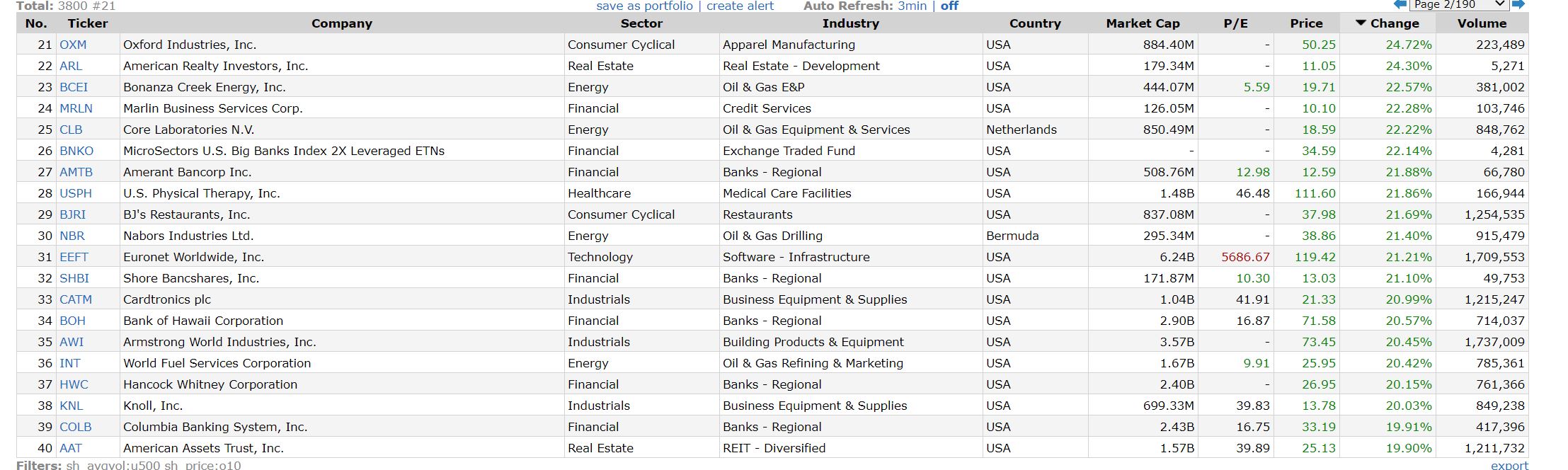

… in my portfolio today. Got ya! If your blood started to boil due to the title of this post, settle down. I don’t bring politics into the equation when it comes to money management, and neither should you. In fact, it’s a damn good thing most of you don’t do this job for a living because the lot of you are more emotional than a school girl. The headlines read, ” THE STOCK MARKET SOARS ON VACCINE NEWS.” Oh? Depends on which “stock market” you are talking about. As a growth investor, today happened to be my third worst day of 2020. How can that be? I’ll show you. Here is the top 50 or so gainers in U.S. Stocks today:

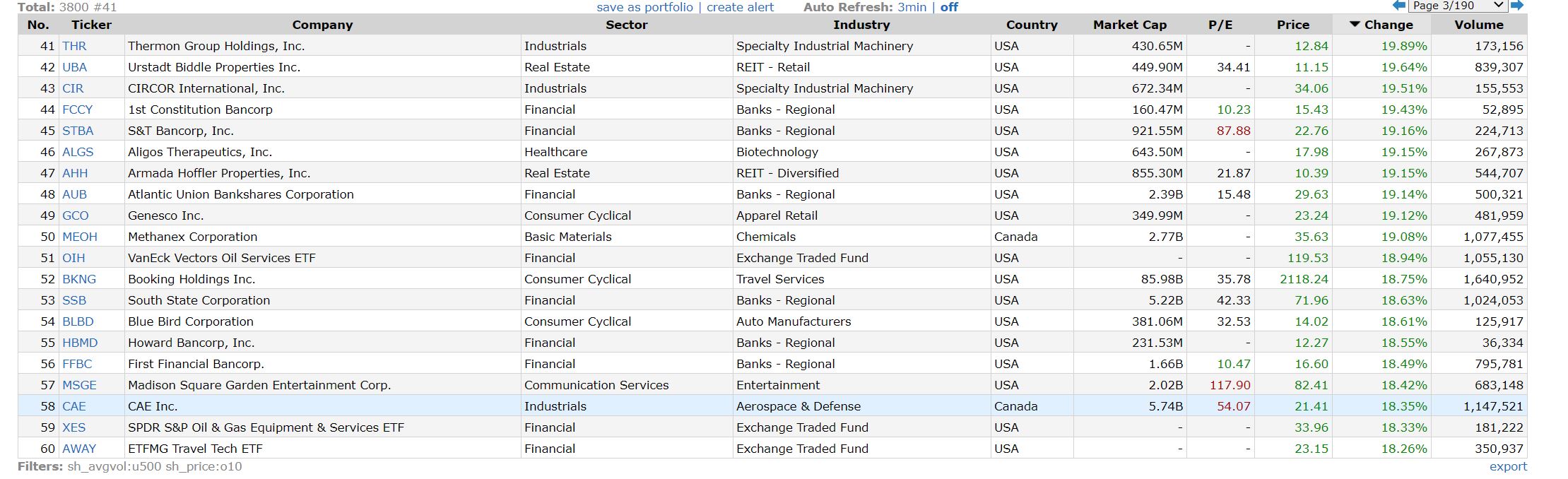

Who owns any of those? I’ve only heard of about 4 of them. Now take a look at some of the biggest losers of the day…

Much more familiar, even own some of them. So what happened? An obvious answer was the growth vs. value trade was extremely lopsided today. In fact, it was the worst day for growth relative to value since 2009. (This same ratio had its best day last week). So again we ask, is this it? It this the big rotation into value we’ve been waiting patiently for over the past decade or two? I doubt it. Vaccine or no vaccine, the foundations have been laid for a seismic shift into the way we operate as a population. Are you going to stop buying things online via Amazon and start spending all that money on cruises? Are you going to cancel Netflix, Roku, and sell your Peloton and head to a casino in Vegas? Didn’t think so.

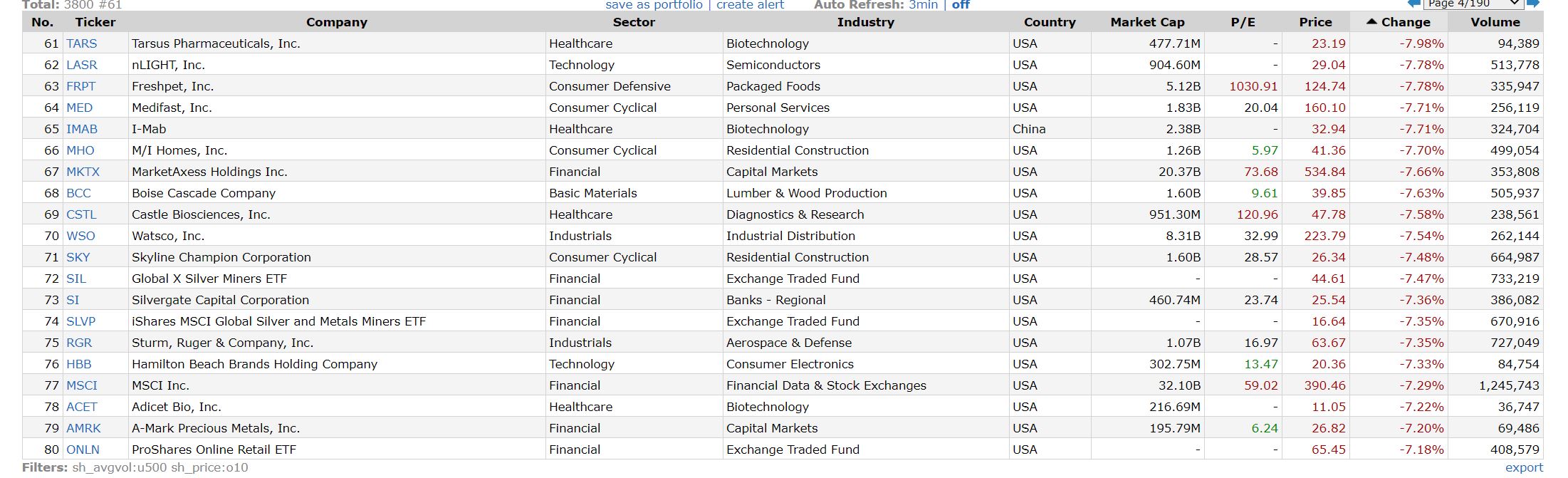

Here is a look at growth relative to value over the past year:

We’ve seen candles like this several times this year, one even recently. What always happens after value stocks have their day(s)?

There is no getting around it, today was painful. However, if you found yourself having a great day today, you are underperforming. If you were loaded up in value stocks via airlines, cruiselines, casinos, and whatever other names you likely lied about owning when the market opened today, you are almost assuredly getting trounced by the indexes. Value has a lot of making up to do, and it could outperform into the end of the year and we’d still come out ahead. Why?

Because we own the M8s and you are stuck in a Ford Festiva with questionable breaks and an air conditioner that doesn’t work. I am not planning to sell my supercars to jump in your go karts.

See you at the finish line.

Trent J. Smalley, CMT