2017 has been a year for the ages for the man you have come to know as OmahaCharts. For over a decade now, I have made it my mission to understand markets. For a long time I thought I did. Certainly from a theoretical perspective I might have, but it didn’t translate into making money consistently until recently. A critical differentiation you will make after toiling away in this game for years is that there are two kinds of people in this industry: Those trying to sell you something and those trying to trade to make money. There are a whole shitload of the first kind, and very few of the second. And of those very few, most of them in time begin shifting over to the first kind as they realize the devastation of relying solely on trading for a living.

My intent isn’t to belittle those selling services or education. There is a lot of value in quality trader education provided that it is backed by rigorous research and is original content. It is simply to state that there are so few out there who have reached a level of being able to live solely off their own trading profits. I myself do not currently rely solely on trading profits. I work for a firm that provides market data, analytics, APIs, and other related content to the financial marketplace. For the first time ever though, if my place of employment were to tell OC to hit the exits, I am confident I could sustain my lifestyle only trading. It took me 11 years to get to the point I am at and I thought I’d bullet point some of the things you may not see in trading books that helped me get to where I am.

1. A respected trading coach or mentor is worth his/her weight in gold. I credit so much of who I am as a trader to one person. Jeff Kohler helped me know both my mental flaws and taught me an approach to trading that fit my personality. Finding a style that fits your emotional makeup will save you time and trading losses. If you are highly emotional, day trading futures is going to be very difficult for you, but you might be a decent options swing trader. Before you start to try and perfect a trading system, take the time to understand yourself as a person and what works best with your emotional makeup.

2. Lower your expectations. Market speculation is not a get rich quick endeavor. If you set unrealistic expectations for yourself you won’t only fail, you will end up frustrated. Time and time again I have seen unrealistic expectations lead to ruin for traders. Don’t let the get rich quick pipe dream get the best of you.

3. “Easy” market conditions lure people in. If there is a trade that has been working wonderfully (like buying Bitcoin) beware that the market is conditioning you. Easy conditions usher in a brand of unsophisticated, highly emotional trader and will spit them out just as fast. This is how the game always has worked and always will work. There is nothing new in the nature of speculation.

4. Xerox stock has a different personality than Baidu which has a different personality than GoPro. In short, stocks have personalities. Screen time is the only way to familiarize yourself with them. How does BIDU act on a day when risk is on? Do investors look to a stock like GPRO during times of uncertainty? Xerox is a solid company, but do you want it as part of your portfolio in a late cycle environment? Knowing the personality of a stock is something professionals understand. So should you.

5. ICJ aka the CBOE Implied Correlation Statistic is something you’d better understand inside and out, frontwards and back if you want to outperform the bench mark. For some time now the indexes haven’t mattered. I rarely even look at the indexes in fact. Understanding sector rotation in our current environment far outweighs knowing what the indexes did for the day, week, month, etc.

6. High short interest stocks, in the appropriate market environment can lead to outsized gains. In our trading room this year, some were amazed at some of the stocks I was able to catch before they made big moves. Truth is, it was simply from a scan I built of stocks that had an average daily volume of 500k shares or more and at least 15% short float. Short squeeze opportunities add fuel to the fire of stocks looking to trade higher. I have a list of them handy at all times, and in risk on environments it is one of the first places I look for opportunities to catch big moves.

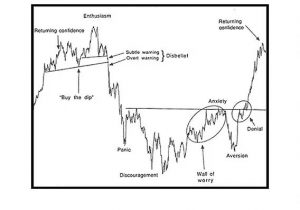

7. Always keep in mind the sentiment cycle chart. Readers here know I beat this to death but the Justin Mamis Sentiment Cycle should be hung above your trading desk. It gives you a road map that works time and time again for risk assets, especially those where highly emotional hands are involved.

