Leave it up to me to pick on billionaire investors that own NBA Franchises and star on hit CNBC shows like “Shark Tank.” However, I think there is a wonderful lesson to be had here with regards to market sentiment and who to take seriously when it comes to market commentary and your money.

Leading up to the Presidential Election last November, there was no shortage of “expert” opinions on what would happen in our markets should Donald Trump win the election. Perhaps the loudest and most profound forecasts were those of Mark Cuban:

In an interview with Fox Business’ Neil Cavuto on Tuesday, the investor and reality-TV star said that the uncertainty from a win by Republican presidential candidate Donald Trump would cause a collapse in the stock market.

Cuban previously expressed this view, but he reiterated it in Tuesday’s interview.

“In the event Donald wins, there is no doubt in my mind the market tanks,” Cuban said.

In fact, Cuban said that if Trump were to win, he would “put a hedge on” that is worth “more than 100% of my equity position.

The full interview can be found here: Cuban on Business Insider

While the likes of Mark Cuban and other members of the high net worth “Smart Money” community were talking to the financial media outlets, I was fielding a couple of questions in real-time on my Facebook page.

If you haven’t paid much attention to “The Stock Market” that needed a “100 Percent Hedge Should Trump Win” since then, I’ll refresh your memory with a chart of the S&P 500 Index which is the most widely accepted gauge of “The Stock Market.”

urns out the election of DJT resulted in the strongest post election rally since the election of John F. Kennedy Jr.

Mark Cuban, Billionaire NBA Owner – 0.

OmahaCharts, Thousandaire owner of free blog – 1.

Now, to the credit of Mr. Cuban. He may have been factitious in his market call, we don’t know for sure. Maybe he was using his platform as a means to try and scare stocks lower so he could jump in and buy at better prices. Whatever the reason, throughout history the markets have had an uncanny knack to sniff out these highly emotional inflection points, and remind us of the fact that forecasting the future is a difficult endeavor.

I was taught to think of these emotionally charged, volatile periods as a “Pain Trade” scenario. Meaning, what can the market do today, tomorrow, or the day after to inflict pain on the most amount of people? When you see news headlines like “The Market Is Sure To Tank” from people who aren’t involved in the markets 12-15 hours a day, you can be sure we are nearing one of those inflection points.

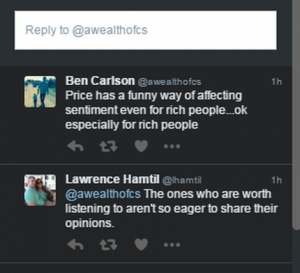

Ben Carlson whom I don’t know personally, but has a great blog I read regularly sent a tweet this afternoon that sums it up best: (A Wealth Of Common Sense)

The evening of the Presidential Election was, to say the least, “Emotionally Charged.” Those who paid attention to the overnight futures session saw a sharp spike lower in the Index Futures once it became clear the expected candidate may not be voted into office. After the sky had fallen and the markets somehow managed to open again the next morning, once again the unthinkable happened. A face ripping rally in stocks that caught nearly every one offside.

The takeaway here is not that Mark Cuban is a terrible trader or investor and that I am a great one. Mark has certainly had his fair share of successes over the years. It is a simple reminder that making boisterous directional market calls is a coin flip, at best in most circumstances. When you get emotional, your Ego takes over and clouds your judgement. The market can sense when a lot of Egos are involved and will make sure to remind you that it’s best to leave yours at the door if you endeavor to make money. The totality of what IS known at any time in the markets is dwarfed by what ISN’T.

That is something to remember when you turn on the TV or see a headline claiming “The Markets Are Doomed.”

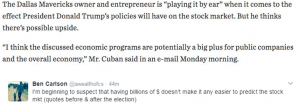

And in a quick update from Mr. Cuban…

Maybe he learned his lesson. 🙂

@omahacharts