One hundred and twenty five years ago today, the Dow Jones Industrial Average made its debut. It has risen an average of 7.69% each year and notched 1,464 record closes, according to Dow Jones Market Data. It climbed above 100 in 1906, topped 1000 in 1972 and crossed 10000 in 1999. Just this year, as the U.S. economy continued to shake off its pandemic-induced slowdown, the Dow bounded above every milestone from 31000 to 34000. (WSJ)

Great depressions, financial crises, global pandemics, and 23 different U.S. Presidents have come and gone, and the century plus year old index has remainded steadfast in delivering returns over the long haul. Driven by an ever expanding economy and growing corporate profits, I would expect nothing less than for U.S. stocks to continue their higher trajectory higher long after the author of this blog and all of its beloved readers expire.

Now for the free lesson(s).

If you aren’t actively trading as a means of income, thinking short term is the enemy. I’m coming up on one year of managing money for clients, and 15 years managing money for myself. If there is anything to be learned from every mistake I’ve made in the past, it’s that fretting over short term performance is not only a gigantic waste of emotional capital, but harmful to longer term wealth generation. Let’s try an example.

Nvidia is one of my favorite companies. Chances are strong that if you invest with me, you’ll own it. Shares of NVDA at the IPO pre 2000 were available for under $2 per share. If you would have purchased a mere 100 shares 20 years ago, it would have cost you less than $200. As of those close today that $200 investment would be worth over $62,000. Were you wrong to buy it there? How about at $20? $50? $200? You tell me:

Were there periods where the stock under performed? Of course there were, all stocks do that. Were there periods where fears of a dot com collapse really caused the stock to sell off? What about periods where the narrative de jour “oh dear God inflation” took its toll on the stock? Maybe the “reopening trade” will cause us to stop needing graphics cards for computers and mobile devices. Those will probably go away since we’ll all be playing in the sandbox outside.

Or they won’t… (Don’t worry, they won’t)

Next lesson. Nvidia is an example of a growth stock, which fits into my preferred style of investing. Somewhere recently I saw an article say that growth style investing is nothing more than recency bias. In short this is to say that events which happened more recently (like many growth stocks having an outstanding 2020) are given more weight than historical events. I don’t know where to start with this comment, but it’s wrong. I suppose if you made the decision to own NVDA just because it did well last year it could be correct, but “growth investing” at its core has zero to do with recency bias. Growth investing is buying appreciable securities in companies that have market beating sales and EPS rates, increasing profit margins, high ROE, and a competitive moat that makes competing with the company difficult. Growth investing is following industry trends, quarterly conference calls, and company trajectories out 2-3 years. If owning NVDA is “recency bias” I’ll have plenty more where that came from. And I do.

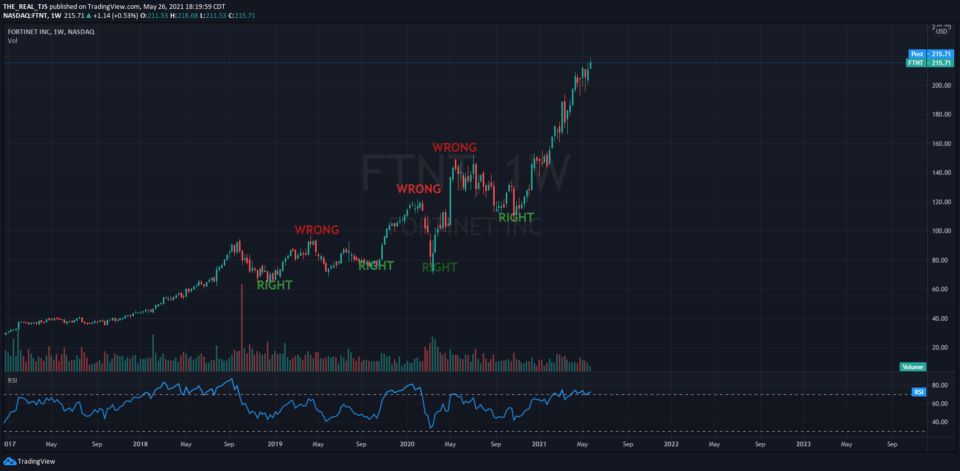

I’ve been right and then wrong and then right again on Fortinet, a network security company and one of my longest holdings. I’m okay with it.

Periods of under performance, followed by periods of outperformance again. And guess what will happen next? Probably underperformance for a while. Oftentimes, the periods of both under and out performance have almost nothing to do with the company itself. But you wouldn’t know that if you just looked at price everyday. If you are, you might want to stop. At least if you can’t handle being “wrong” sometimes.

Final free lesson. You may notice that the stocks mentioned go up and then down. And then they go up again. When I started investing, likely the most detrimental mindset I found I posessed was worrying that the up part would never happen again when I found myself holding a stock through the down part. I also worried my total account value would forever be lower than “that one day” when it was at its all time high. I found plenty of people worried that the internet and tech stocks were going away since the economy was reopening. I found more people worried that a new President was going to crash the market. And more even that called doomsday when rumors of a higher capital gains rate was to be passed. I’ll address those here one by one:

Wrong, wrong, wrong, and wrong.

Those who I talk to daily and trade with, know that if I am allergic to one thing it’s pessimistic world views. I can’t imagine living that way, which is why I choose not to. My stock won’t ever go up again, higher inflation, higher taxes, the internet is dead, and I’m just waiting for this thing to crash. You do that. And while you do, I’ll be spending my hours investing for our clients in companies that don’t care about your theme or worldview. We’ll go through some ups and some downs together, and they’ll win in the end. And pick up some free lessons along the way.

Trent J. Smalley, CMT

Please remember that past performance may not be indicative of future results. Different types of

investments involve varying degrees of risk, and there can be no assurance that the future performance

of any specific investment, investment strategy, or product made reference to directly or indirectly in this

newsletter (article), will be profitable, equal any corresponding indicated historical performance level(s),

or be suitable for your portfolio. Due to various factors, including changing market conditions, the content

may no longer be reflective of current opinions or positions. Moreover, you should not assume that any

discussion or information contained in this newsletter (article) serves as the receipt of, or as a substitute

for, personalized investment advice from JSPM LLC. To the extent that a reader has any

questions regarding the applicability of any specific issue discussed above to his/her individual situation,

he/she is encouraged to consult with the professional advisor of his/her choosing. A copy of our current

written disclosure statement discussing our advisory services and fees is available for review upon review.