Carnage. Pain. Blood in the streets. Whatever you want to call it, equity markets are taking it on the chin, as am I. We can’t be certain where the sell off stops, but one of the most prudent things we can do on days like today is look for areas of relative strength in the market. Today amidst the selling there are a few areas where the selling is either light, or pockets of strength have actually pushed stocks into the green.

Banks

Solar

Cannabis

Biotech

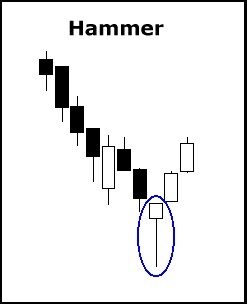

Another thing I do is use a tool called Finviz and setup a technical scan for Hammer Candles. For the uninitiated, the hammer is a candle with a long lower shadow, signalling buyers defending prices from below. These candles often signal reversals higher. In other words, we expect that when the selling pressure lets up in the market overall, these stocks exhibiting relative strength are primed to resume trading higher to a greater degree than those with a candle without intraday strength. These look like so:

Finviz.com allows us to scan the US Equity Markets in real time for stocks that are working on a daily hammer candle. I pulled this scan a few mins ago, and of course sellers could push prices lower invalidating these candles but here is a look at a few stocks where buyers are doing their best to defend:

Just a few ideas on a day where a silver lining is needed.

OC