Markets are the ultimate conditioning mechanism. By this I mean, that once you think you have it all figured out, you are quickly reminded that almost by law, Mr. Market can, and will tell you to fu*k off. I should know, it’s been telling me to do that a lot this year. My guess would be, other active managers are feeling much the same way.

Currently, the market, at least in the very short term, is not rewarding breakouts. Take a look at some of the recent action in individual stocks:

Yesterday, a few of us were joking during the day that a company called FUTU Holdings $FUTU, which was a holding in the JSPM-Omaha Growth portfolio had such a good day that surely, after hours news would follow to take the stock down. Sure enough, a secondary offering was announced after hours… Mr. Market can, and will tell you to fu*k off:

By the grace of God, I sold it before the sick joke played out. Why? The market has conditioned me to know that what is up today will likely be down more tomorrow.

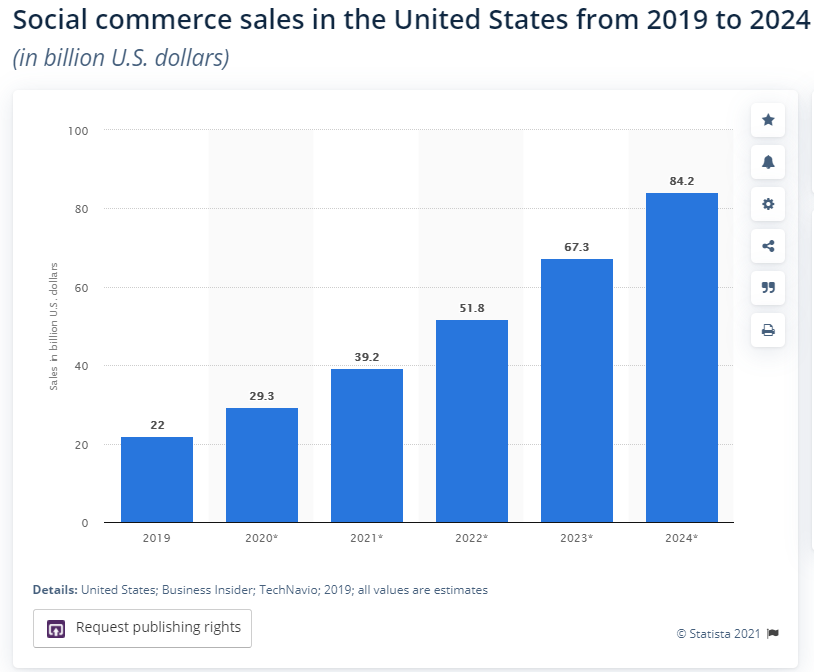

In the short term, the market hasn’t cared much for companies with accelerated sales, EPS growth, or a monstrous TAM (total addressable market, either. Much of how I view the investment landscape comes from hundreds of hours spent on Statista.com, a wonderful repository of thematic trends across multiple industries backed by data. From this library one can garner a view of emerging thematic trends. Trends such as genomic research to eventually cure cancer, cloud software trends, data infrastructure, and social commerce spend. One simple visual example is that of social commerce sales projected over the next 3 years. Source: Statista

Once you have a strong trend in a thematic, you back into finding companies that stand to benefit from said trend. Last year, Ophir Gottlieb of CML Viz, spotted brilliantly one company poised to take advantage of this thematic in particular. Pinterest, which was relatively deep in my list of probable investments quickly moved to a core position. (Thanks to him) The past two quarters reported by the company were nearly flawless in every sense of the word. The stock price YTD? Flat.

I should mention it did have a huge run in the second half of 2020, but you get the picture.

So, when research backed by trends isn’t currently being rewarded, momentum breakouts backed by large volume are being erased in swift fashion, and companies with revenue growth in the mid double digits are seeing their stocks fall day after day, where does that leave you? Dogecoin of course, duh. Or Gamestop.

I don’t read too many blogs these days, I’ve got my hands full with my own business. But when I do, I always check out Nick Maggiulli over at OfDollarsanddata.com

His recent post linked above, came at a time when I was about to write up something similar. Be sure to check out the full post because it’s great, but I will borrow a couple things from him here.

“Currently, we have an antiquated video game retailer (GME) being valued at $10 billion (nearly 10 times what it was worth at the start of the year). We have a literal joke internet coin (Dogecoin) that has a market cap of over $50 billion. And I just recently heard about a single deli in New Jersey (HWIN) that was recently valued at over $100 million. The deli had $35,000 in sales over the previous two years. Here’s a picture of the interior:

Nick continues, “The joke internet coin (Dogecoin) is now one of the top 5 largest cryptocurrencies by market cap. The joke video game retailer (Gamestop) is worth over $10 billion. The joke electric car manufacturer (Nikola) has a price-to-sales ratio near 10,000 and is still a multi-billion dollar company. I could go on, but you get my point. The joke as investment idea has arrived.”

Thanks Nick, you took the words out of my mouth. Although I hesitate to call much of anything going on currently “investing.” It’s more like throwing shit at the wall and hoping it sticks, and lately it’s been working.

Imagine spending years getting a Masters in Finance, a CMT, CFA, CFP, etc. and some Reddit trader named “Roaring Kitty” makes 1600% in a month while you plug away at your DCF models and try to preach “stay the course” and “we advise proper asset allocation and portfolio construction.”

I began in this business in 2007, and when I started nobody cared what I was doing. The stock market was boring, and only something one should pay attention to when it came time to retire. A few people knew enough to contribute a few percent to their 401ks as their company matched the investment. Where the money was invested was unbeknownst to them, and they didn’t bother to open their quarterly statements, rather let them collect dust in the pile of mail they might get around to opening someday. Now I get no less than 50 texts a week asking about some stock, altcoin, or investment fad. I’d love to invent / invest in an iOS app that autoresponds, “hell if I know just go buy Dogecoin.”

As it stands today, the JSPM-Omaha Growth model stands at nearly flat YTD. Silly me, I wasn’t on top of Gamestop and to my knowledge, RIAs aren’t allowed to buy clients Dogecoin. However, I am going about this the only way I know how, and that is pouring over hundreds of hours of research, using risk management principles that keep clients out of trouble, and this process has never lead me astray. The thematics will play out in due time, the market will once again reward the research, and the process will pay off.

I take periods of underperformance personally, and the weight of each and every JSPM client and their financial future is riding on my partner and I. We like it that way. We all get frustrated, and I don’t buy the bullshit that it isn’t professional to show it. I’m there, maybe beyond. In talking to a friend this evening, who could clearly sense my frustration, she offered up the following, “Soon! It will pay off soon! You’re a badass and better at this than most other humans so if not you then who?”

If not me, then who? Got that right.

Trent J. Smalley, CMT

Please remember that past performance may not be indicative of future results. Different types of

investments involve varying degrees of risk, and there can be no assurance that the future performance

of any specific investment, investment strategy, or product made reference to directly or indirectly in this

newsletter (article), will be profitable, equal any corresponding indicated historical performance level(s),

or be suitable for your portfolio. Due to various factors, including changing market conditions, the content

may no longer be reflective of current opinions or positions. Moreover, you should not assume that any

discussion or information contained in this newsletter (article) serves as the receipt of, or as a substitute

for, personalized investment advice from JSPM LLC. To the extent that a reader has any

questions regarding the applicability of any specific issue discussed above to his/her individual situation,

he/she is encouraged to consult with the professional advisor of his/her choosing. A copy of our current

written disclosure statement discussing our advisory services and fees is available for review upon review.