Good evening. The performance and statistics to follow will cover the JSPM-Omaha Growth Strategy YTD performance through the end of January. Clients invested in this strategy have demonstrated the proper risk tolerance and suitability for this style of investing. A more complete report will be done, as always, at the end of Q1 but providing monthly reports is a practice I’ve been in the habit of and find it to be a useful look back tool.

January 2021 has already shown two spikes in volatility as shown by the VIX Index. More about the VIX here.

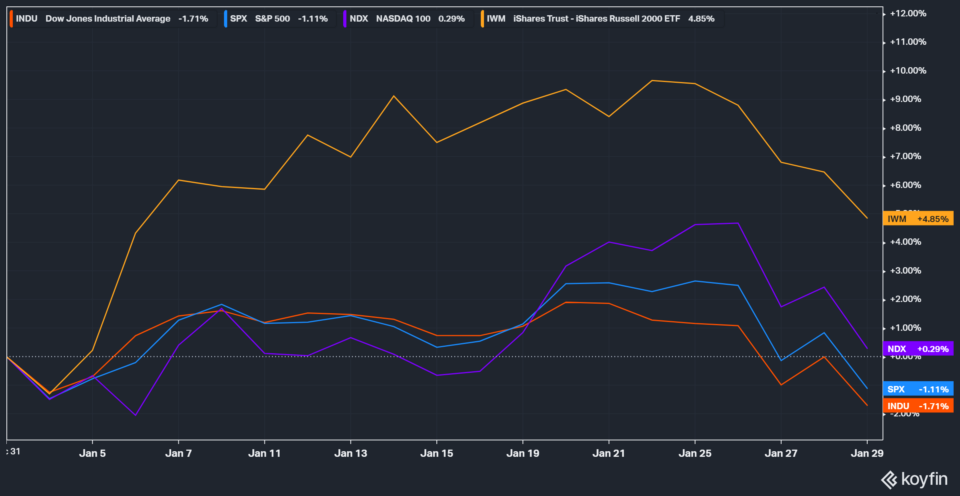

Spikes in volatility generally coincide with overall market pullbacks. Although not always the case, these bouts of volatility are a warning sign that the risk profile of the market has increased, and active money managers need to pay special attention to risk management. In some cases this may mean we look to take a portion of gains off the table, tighten stop losses, or add hedges. The JSPM-Omaha Growth Strategy is long only strategy comprised mainly of common stocks with superior fundamentals, revenue growth, and strong relative strength as compared to index benchmarks. Index benchmarks YTD are as follows:

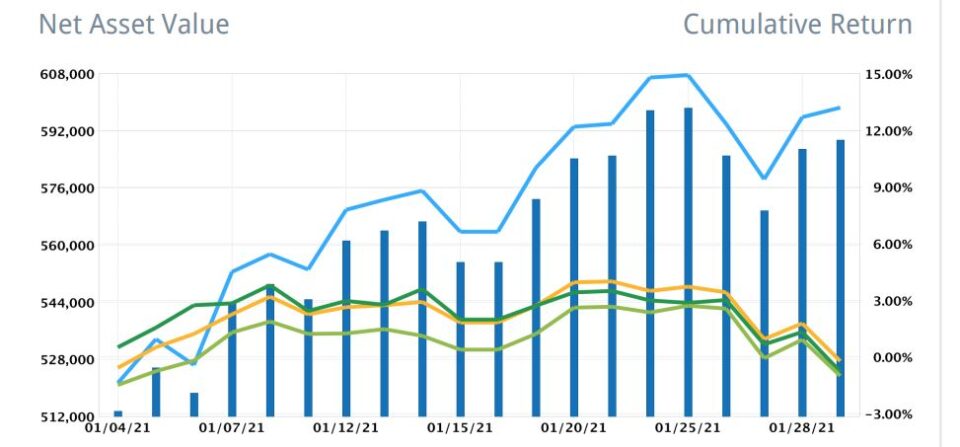

Only the small caps (IWM) showed any significant return as we rounded out January. The NASDAQ ended the month flat and the SPX and Dow Jones went negative in the final week of the month. The following shows the JSPM-Omaha YTD performance of an actual client account invested in this strategy, of course omitting account numbers.

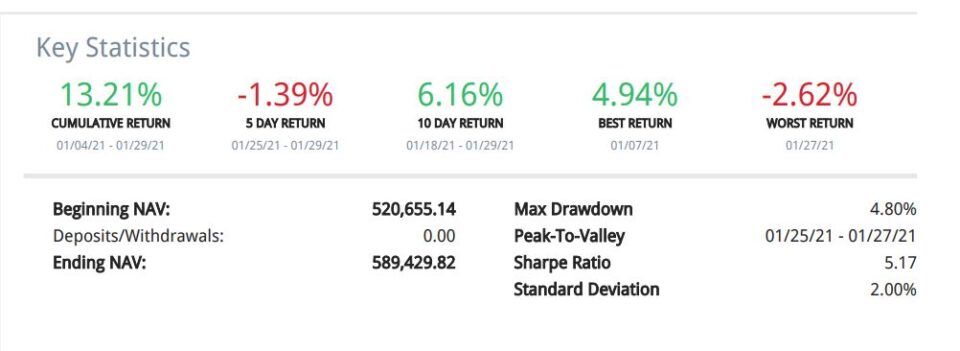

Cumulative time weighted returns came in just over 13% for the month of January, surpassing handedly the returns (or lack there of) of the U.S. equity indexes.

Obviously, this highlights the importance of individual stock selection as well as the necessity of having strict risk management rules. Allowing winners to run, and cutting losses quickly can and will lead to outperformance provided proper position sizing is used. The strategy benefited in January by holding two individual stocks in particular which were targets of the recent high short interest frenzy. These names were not added in an effort to take advantage of the market’s most recent fad de jour. They were holdings that were a part of the portfolio before the run on highly shorted stocks took place. One of these names remains in the portfolio, while the other was sold on strength in the final days of the month.

Where “the market” goes from here in the short term is anyone’s guess. It may come as a surprise to some that I read relatively little with regard to other analyst’s analysis or commentary. The vast majority of it is sophomoric, and my guess is that it is more driven in an effort to capture one’s attention or to push a narrative. Remember that fear sells, and I have nothing to sell to you.

I wish everyone the very best in the month of February, and in the coming days I’ll be addressing the recent unprecedented market moves in a handful of highly shorted names. While captivating to say the least, commentary around this has no place in real portfolio management.

Be safe.

Trent J. Smalley, CMT

JSPM-Omaha Portfolio Manager

Please remember that past performance may not be indicative of future results. Different types of

investments involve varying degrees of risk, and there can be no assurance that the future performance

of any specific investment, investment strategy, or product made reference to directly or indirectly in this

newsletter (article), will be profitable, equal any corresponding indicated historical performance level(s),

or be suitable for your portfolio. Due to various factors, including changing market conditions, the content

may no longer be reflective of current opinions or positions. Moreover, you should not assume that any

discussion or information contained in this newsletter (article) serves as the receipt of, or as a substitute

for, personalized investment advice from JSPM LLC. To the extent that a reader has any

questions regarding the applicability of any specific issue discussed above to his/her individual situation,

he/she is encouraged to consult with the professional advisor of his/her choosing. A copy of our current

written disclosure statement discussing our advisory services and fees is available for review upon