8. Sentiment understanding ties together other forms of analysis. If you are a technical, quant, or fundamental purist who for whatever reason refuses to (expose yourself) to other schools of analysis, you are doing yourself a disservice. I like to say I have a PhD in Technical Analysis, a Masters in Sentiment Theory and a Bachelors in Quantitative Methods. It wasn’t until this year that I got a grasp on sentiment, how it works, and why and it may be the single most important area of study should you wish to capitalize in markets.

9. Accepting or Discovering. That is it. The two things price is doing. After periods of price acceptance comes price discovery, and periods of price discovery lead to further acceptance. No matter what your trading style asking yourself what price is doing, accepting or discovering, is a simple way to know whether you want to get involved or look elsewhere.

10. So much of what is out there is for entertainment purposes only and is noise that can be detrimental to your P&L. When I started, I watched CNBC all day, and was a daily visitor to all the main financial news websites, blogs, etc. I read almost nothing now and haven’t seen CNBC hardly at all this year. I felt like being “in the know” would prepare me for opportunities or keep me out of harm’s way. While I have nothing against CNBC or any of the people churning out constant links, stories, tweets, etc. it never once helped me make money.

11. Market of Stocks or Stock Market? This is a major difference you will come to understand once you are familiar with #5 listed above. This goes back to sector rotation, and the idea that indexes don’t always matter or tell us the true story.

12. ATR or Average True Range is one of the classic technical indicators that does have forecasting power. Perhaps though not in the traditional sense in the way it is taught. Do some backtesting using ATR on longer term charts of both individual stocks and indexes and see what you find. It takes time but is one of the few indicators on my charts anymore.

13. Learning to sit in big wins was my, without a doubt, biggest obstacle to overcome when turning the corner to becoming a profitable trader. In the current environment I trade a lose small win big system utilizing the leverage of options. I was a pro at losing small, but winning big was something that I had to get a handle on psychologically. Us humans are programmed to be emotional beings, especially when it comes to money. Losing never made me nervous, but sitting in a gain (aroused) every last emotion in me. If you trade with leverage, it will be your job to understand how you react when you see a $1000 position gap up to $3000. Are you quick to book the gain or are you mentally tough enough to watch that position drop to $2600 before trading higher again to $3400?

14. Losing your own money is stressful. Losing someone else’s money induced panic. I began trading other people’s hard earned money before I was ready. But that was likely my defining moment as a trader. It is a lesson no stock market course will teach you. No textbook will be able to test you over how you feel inside when you are down, and losing more. I was lucky to have someone who had been there himself know that this had to happen to me if I was ever going to have a chance in this game. I can only hope those of you who are serious about this as a living can be so lucky.

15. Day to day market movement is often just to get you to react. It has been said that markets on Monday know where they plan to close on Friday. The noise in between is to get you to make an emotional response. Know that not every little move is not for any real reason. The “why” seldom matters.

16. I blew up two trading accounts and nearly a third. So will you. Make no mistake. It took a mentor to bring me back in the game and show me the error of my ways. An understanding of your own personal mental makeup will come from your early failures as a trader. Doctors go to school for 10 plus years and pay hundreds of thousands for medical school. I would say that professional level traders are similar.

17. Correctly understanding Volume Profile can be the only technical tool on your charts if you know how to use it correctly. Over the past five years I slowly have moved away from your traditional technical indicators like RSI, MACD, Moving Averages, etc. and began using Volume Profile analysis heavily. If you aren’t using it, make it a point to learn it in 2018.

18. Keeping a trading journal is a necessity until your trade setups become so routine (boring) that you don’t need them anymore. Journals I used were Trade Metria and EdgeWonk. I currently trade the same exact setup, or maybe same two setups time after time so a journal isn’t something I am currently using. If I was to change trading styles in a new market environment I would begin journaling every trade again.

The above a fairly comprehensive list that I had scratched in my notebook throughout the year. If anyone has any questions about any of this email me. I love to chat with passionate traders at all skill levels. The market had its way with me for a long time, but I got my revenge and then some in 2017. Expect that to continue. 😉

OC