It’s okay you can tell me. This is a safe place. We are all friends here on OmahaCharts.com. I rarely look at my Cryptocurrency balances but it would be painful if did without a doubt. I am sure the business news media is all over the massive correction taking place in this asset class few understand. The haters are out in full force on Twitter, and soiled panties are strung about the landscape. Sentiment is approaching somewhere between depression and despondency.

But if you missed the runaway train that has been Bitcoin, Litecoin, Etherum, Dash, Ripple, etc… you may get your chance.

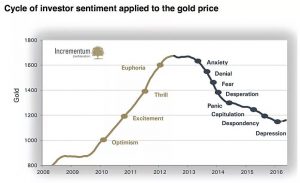

As we approach the following charts, keep a very simple sentiment chart in mind and refer back to it as necessary:

This particular chart pertains to Gold, but works well for Cryptocurrencies with a couple tweaks.

Let’s start with Bitcoin, our elder standby.

Compare the sentiment cycle chart to that of BTC. I would argue that the main difference is the angle of the uptrend and the angle of the downtrend. In other words, we’ve had a steeper more euphoric buy up and followed it up with a more “panicky” sell-off in Bitcoin as compared with Gold.

This is a result of the type of trader/investor that cryptocurrencies have attracted. Back in 2008-2012 I don’t remember my nurse friends, weightlifting buddies, hair dresser, office secretary and friend with $112 in his checking account asking me how to buy gold. On the contrary, Bitcoin’s popularity explosion is unsurpassed in anything I’ve seen in 11 years in markets.

In short, Bitcoin has attracted your Sunday golfer type of trader, the uninitiated and highly emotional gambler moonlighting in his social media profiles as a Cryptocurrency genius. The buy ups will be chased and the sell offs will induce panic.

The sentiment cycle would lead me to believe that a near term bottom in on the horizon for Bitcoin. Let a bit more of the “depression” phase play out and get your cash reserves ready if you are interested in getting long BTC. If you want to get fancy, I’d look to buy near the convergence of the 200 Day Moving Average and the 78.6% Fibonacci Retracement (should we get so lucky). That would be around $8600-8800.

Next up is my personal favorite from a technology standpoint, Ethereum.

ETH obeys technicals so well, it could be used over and over in old school technical analysis books. The up and downswings were even a bit more pronounced here. I think you get a chance to buy this near $750-800 soon and I will be doing just that and adding to my long term position in this. More weak, shaky hands will be alleviated from their positions and I’ll be there to buy from them.

As for Litecoin, $130-150 as it comes into a recent balance area where the buyers buy is where I would add to my position.

Of the 3 first major Cryptos, LTC here had the most severe buy up phase. Look at that chart. That uptrend, if you can even call it that is like 180 degrees. Who was the dude who bought up there at above $400? It certainly wasn’t any one who does this for a living. Rather it was likely someone who had $400 and didn’t have enough for a Bitcoin so they saw this and said, “IDGAF just get me ONE LITECOIN!” That same guy just sold his Litecoin for around half of what he paid for it. With a little luck we will get to buy it cheaper yet, around $125.

Stop doing that by the way. Buying sh*t in a 180 degree uptrend. Try buying it before it does that next time, it works better.

For our purposes here, one other asset to take a look at as it has sold off hard is Ripple.

I think we might get a chance at this around 0.85. If we do, count me in. This is the only one I don’t currently have a position in.

In trading like in other arenas in life, it is important to know your audience. In the early stages of the cryptocurrency game, you have total novices trying their hand at trading against seasoned professionals. Probably more so than in any point in history. Those who are seasoned, have an edge and have control over their emotions are going to be taking money from the less initiated. That is how a market works.

For the novice, if I were to give one piece of advice it would be the following:

If you are giddy to put your money in the market because you feel like you are missing out, stop and back away from the mouse and keyboard. You are euphoric and the seasoned pro knows that. If you are comfortable buying, and feel like you are being left behind because everyone else is getting rich, it’s a bad time to buy. When you are uncomfortable, and you feel sick to your stomach because you just KNOW the money you are about to toss into BTC,ETH or LTC is going to be like tossing hundred dollar bills up in the air, click the Buy button.

That trick above is simple, but it’s not easy. In time it gets easier but my best trades are still those I feel uneasy putting money into.

Any questions?

OC