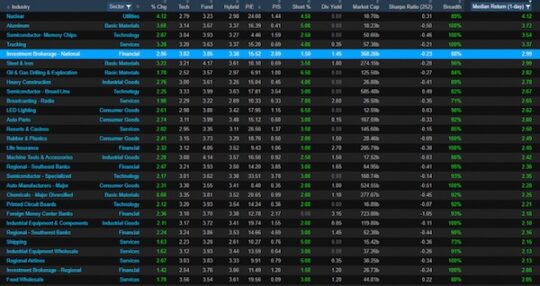

Welcome to April. I had a feeling this might happen, but feelings and financial markets are words not to be used in the same sentence, so let’s set how we feel aside shall we? As we come into the final hour of the first trading session in April, here is a look at the industry groups which are up strong for the day:

Among the leaders: Semiconductors, aluminum, trucking, auto parts, heavy construction, resorts and casinos, etc. The reason I watch these groups is they are indicative of how market participants “feel” about putting capital to work. If you see groups like Gold, REITS, and utilities among the leaders you might have yourself a risk off environment. One in which you find skittish investors scared of every little twist and turn. But when you have groups like we have today among the leader board? To me this shows strength in investor perception and participation.

So why the FOMO (Fear of Missing Out)? Why today? I’m glad you asked and I think I might have the answer for you.

Imagine for a moment that you are a manager of other people’s money. I don’t mean the 100k you manage for your uncle, I mean mutual funds, hedge funds, etc. managing well into the billions of dollars. Your compensation is largely based on your performance against a benchmark index called the S&P 500. In other words you are an active manager that believes beating the benchmark is possible through picking stocks, using leverage, and outsmarting your competition which is the S&P as well as other fund managers. If you manage to beat the index, you keep your job, attract more client funds and thus a bigger paycheck, and receive the accolade of your peers in the industry. If you don’t you are fired or your investors go somewhere else that either beats the index or charges a lower fee than you.

You came into 2019 flat after taking a beating in Q4 of 2018. Fresh in your mind were the losses that piled up as markets cratered in the fourth quarter. The news flow at the outset of the year was uncertain, and you weren’t at all eager to be offside again. Let someone else jump out in front of oncoming traffic, you can’t afford to be wrong again. Let’s let the other guy be the fool, watch him go first and get clobbered. You don’t believe in this rally one bit and you will sit in cash, safe and sound and out of harm’s way.

But there is a problem. That index you are graded against forgot about what happened at the end of 2018. It starts running higher. And higher…

The index is up close to 20% now. It charges nearly nothing to its investors. It’s passive. You are an active manager charging 2% (or more) and you are way behind as we start the 2nd quarter of this year. One publication you subscribe to sends out a monthly report on how fund managers are positioned. You are just sure other guys are all in, and you are certain they are going to meet their maker. You feel like this rally isn’t for real, it was a “V Bottom” / “Dead-Cat Bounce” / too far to fast setup. There is no more money to put to work, everyone is all in and you are waiting for the big rug pull. You open March’s Global Fund Manager Report and….

uh-oh

The largest position among fund managers was cash? Followed by REITS, EM and Utilities?? And equities are the most underowned asset class??

You still feel like this rally isn’t for real? While you are busy feeling, you might consider how your investors feel when they open their Q1 statement and it shows you are lagging the SPX by 20%. The probably feel like you aren’t doing your job.

So even though you might not feel like buying stocks, your hand has now become forced. To the tune of 300 Dow Points in one session.

Feeling good on a Monday.

Trent J. Smalley, CMT