well. Some environments are perfect for directional option traders, while others benefit futures traders. Know how your style fits the current environment and step aside if you don’t see your conditions. The market will always be here and forcing trades is only going to be deleterious to your P&L. Be patient and wait for your pitch.

As a new trader, start with a small amount of capital that you consider your first year trader’s tuition. That will be different for everyone depending upon your circumstances. Maybe it is 50k, maybe it is 5k. You didn’t get your college tuition back and you won’t get this back either. You will lose it. But, you will have gained the lessons needed to push you into year 2. Also, first year students don’t start with futures. Leave that for year 4 or your residency should you decide to specialize.

Trading and investing are hardly the same thing. Your financial adviser makes fun of you with his buddies. He claims the only sure way to wealth is to dollar cost average over the long term. He isn’t a trader and I fully agree with him. Wealth is built up over time and the only thing we can control is our percent of savings. We can’t time the markets perfectly and don’t know how long we will live. Your financial adviser is tasked with the monumental job of trying to ensure you are financially secure enough to live out your golden years comfortably. Should you be lucky enough to find your way into a successful trading career, take a percentage of your profits and start an account for the long term with a trusted adviser. In my personal experience trying to trade as well as manage a long term portfolio is like practicing hitting baseballs at a batting cage and then going straight to the driving range to perfect your golf swing. They work against each other. Let him handle your long term money and you focus on the short term. You’ll thank me for this later.

I think that about rounds out the most important points I wanted to cover. I will follow up soon with a book list that I hand pick for you. Books and mentors while important are no substitute for the real thing. The market doesn’t care about your degrees, designations, number of Twitter followers, or how much time and money you have spent trying to profit. It’s unbiased. It’s a mechanism designed for wealth generation and transfer. It doesn’t know your name and won’t shed a tear if you lose your house to its gyrations. It won’t cheer for you if you find a way to beat it.

It’s just there. Serving to constantly remind you that you will probably never be an expert.

Trent J. Smalley, CMT