Before the start of each new month, I utilize a stock screening tool called Exodus Market Intelligence by iBankcoin, in order to generate ideas. As we head into the final month of 2017 we want to zero in on sectors, industry groups and individual names set to outperform the indexes. I am unsure if we see more all time highs in the market indexes, or if the gains from a great year are consolidated. One thing I am sure of however, is that there will continue to be ample opportunities in individual groups of stocks as the stock to market correlation remains extremely low.

Here is a look at a scan I run in Exodus going into each new month which has provided outsized gains all year long:

What we have here is a proprietary screen based on seasonally strong stocks for the month of December. I filter for names which have historically gained 10% or more in the month, and are up at least 75% of the time in December. I also like to make sure I look at stocks for which we have at least 5 years of data. As you can see from the screen, there are a handful of names that have been in the green in December 100% of the time over at least 5 years. You can also see some sporting incredible gains on a percentage basis in December.

If a new trader got his hands on this list he/she may be tempted to say, “I’ll just buy the top 3 % gaining stocks from this list, sit back and watch the money roll in.” That would be why most new traders end up sitting back and watching their asses get handed to them. I should know, I’ve been there (a couple times). What this list is not is a blueprint for sure gains. That is never the case, with any chart or any stock screen. What it is however, is a list from which we can dig deeper, seeing if we can find further confirmatory points that strengthen our bull case.

A quick glance at this list shows me that my $CLVS position I wrote about here shows up as a strong candidate in December. Specifically, over the past 6 years, it has been up an average of over 11% in December, and hasn’t had a losing month in 6 years.

$ICPT is another one that has my eye. It’s a familiar biotech stock that may be looking to pop out of its consolidation pattern. Seasonally we can see that the month of December has been good to owners of $ICPT showing average gains of over 16%.

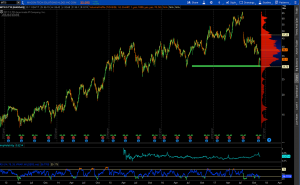

One last name from the above list I would be willing to take a long in, should we see a pullback would be $MTSI.

A fairly sharp recent selloff down to under $30 was met with a strong buyer where we saw a bounce back to $33. I will be taking a shot on the long side if we see $31-$32.

Perhaps you can find some names that will help your portfolio finish out 2017 strong from the screen above.

What are some of your favorites into year end?

OC