Overall market wise, there hasn’t been an awful lot to talk about. The environment continues to provide ample opportunity with respect to individual stock picking. Very little market volatility, speed, and low correlation among individual stocks with respect to the indexes further promotes an environment we want to continue to participate in. If the old playbook continues to work, we aren’t going to change it.

Here are some names I am watching or have taken a position in within the past few sessions:

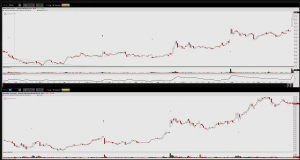

$WB off this move in $SOHU:

SOHU (on top) just made a monster move. Out of the China Internet names, as far as I can tell $WB is setup most like $SOHU was pre breakout.

Long $WB NOV17 $110 calls at $2.40.

$SSTK

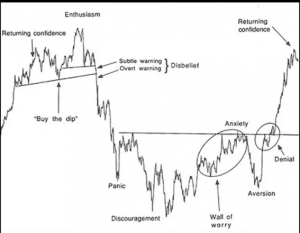

Do you remember the Justin Mamis sentiment chart from his book “The Nature of Risk?”

You can always easily spot a stock in the “Enthusiasm” phase. Start there and work your way to where you think we may be now. That paired with volume pocket above, and a pattern setting up. Plenty of room to run should we get a breakout into that $36 area.

Long $SSTK NOV17 $35 at $1.55.

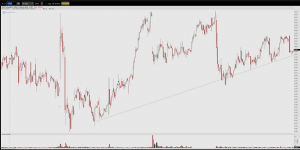

$GDDY

Obeying uptrend line well for the past couple months. Pair that with 10% of the shares held short and we may be onto something.

Long $GDDY NOV17 $45s here.

Last but certainly not least, $RDFN.

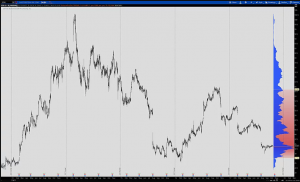

Loud, to quiet, consolidate, price discover:

Confirmed for a short term buy by what I believe is a favorable risk/reward ratio as shown by volatility charts:

Long $RDFN NOV $30s at .55.

These are some of my favorites this week.

By the way, are any of you utilizing any online trading journals? I was going to make the move from pen and paper over to something a bit more robust. I see EdgeWonk and Tradebench doing some unique things, so if you guys have any experience with those or any other let me know.

Thanks!

OC