….Not even a total rout in the Solar Energy Industry Group. In case you weren’t aware, my beloved solar stocks have gotten deballed so far this week, with further pain to come in the early going here this morning. In my long term accounts I am flush with solar stocks – 10% of my long term holdings are made up of First Solar, Canadian Solar, Jinko Solar, and SunPower Corp. Ouch.

China put in place caps on the industry which is reducing benefits for solar power users. The Chinese government indicated that the curtailment was aimed at “promoting the solar energy sector’s sustainable development, enhancing its development quality and speeding up reduction of subsidies.”

Because China is the world’s leading consumer of solar power, I didn’t expect this decision to have a huge impact on China’s solar industry. But now that a larger trade war looms, China may have made a decision to signal to the U.S. that it will stop allowing Chinese solar panel makers to substantially undercut U.S. manufacturers.

The “winners” here may be a few U.S. solar companies, but the overall growth rate of the solar industry may suffer. In the long run, solar PV is still certain to outgrow every other energy category, but in the short term this decision is going to create a lot of uncertainty around the industry.

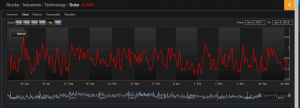

From a technical perspective we can make some guesses as to where the industry group will firm up in the near term. The TAN ETF zoomed out taking 10 years of daily data into account:

Price has just fallen under the Volume Point of Control into seller controlled territory. We will see today if the bulls defend this area around $24. If they cannot, expect further declines to $21.50 or so.

As a group from a fundamental perspective solar is cheap by nearly all accounts. I’ll spare you the math because nobody likes math. Taking into account all names from this group, the industry oscillator is nearing the lower end of “normal” or approaching oversold territory.

If I weren’t already heavy in these names I would be looking to take positions in FSLR and JKS as soon as I see any sign of strength. I may jump on them for an options play and will of course relay that information to you, dear reader, as soon as I pull the trigger.

Happy trading.

OC