You try and find an image for a blog title dealing with Short As A Percentage Of Float… Not easy. It’s obvious I came up short but it’s October and that picture above is scary as hell. Anyway, I am not sure if you have caught on to this or not, but it seems the market never goes down anymore. Day after day the indexes go higher, if not ever so slightly. The old standard bench mark S&P 500 continues making new ATHs whether you believe in the market rally or not. In these environments the big money managers, tasked with managing millions or billions of dollars have to find ways to try and outperform the benchmark. When you have an overall market making new highs every week, what do you allocate funds to in order to outpace the index?

Well that’s easy… Whatever is going up faster than the index of course, silly. You might hear some refer to this as Relative Strength. If a hedge fund or mutual fund manager running large sums of investor money wants to keep their job, they have to find risk assets that are outperforming the index on a relative basis. Otherwise, the clients would just put the money in an Index Fund for a very low fee. Hot shot fund managers typically charge a much higher fee than Index Funds so they’d better be able to outperform the benchmark (most of them don’t) or they’ll soon be working for the local parks and rec, playing noon ball at the YMCA… Not where you want to be.

Back to my point. In markets there are themes that always have been and always will be present. One of these is the Risk Cycle. In an environment where we’ve gotten a bit overheated, at least short term, you find rotations into riskier and riskier stocks. If you picture stocks grouped into 5 categories you would have something like this:

1. Quality Stocks (Blue Chip Companies, Good Financials, Dow Jones Industrials

2. Momentum Stocks (Solid Companies but move a little faster)

3. Laggards (Not as solid financially, but high potential to be volatile due to higher risk)

4. High Short Interest (Stocks where upwards of 20% of overall float held short – people betting against)

5. Dumpster Fire Stocks (Total spec names, shady financials, might not be around until Christmas)

In running a scan this morning for stocks with > 20% of the float held short I noticed that there have been some major moves recently in this group. If you are interested in the full screen it is here:

Short Interest Screen in FinViz

Looking through those you can see what many have done. Ripped higher, or are in the process of doing so. Don’t buy them. You missed those. Looks for the ones who haven’t yet. There are a few in the bunch and a couple others I am tracking that will likely do the same thing over the next couple of weeks.

Here are a couple I am eyeing along with another that will likely take longer but should prove to be a big winner if you give it time.

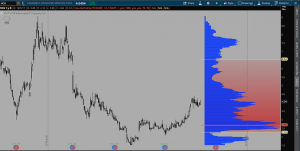

$HOS

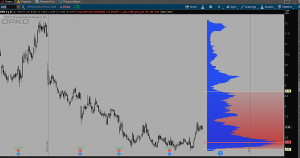

$OPK

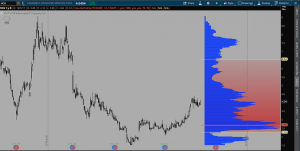

$TRIP

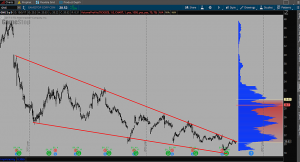

And last but not least… Gamestop $GME. Over 20% of the float short and just looookkk at this thinggggg.

$GME is good for a 20 point move should it break out of this falling wedge. Promise me you wont miss it…

OC