Over the course of the last month, we have started to witness some tradeable lows in a wide range of growth stocks which we cover. Nearly all of the core positions in the JSPM-Omaha Growth strategy reported strong Q1 numbers, with many beating and raising guidance. This is a good thing, for it means I’ve done my analyst job well. I expect that the stocks attached to these companies begin to do theirs over the summer months. (They haven’t thus far in 2021 for the most part)

One barometer of overall growth stock performance is the ARK Innovation Fund. Highly tech centric, this group of stocks got taken to the woodshed starting in February. Ascribe whatever reason you want to that, whether it be a reopening economy, rising 10 year yield, or inflationary fears. Those of us doing this for a living call it something else: The stocks were up a lot. They were ripe for a correction, and they got one. More importantly though, something else happened while the average growth stock was dropping 40,50,60% from their previous highs… the companies themselves were getting stronger. Multiples fell as they should have, and while certainly not “cheap” many of these names no longer appear outlandishly expensive. Further, from a technical perspective a tradeable low may have been reached:

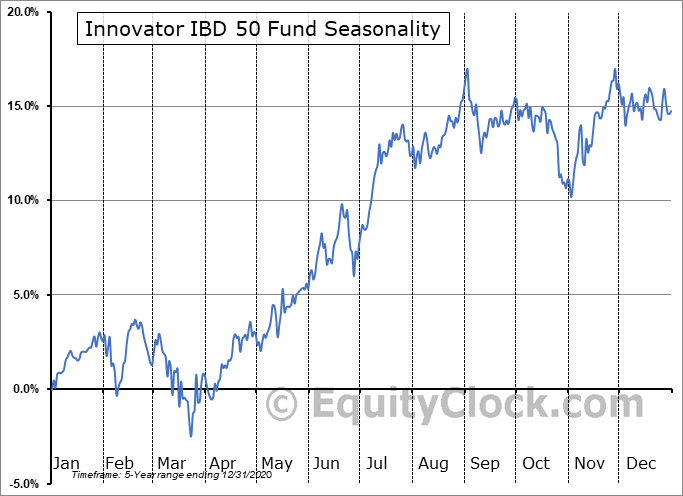

Of course one ETF held by one investment manager doesn’t tell the full story. There is however some further evidence to support that growth stocks tend to perform well over the dog days of summer. The IBD 50 Innovator Fund seasonality is particularly strong from June to August:

Over the past 5 years, this particular index has been positive 60% of the time in June, and 80% of the time in both July and August with an average return for the group between 7-9%.

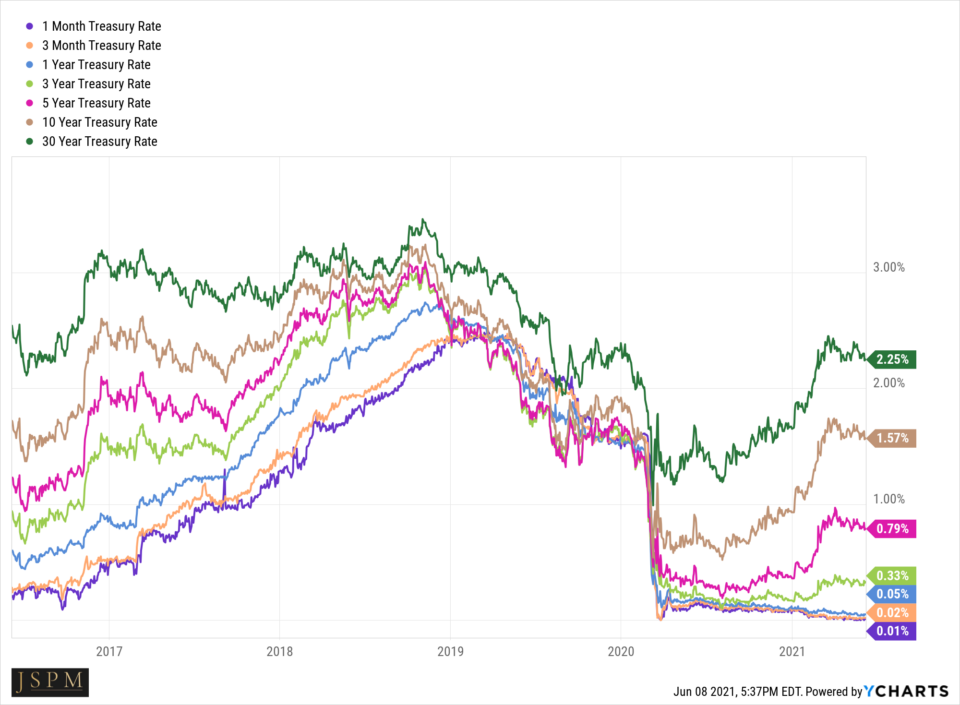

The generally accepted reason for the abrupt sell off in higher multiple agressive growth stocks at the start of February was the swift upward rate of change of fixed income yields. Those yields have leveled off somewhat and the upward trajectory has slowed. And while inflation has been felt across the board and commodities have risen, many higher growth names have acted well. From the chart below you can see that rates are still of course historically low, not yet back to where they were pre pandemic:

While the growth trade got off to a slow (to say the least) start in 2021, the overall bull market in equities broadended out. Financials, industrials, and energy names started the year strong. For the health of the overall market these are positive things and as we progress into the second half of the year, I think it is a “something for everyone” scenario where money can be made across the majority of sectors in the U.S. markets and abroad.

Among my “diamond list” of growth stocks which encompasses roughly 40-50 core names and about 100 other stocks, the average 3 year drawdown falls in the range of 44-56%. Many met and exceeded that figure and have begun to show me once again why I own them. When it is their time to shine, they return in a week what many cyclicals can take a month or more to. And over the longer term, they should far outpace many of the darlings of the first half of 2021.

Our bets are on that “50% was enough” for these stocks and the good times are about to roll.

Stay cool.

Trent J. Smalley, CMT Portfolio Manager JSPM

Visit our websites: (MyPortfolioFix)

Please remember that past performance may not be indicative of future results. Different types of

investments involve varying degrees of risk, and there can be no assurance that the future performance

of any specific investment, investment strategy, or product made reference to directly or indirectly in this

newsletter (article), will be profitable, equal any corresponding indicated historical performance level(s),

or be suitable for your portfolio. Due to various factors, including changing market conditions, the content

may no longer be reflective of current opinions or positions. Moreover, you should not assume that any

discussion or information contained in this newsletter (article) serves as the receipt of, or as a substitute

for, personalized investment advice from JSPM LLC. To the extent that a reader has any

questions regarding the applicability of any specific issue discussed above to his/her individual situation,

he/she is encouraged to consult with the professional advisor of his/her choosing. A copy of our current

written disclosure statement discussing our advisory services and fees is available for review upon review.